Season’s Greetings: Markets Rally as 2025 Nears the Finish Line

- The S&P 500 snapped back after an early slump, finishing November at new highs

- Fed commentary swung markets, while AI giants battled for dominance

- Holiday spending looks strong despite persistent inflation pressures

Stocks stormed back over Thanksgiving week, finishing November in positive territory. The S&P 500 was down 4.4% for the month at one point, but the best five-day rally since May helped lift the market to yet another all-time high monthly close.

The Nasdaq underperformed, giving back 1.5%, with some movin’ and shakin’ among the Magnificent Seven tech stocks. Specifically, shares of Alphabet (parent company of Google) soared 14% over Q4’s middle month, thanks to the well-received rollout of its Gemini 3 AI tool. NVIDIA fell by about the same amount, as investors perceived its position in the AI race being less dominant.

November Gravy: S&P 500 Adds to 2025’s Gain, Nasdaq Lagged

Source: Stockcharts.com

Most Investment Areas Had a Seat at the Table

Elsewhere, U.S. small and mid-cap stocks sported modest gains, along with blue-chip value stocks. Shares of international companies also inched up heading into year-end. The bond market was quiet—the benchmark 10-year Treasury note yield dipped to 4% by Black Friday. Gold added 5%, silver soared to new records, and bitcoin was bloodied (but bounced in November’s final week).

10-Year Treasury Rate Dips Toward 4%

Source: Stockcharts.com

All told, the bull market presses on, carried by record earnings expected and a Federal Reserve that, while stubborn at times, appears poised to cut interest rates once again. Let’s flesh out where things stand with the market, the economy, and your money as we put the finishing touches on another strong year.

Fed Watch: A “Hawkish Cut” That Left Investors with Indigestion

Investors were skittish coming into November. Two days before Halloween, the Fed spooked stocks, issuing what was dubbed a “hawkish cut,” in which the Federal Open Market Committee (FOMC) lowered interest rates by a quarter-point but poured cold water on the chance of a December ease.

Chair Powell did not mince words about prospects for a third consecutive cut come December. “A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it,” said the Fed chief. That sent the stock and bond markets into a modest malaise.

Fed Officials: A Pre-Holiday Food Fight

Over the ensuing three weeks, a growing chorus of Fed officials reiterated that stance. Others, however, like recently appointed FOMC voting member Stephen Miran (on leave from the Trump administration), underscored the case for further easing of monetary policy. The hawks (those who want to keep rates on hold in December) and the doves (those who want to cut rates) duked it out.

John Williams Delivers an Early Christmas Gift

Who had the final say? It was New York Fed President John Williams. You see, the NY Fed leader is unofficially seen as the chair’s second-in-command. Williams delivered an early Thanksgiving treat for the bulls when he stated there is “room for further easing in the near term.”

Nobody knows for sure, but many economists believe he had to run that by Powell first, as it was really the final piece of “Fed speak” before the December 9–10 meeting and interest rate decision.

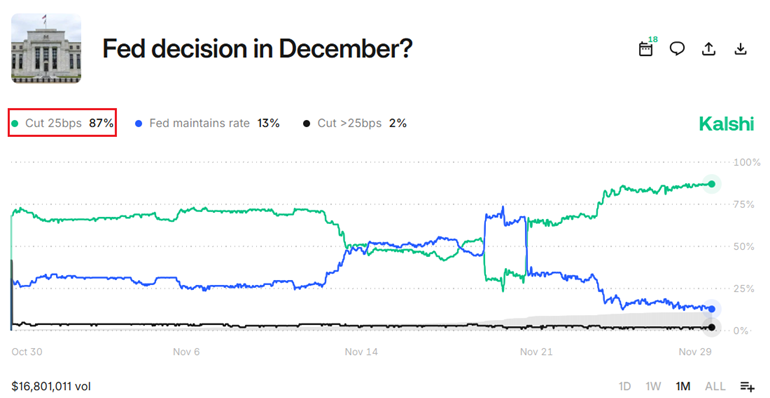

Another Helping of a Fed Rate Cut Likely, 87% Chance

Source: Kalshi

Stocks’ Bullish Trot Leading into Turkey Day

Equities were off to the races after Williams’ words crossed the wires. The S&P 500 notched a November low of 6522, then closed higher in each of the final five sessions. Bitcoin bounced big, from $80,000 to above $90,000, in a clear sign of renewed risk appetite. And precious metal investors got their fill, with gold scaling $4,200 per troy ounce and silver tagging a record above $55.

Among the biggest beneficiaries of the Fed doves apparently winning the battle were U.S. small and mid-cap stocks. Seen as more sensitive to interest rates, the group soared more than 7% over the five trading days ending on Black Friday.

November Performance Heat Map: Big Tech Sags, Other Groups Picked Up the Slack

Source: FInviz

AI Giants Jockey to be on Investors’ Nice List

Yes, the Fed played an outsized role in November, but it doesn’t change the reality that the AI revolution remains in full force. It’s a constant battle among the giants, like NVIDIA, Alphabet, Meta, and even some newcomers. No doubt the month’s major development was Google’s Gemini 3 release.

Now the world’s third most valuable company, the search giant is seen as a contender to snatch share away from Jensen Huang’s NVIDIA. It all has to do with Alphabet crafting its own Tensor Processing Unit (TPU) semiconductors (NVIDIA specializes in the design of world-class Graphics Processing Unit (GPU) chips).

Although NVIDIA’s semiconductors and platforms are still seen as the gold standard, industry experts increasingly believe that Alphabet’s TPUs could be a revolution of their own, potentially paving the way for so-called “agentic AI,” in which tools evolve beyond large language models.

The New AI Kid on the Block is a Familiar Name

Source: The Wall Street Journal

It gets into the tech weeds, but each month, there seem to be groundbreaking developments at one or more of the world’s largest companies. For instance, Broadcom, while not technically a Magnificent Seven stock, asserted itself as an AI stalwart. It partners with Alphabet to design and build TPUs. Shares climbed 9% in November to new all-time highs… while NVIDIA shed 13%.

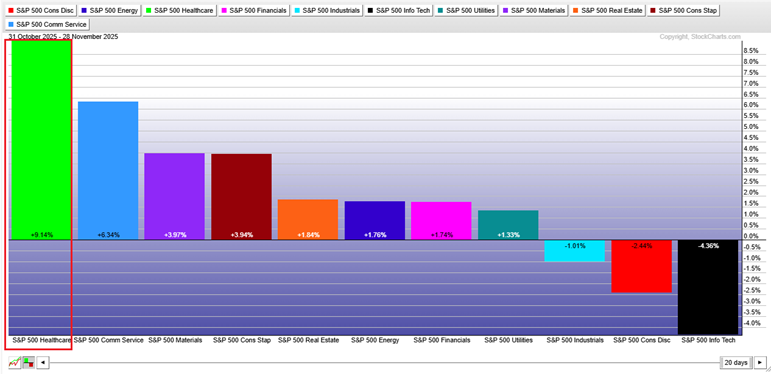

Unwrapping Bullish Trends Not in Tech, But Health Care

Investors, strategists, and consumers continue to be in awe of AI’s progress (and of all the money being poured into its development). But tech was actually the worst-performing of the 11 S&P 500 sectors in November. Health Care was the quiet winner, up 9%.

Large-cap pharma stocks posted solid gains, powered by Eli Lilly, which became the first trillion-dollar Health Care stock (by market value). Small and medium-sized speculative biotech stocks were also in vogue, no doubt helped by lower interest rates.

The Pharma Factor: Health Care Led in November

Source: Stockcharts.com

Big picture, this kind of passing strength from one sector to another is common during a bull market. An uptrend pinned to a single theme can be risky, but when many industry trends are working at once, the overall market tends to be more stable. Traders say that “sector rotation” is a bull market’s lifeblood. Indeed, the rally’s vital signs check out.

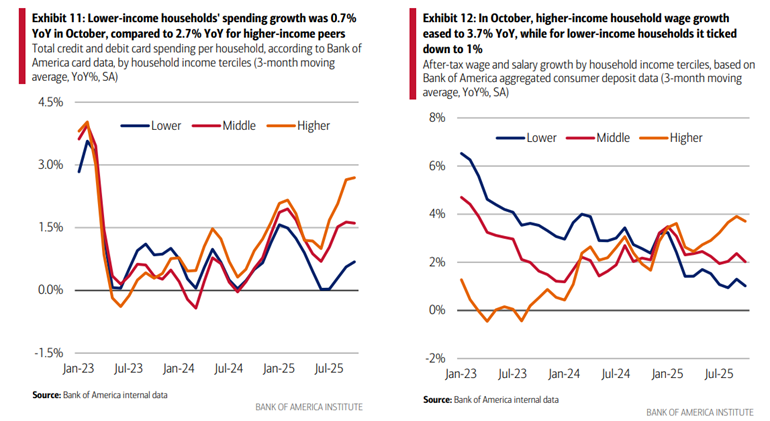

A K-Shaped Christmas?

But not all facets of the economy are flexing their muscles. The consumer is bifurcated heading into Christmas. The so-called “K-shaped” economy appears as entrenched as ever, with higher-income households and the wealthy faring well. At the same time, the lower tier of income earners (and those not involved in the stock market) struggles to keep up with the rising cost of living. Ideally, all boats would be lifted, but that’s not the case today.

Wage growth is slowest for those making the least, with the “rich” commanding an ever-growing share of total wealth. Believe it or not, lower-end workers benefited the most coming out of the pandemic—a time when hourly pay increases outpaced inflation, and the unemployment rate was near historic lows. That has gradually reversed, and it’s a key reason the Fed may err on the side of lower interest rates this month.

Lower-Income Household Spending and Wage Growth Lag

Source: Bank of America Institute

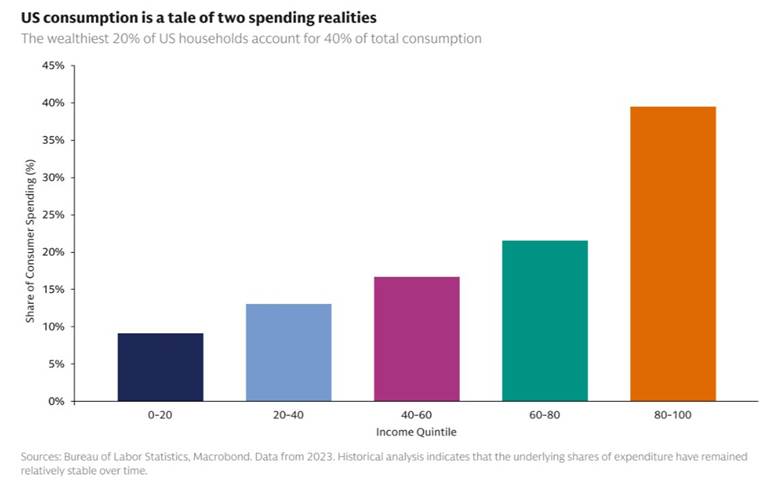

Retailers Ring the Jingle Bells, Care of the Wealthy

The reality is, though, that the wealthiest 20% of U.S. households account for 40% of total consumption. As far as Wall Street is concerned, if they are spending, there’s nothing to worry about.

Even with the unemployment rate ticking up to 4.44% (as of September), robust Thanksgiving-week retail sales suggest a record holiday shopping season. Perhaps not surprisingly, retailer stocks were in full rally mode through Black Friday—a good sign for the most wonderful time of the year (and the most crucial for consumer companies).

Top-Heavy Consumer Spending

Source: Goldman Sachs

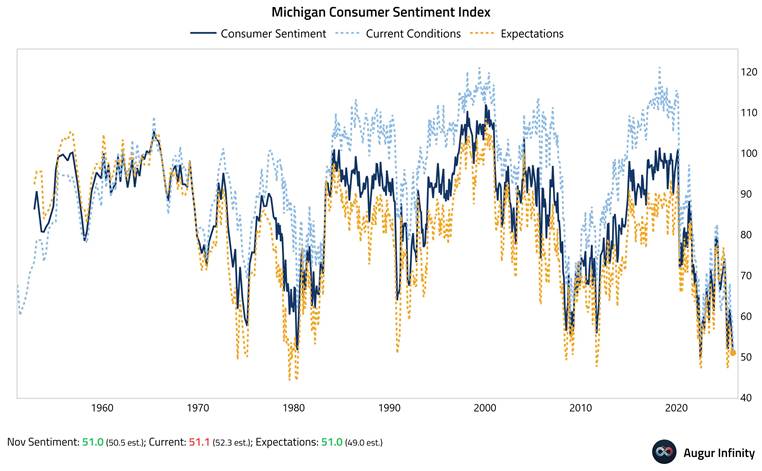

Sentiment Surveys Stay Grinch-Like

Ultimately, it’s the “watch what I do, not what I say” economy. Survey respondents are clearly displeased (even angry) when asked about how macro factors affect them.

The most recent University of Michigan Surveys of Consumers report featured the second-worst sentiment reading in its more than half-century history. The Conference Board’s Consumer Confidence Index is hardly better. What’s more, a gauge of investor vibes has been net bearish more often than not throughout 2025—during a bull market!

Humbugged Household Sentiment

Source: Augur Infinity, University of Michigan

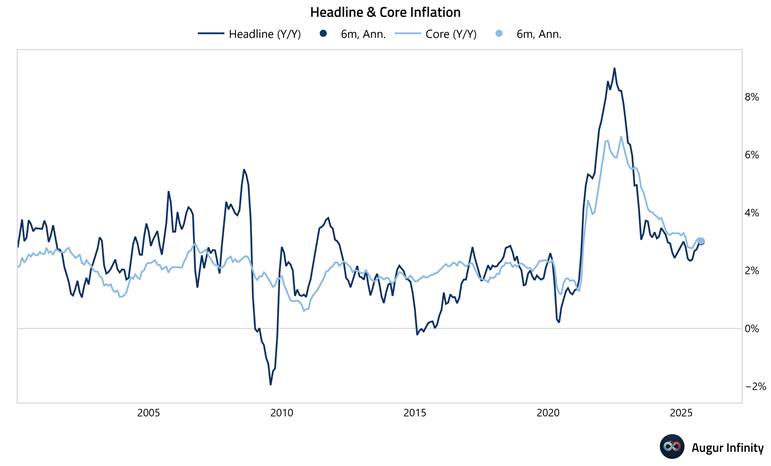

Dismissing household pessimism isn’t the right tack. Rather, digging into the why is the better approach. You see, elevated inflation affects everyone. At 3% today, inflation is not nearly as big a problem as it was a few years ago (when it was north of 6%). It’s still elevated, and folks are fed up.

By contrast, if the unemployment rate ticks toward 5% or 6% (recessionary levels), that only impacts one or two more people out of a hundred. It’s an economic quirk that underscores inflation’s wide-reaching, aggravating impact, compared to the more acute pain of unemployment.

US Inflation Near 3%

Source: Augur Infinity, BLS

Santa Claus Rally Odds Look Jolly

Looking ahead, December tends to be a strong month for stocks following significant gains in January through November. Returns have historically been loaded in the final two weeks of the month, capped by the jolly “Santa Claus Rally” period, which stretches from the current year’s final five sessions through the first two trading days of the new year.

Between now and then, we’ll get the aforementioned Fed interest rate decision, a slew of economic reports (some fresh, some stale, due to the record-long government shutdown), and a bunch more year-ahead outlooks from Wall Street’s finest forecasters.

The Bottom Line

There were some tense moments ahead of Turkey Day, but we can all be thankful for a seventh straight month of gains. A December rally would be gravy after a strong year across global markets and asset classes. We remain upbeat, though, as we highlighted, there are plenty of risks to be mindful of. Still, corporate profits are at record highs, we (consumers) will probably break records this holiday season, and even the Fed has adopted a cheerier stance.

Enjoy this time with family and friends. There’s nothing better than the Christmas season. Rejoice, relax, and refuel.