Never Panic: What April’s Selloff Taught Investors About Staying the Course

- We revisit the April Tariff Tantrum to show how disciplined investors were rewarded with one of the strongest rebounds in market history.

- Four real-time strategies executed in the depths of the selloff prove how panic can be transformed into long-term value.

- 2025 serves as a lasting reminder: volatility is normal, expected, and something investors should learn to embrace.

What’s Warren Buffett’s No. 1 rule about investing? It’s “don’t lose money.” That’s a little tongue-in-cheek, as nobody can outsmart the markets day in and day out, not even the world’s greatest investor.

The Oracle of Omaha’s point is arguably more about temperament than stock picking. He, along with his late partner Charlie Munger, talked about the difference between temporary and permanent losses. You shouldn’t sweat the former type. But the latter… well, that’s where too many everyday investors get tripped up.

Case in point: April 2025. Those who only casually glance at the stock market might think nothing of it, but most people surely recall “Liberation Day.” That’s when President Trump toted out those now-infamous poster boards detailing steep tariff rates other nations would face.

Stocks plunged. All the gains accumulated over the previous 12 months were wiped out in a handful of trading sessions (though the market peak actually occurred almost two months prior to the tariff announcement from the White House Rose Garden).

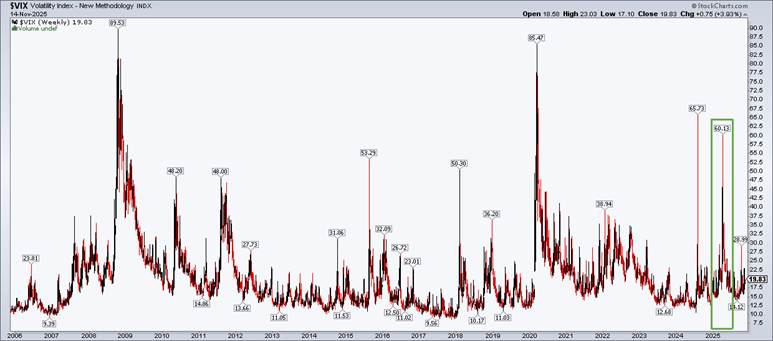

The Volatility Index (the VIX), also known as Wall Street’s “fear gauge,” spiked to levels only previously seen in March 2020 and during the 2008 Great Financial Crisis. Headlines at the time called for another “Black Monday 1987” moment and the potential for Great Depression-era tariff rates.

It was that hyperbole, that panic cascade, when investors encountered their best chance in years to recalibrate their portfolios and set themselves up for long-term success.

VIX Index Spiked to Extreme Fear, Above 60 in April 2025

Source: Stockcharts.com

Clear Harbor’s Real-Time Response

That’s what we did at Clear Harbor. It’s not just hindsight, either. You can check out our blog post published during the throes of the mass financial hysteria. The S&P 500’s ultimate low was 4835 on April 7, the same day we published a note calling on investors not only to keep their cool but to pounce on a major flash sale taking place not at a mall, but on Wall Street. Those who succumb to fear, however, locked in those dreaded permanent losses.

The S&P 500 is up 39% since then, even with bouts of recent volatility. Big-cap technology stocks (some of our favorites) have returned between 20% and 120% over that stretch.

S&P 500’s Big 10 Tech Stocks: Up a Ton Since April 7, 2025

Source: Stockcharts.com

Why Panic-Selling Is the Easy Part (and the Wrong Part)

What made the April 7 nadir so tough on those who fearfully scurried to cash amid the carnage wasn’t so much the drop. It was the hard-to-predict rally that began just two days later. It’s simply true that panic-selling is the easy part; buying back in is far and away the greater task. Why? Once an investor is out of the market, one of two outcomes generally occurs.

- Stocks keep dropping, and they feel vindicated and assume that conditions will only get worse

- The market snaps back, and they wait for the next crash (that often never comes).

Either way, they are financially paralyzed by their attempts to time the market.

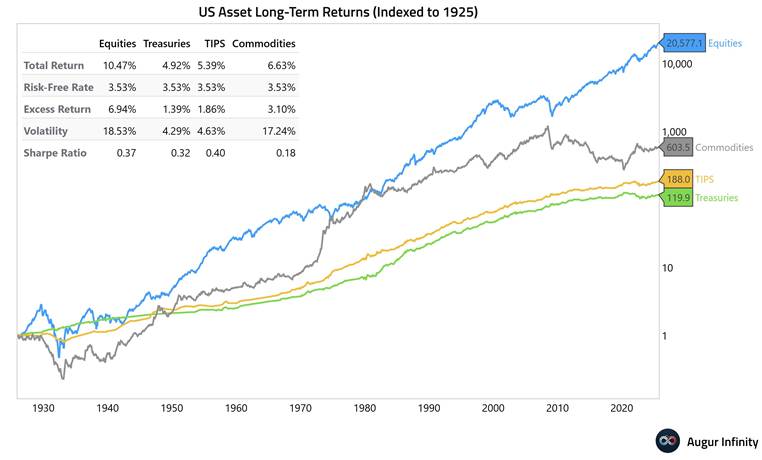

That’s how not to invest. The successful long-term allocator knows that periods of panic are unavoidable and normal. And guess what? That’s a great thing! Without people losing their minds amid a 20% decline, there would be no “risk premium” in stocks.

Fear is the ticket to the ball game. It’s also the reason you and I should expect 8%–10% compounded average annual gains in the S&P 500 and other broad indexes over the long haul. Yes, periods like April 2025, March 2020, and October 2008 can be scary, but as they say, “when there’s blood on the streets, buy.”

Stocks for the Long Run: Equities Trounce Other Asset Classes, Particularly Cash

Source: Augur Infinity

A Playbook, Not a Pat on the Back

This piece is not about taking a victory lap on a good market prediction. We don’t gamble on where stocks may go over a few weeks. We have no idea (nobody does).

Rather, the point is to reinforce that there are strategies to responsibly take advantage of sharp declines. Let’s review those so that you (and we) are ready for the next time the Grim Reaper lurches down Wall Street.

- Tactical Rebalancing After Portfolios Drift

When stocks fall, a well-constructed allocation gets out of whack. An 80/20 stock/bond portfolio becomes 70/30. To keep your investment mix anchored to your long-term goals, the right thing to do is bring it back to the target weights.

What’s more, in April, U.S. stocks had taken the biggest shellacking, so rebalancing also meant adding more to domestic funds compared to international stocks. Rebalancing is rarely exciting, but it’s one of the most reliable ways to systematically buy low and sell high.

In the heat of the moment, pressing the buy button felt like climbing aboard a roller coaster, but it was the right thing to do. Jump ahead to today, and the payoff is clear. As fast as stocks plunged early in 2025, they snapped back with intensity—the “V-shaped” bottom, as some call it. The very stocks that were crushed the most have been some of the biggest winners (NVIDIA, Tesla, Alphabet, the parent company of Google).

The lesson? You don’t rebalance because conditions feel good; you rebalance because your long-term plan requires it. When markets ricochet, tactical discipline is often the difference between staying on track and drifting into risk levels you never intended to take.

S&P 500 in 2025: The V-Shaped Rally

Source: Stockcharts.com

- Buying the Dip with Cash (and Courage)

In the April article, we noted that we were selectively buying the dip, taking advantage of market dislocations for clients who had cash on hand or were in the middle of staged investment plans. Buying during market stress is one of the oldest investment disciplines and the hardest to execute emotionally. It requires:

- A long time horizon

- A cash hoard (perhaps from a tax refund, sale of business assets, or some other one-off recent liquidity event)

- A willingness to be early

That third bullet point is crucial. Nobody rings a bell at the bottom. When opportunities arise, they are never accompanied by comforting headlines. It’s the opposite. Pundits are on air saying, “more volatility is ahead, it’s a new world, the previous bull market is over,” and everything is over the top. Sentiment is fearful, and few dare to utter the words “buy the dip.”

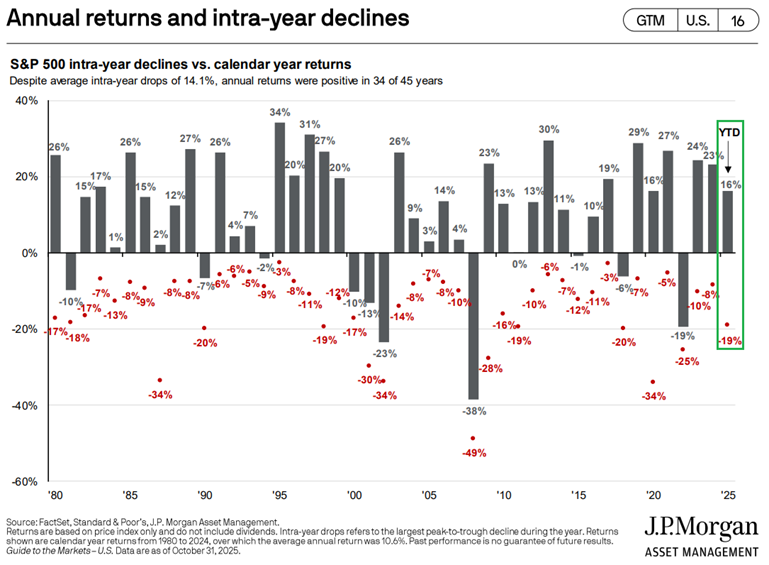

But those who put cash to work benefited meaningfully as the year unfolded. Looking back (pictured below), 2025 could actually turn out to be a very normal year in terms of the annual gain and intra-year decline.

The lesson? Cash is an opportunity generator, not a drag, when used intentionally during moments of market stress.

S&P 500 Annual Returns & Max Yearly Declines: 2025 Is Actually Normal

Source: J.P. Morgan Asset Management

- Tax-Loss Harvesting to Turn Volatility into Bankable Value

Not everyone has a ton of cash to deploy when stocks drop 20% (nor should they). Still, investors with sizable taxable brokerage accounts have the chance to financially optimize with tax-loss harvesting.

It’s the strategy of selling losing positions and immediately buying similar securities to capture realized losses, thereby reducing future tax bills. Tax-loss harvesting rarely makes the front page of financial news, but it can add real dollars to after-tax returns over time.

Many of Clear Harbor’s clients will now pay a bit less to Uncle Sam in 2025 (and future years) thanks to this strategy. Their portfolios are largely the same as where they otherwise would have been (thanks to the proliferation of low-cost fund choices).

Critics might argue that tax-loss harvesting merely defers what you’ll eventually owe, but we counter that. Years or decades down the road, donating appreciated shares to a charity near to a client’s heart or taking advantage of “stepped-up cost basis” when passing positions down to heirs are common outcomes.

The lesson? April’s selloff created a window to reduce tax liability without taking significant risk or altering a long-term portfolio.

- Roth Conversions: Smart When Markets Drop, Even Better When They Rebound

One of the most misunderstood tools in retirement planning is the Roth conversion. The April pullback created a perfect environment for doing them. When account values are depressed, converting pre-tax assets into a Roth means you pay taxes on a smaller base, and all subsequent recovery happens tax-free.

A smaller pre-tax bucket is huge in retirement, as it means lower Required Minimum Distributions (RMDs) and less of a chance that you’ll get slapped with Income-Related Monthly Adjustment Amount (IRMAA) surcharges on Medicare premiums.

This is one of the few instances where market volatility works undeniably in your favor. Converting during a downturn is like paying tax on the sale price but keeping the appreciation. For clients for whom we executed conversions in April, the rebound since then means a larger tax-free growth base heading into 2026 and beyond. That’s a long-run reward for short-term discomfort.

The lesson? Investors who max out their pre-tax 401(k) contributions and lack significant Roth assets should consider converting from pre-tax to Roth (i.e., paying taxes in the current year) when stocks fall significantly.

Fear Is Inevitable, but Damage Is Optional

So, that’s what we did for clients when it felt like the financial world was ending. To us, the post-Liberation Day drama was a gift. Conversely, those who panicked paid the price. Going forward, remember that every 10% decline and 20% bear market feels different while you’re in it. The narrative changes—tariffs, elections, recessions, inflation—but the emotional pattern is the same. Blame it on good ole animal spirits!

Markets fall fast. Headlines turn dire. Predictions of prolonged pain become louder. Your instincts tell you to retreat, but the long-term data paints a very different picture, as stocks have recovered from every downturn in modern history. The majority of the market’s best days occur near the worst days, and staying invested and following a disciplined plan consistently beats reacting to the gaslighting talking heads.

The April 2025 selloff was no exception. A moment of heightened anxiety became one of the strongest buying opportunities in years during this AI-fueled bull market. Investors who stayed focused on rebalancing, tax planning, and long-term positioning won the game. Those who sold into fear locked in losses and missed one of the best rebounds in history.

The Bottom Line

If you look at all four strategies we outlined in real time during the April Tariff Tantrum—rebalancing, dip-buying, tax-loss harvesting, and Roth conversions—they all share one thing in common: they require a plan.

You can’t improvise your way through market stress. You need guardrails, guidelines, and a framework that tells you what to do before volatility hits. That’s what we deliver to our clients, and you can have the same confidence if you get started now, before the market’s next emotional test.