Stocks Suffer Post Liberation Day, S&P 500 Nears “Bear Market Territory”

- Last Thursday and Friday were tough on the bulls, with the S&P 500 tallying a 10% two-day drop, the worst since March 2020

- With fear comes opportunity, though, and we are taking advantage of what the bears have brought about

- A recession is getting priced in, but history shows that when dramatic declines occur, powerful rallies can develop fast

“People are really strange during market downturns. Most folks are savers — and that means they’ll be net buyers. They should want the stock market to go down. They should want to buy at a lower price.” – Warren Buffett

Stocks plunged after President Trump announced universal and reciprocal tariffs from the White House Rose Garden last Wednesday afternoon. The S&P 500 posted their worst week since March 2020, tumbling 9%. The Nasdaq Composite lost 10%, dragged down by major declines among shares of the Magnificent Seven stocks. Small caps and international equities—even defensive sectors—were unscathed, too. The Volatility Index (VIX) soared to its loftiest level since the COVID crisis.

Traders’ eyes remain glued to screens this week, with their ears tuned into the latest words from the president on tariff policy. Investors may be left uncertain how to react—sell some stocks (it’s been a great few years, of course), hold off on new buys until the dust settles, or back up the truck and buy the dip.

Here’s our take: Volatility is probably here to stay for a while, but after a significant drop already in the books (down more than 17% in the S&P 500 peak to trough), stocks are probably on sale. Could there be lower prices in the months ahead? Sure. Who knows. Anybody suggesting markets will surely snap back and hit new all-time highs in short order is fooling themselves. At the same time, doomsdayers proclaiming an imminent global depression have gone off the deep end.

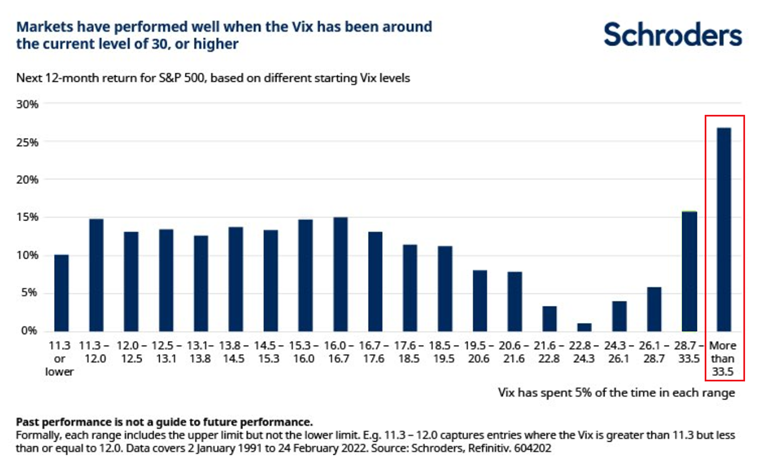

Buying Stocks When the VIX Is High Has Been a Winning Strategy

Source: Schroders

The truth is, there have always been corrections (down 10%), bear markets (-20%), and crashes (down 30% or more). And they can happen at any time for any reason. Last year, we noted in various market updates that making portfolio moves based on politics was foolish. That same advice holds today. True, the pile of unknowns regarding tariffs is heaping—a bear market and recession is a real possibility. Also correct is the reality that markets have priced in a high chance of those adverse events happening.

Making matters worse for those who bail today (or even sold at the exact top in stocks on February 19) is that getting back in is by far the tougher struggle. You see, when stocks are at their lows—think October 1987, October 2008 or March 2009, March 2020, or even October 2022—those staring at CNBC all day become paralyzed, trying to figure out if the macro will deteriorate further.

The media only dives into the bad stuff, and prices confirm that negative narrative…at least for a little while. The bottom happens, and the economic news actually gets worse, which almost always keeps those overconfident market timers stuck in cash. The upshot: Selling is the easy part; buying back is way more challenging.

So, that’s how not to invest. What about actions that make sense when stocks get scary? Turmoil is terrific in some respects. Here’s why: There are tactical strategies we execute that have nothing to do with calling a bottom in the S&P 500. Among them include:

- Tactically Rebalancing Portfolios

Rebalancing—bringing an allocation in line with an individual’s goals—means trimming what has done well (or least bad) and using those proceeds to buy more of what dropped big. For us, that may mean selling bonds and buying high-quality tech stocks down about 30%. The key is to adjust portfolios back to their intended risk parameters so that long-term goals can be better achieved.

- Buying the Dip with Cash

Now is the time of year when people have a little extra chunk of change—maybe from a bonus or a tax refund. It’s also possible that you accumulated more cash than you intended, given how high savings account rates and money-market yields have been. Taking that excess liquidity and putting it to work in high-return potential assets—stocks—is a fine play for those with a time horizon beyond five years. Buck the herd by scooping up shares on sale.

- Tax Loss Harvesting

Corrections and bear markets also present the chance to dump losing stocks or positions you don’t really want to own—maybe ones bought due to FOMO. This strategy entails snapping up losses that can be used to offset capital gains. Moreover, taxpayers can use up to $3,000 of losses annually to count against their income to reduce their tax bill.

- Roth Conversions

Are you approaching retirement? We have many clients in that boat. For them (and this can apply to investors of any age), converting pre-tax assets within a traditional or rollover IRA into a Roth IRA may be a long-term tax win. Locking in today’s tax rates at low prices means the future rebound comes on tax-free positions, which can turbocharge your path to retirement. Much depends on your personal tax situation, of course.

When the market takes it on the chin, how you respond matters way more than how the S&P 500 responds. The case for calm is airtight. History shows that just sticking with your plan is the right thing to do. As Jack Bogle, the founder of Vanguard, quipped, “Don’t just do something. Stand there!” That’s easier said than done for some investors, but we also have clients who hardly flinch with volatility spikes.

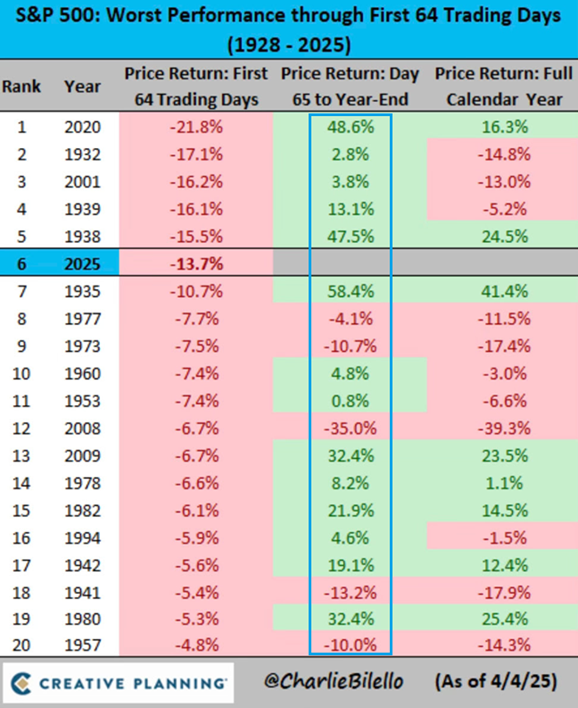

Bad Beginnings Often End Well

Source: Charlie Bilello

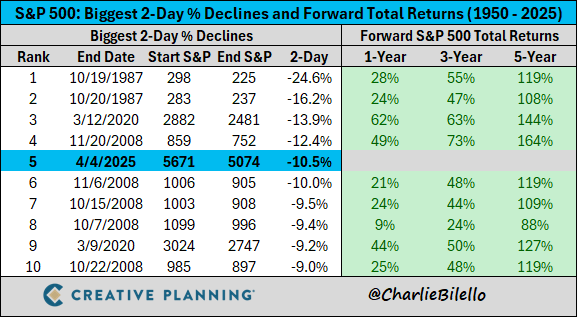

Strong Future Returns After Huge 2-Day Selloffs

Source: Charlie Bilello

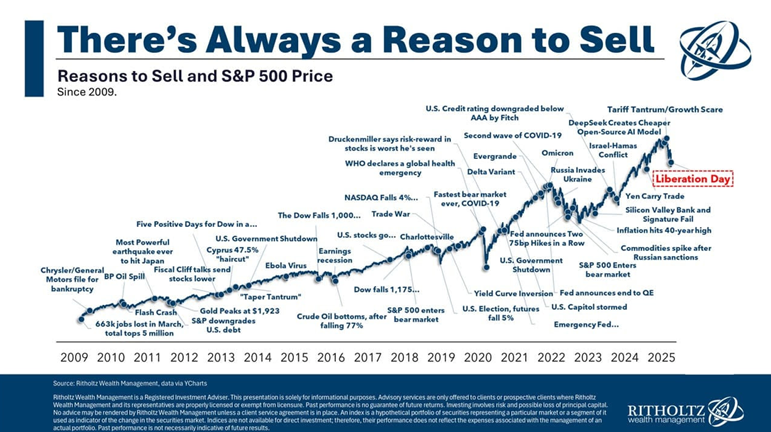

There’s Always a Reason to Sell

Source: Ritholtz Wealth Management

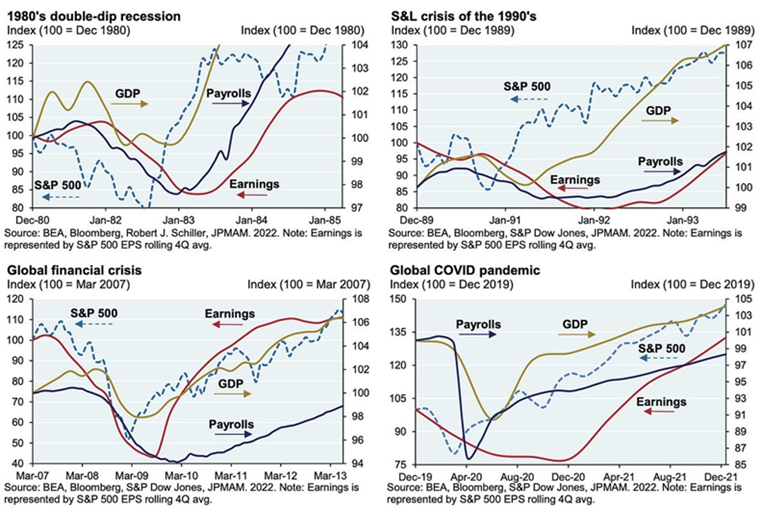

This One’s Complicated…But Stocks Usually Bottom Before the Worst Economic Conditions Hit

Source: J.P. Morgan Asset Management

What’s Going On?

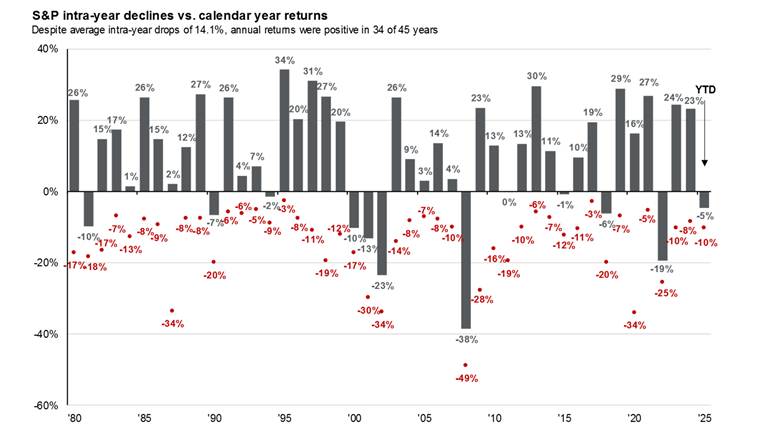

So far in 2025, the S&P 500 is down 13.5%. That’s a funny number because it’s smack-dab the average intra-year decline seen in markets over the long haul. So, it’s normal to see price action like this—and while fear’s reason is always novel, the media and some people without a plan always overreact.

The Average Intra-Year S&P 500 Drop is 14.1%

Source: J.P. Morgan Asset Management

What’s different in 2025 compared to, say, 2022 is that bonds are doing very well—up 3.6% through last Friday. Foreign stocks have outperformed, off by only 2% YTD, though small caps, tech stocks, and the mega caps have been taken to the woodshed. Interestingly, shares of the likes of NVIDIA (NVDA) and Alphabet (GOOGL) are now cheap on traditional valuation metrics. Apple (AAPL) and Amazon (AMZN) sport price-to-earnings ratios that are FAR lower than just a couple of months ago. Thus, diversification has done its job in 2025, and bargains are perhaps out there for those who keep buying.

Interestingly, guess what asset held up remarkably well last week amid the carnage and dramatic headlines? Bitcoin. The world’s most valuable and often volatile cryptocurrency was positive last week, and its price trend was downright dull before a Sunday drubbing. Once the macro waters calm, it will be interesting to see if bitcoin acts like a beach ball under the water, ready to rise quickly.

Away from performance numbers, the economy appeared to be on a decent footing going into April. Last Friday’s March jobs report was strong despite being an afterthought in the news. The economy added 228,000 positions, much better than the forecast of 140,000. The unemployment rate barely rose from 4.14% to 4.15%–basically unchanged.

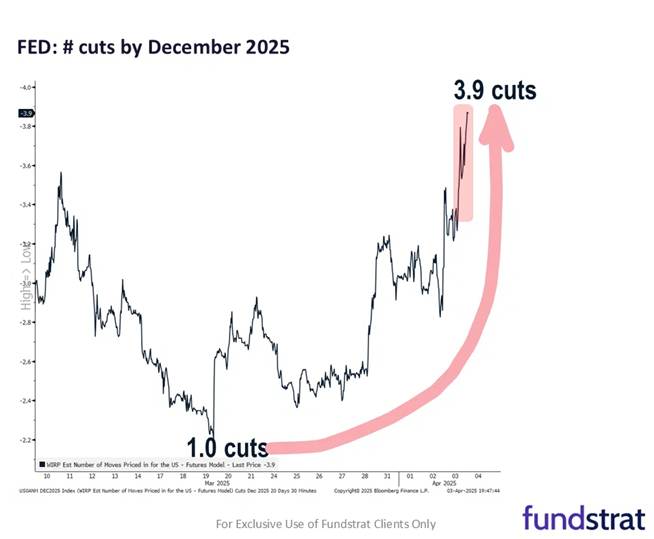

Inflation remains a wildcard, but if cooler heads prevail on the trade situation, much lower oil prices should drag on the CPI rate. And, believe it or not, the cost of eggs weighs materially on US inflation, so its 60% plunge is encouraging. Finally, along with steady rents, used car prices have dropped slightly, paving the way for the Federal Reserve to cut rates sooner rather than later.

Fed Rate Cuts Likely

Source: Fundstrat

There are some positive happenings, but tariffs and what could be a fundamental shift in how economies, big and small, interact is an irresistible force. The betting markets price in a 60-65% US recession probability; they also think Q1 GDP growth was flat after two years of strong expansion.

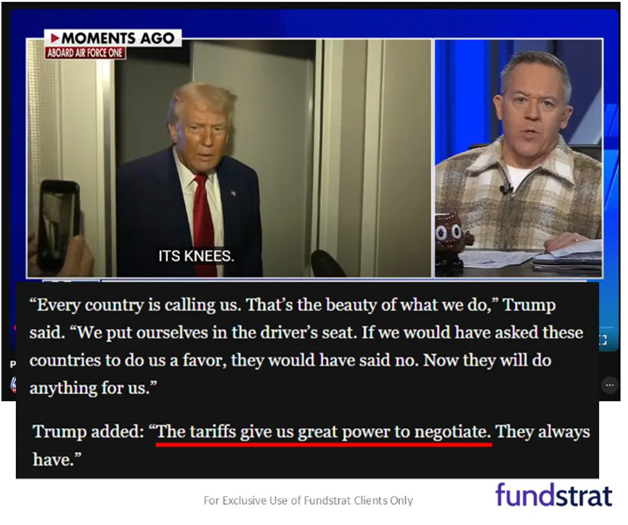

President Trump and Treasury Secretary Bessent signaled that some pain was in the offing—an “adjustment period” is the latest euphemism—and that may persist. We believe it will shake out eventually, and lawmakers can then focus on the good stuff—tax cuts and deregulation.

At His Core, Trump Wants Higher Stock Prices

Source: Fundstrat

The Bottom Line

Global stocks plummeted last week after a decent start to the year. Volatility rattled some investors, but with market pullbacks come opportunities for portfolio optimization. History shows that when drops of 15-20% occur quickly, the S&P 500 often performs very well in the 12 months thereafter. Several indicators suggest panic reached an extreme, and though more downside may be to come, we assert that holding stocks today will prove lucrative looking out a few years and beyond.