January 2026 Market Recap: Strong Earnings, Steady Consumers, and Macro Crosscurrents

Solid Start to 2026 for Stocks, Gold & Silver Go Crazy, and a New Fed Chair Spices Up the Macro

- Volatility catalysts were plentiful in January, but stocks hit new records amid the noise

- Diversified investors benefitted from small-cap and international outperformance, while the Mag 7 were only slightly positive

- The “Sell America” trope and “debasement trade” narrative made the media rounds, but U.S. fundamentals still look strong

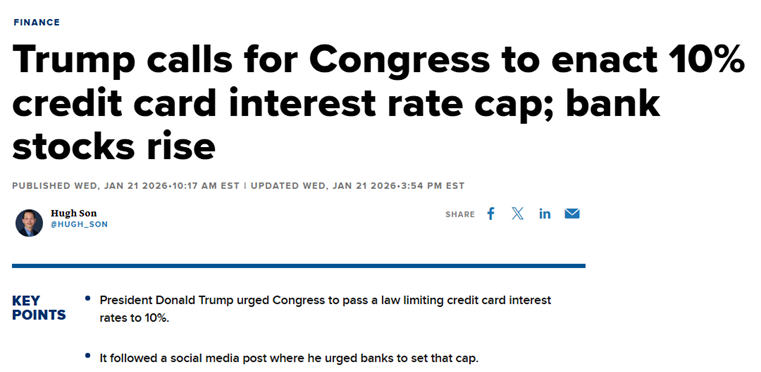

It was a barnburner of a start to the year. From a regime overthrow in Venezuela to proposed credit card interest rate caps, a new Fed chair pick, and another government shutdown, the first 20 trading days of the year felt like 200 for those with their heads buried in the day-to-day minutiae.

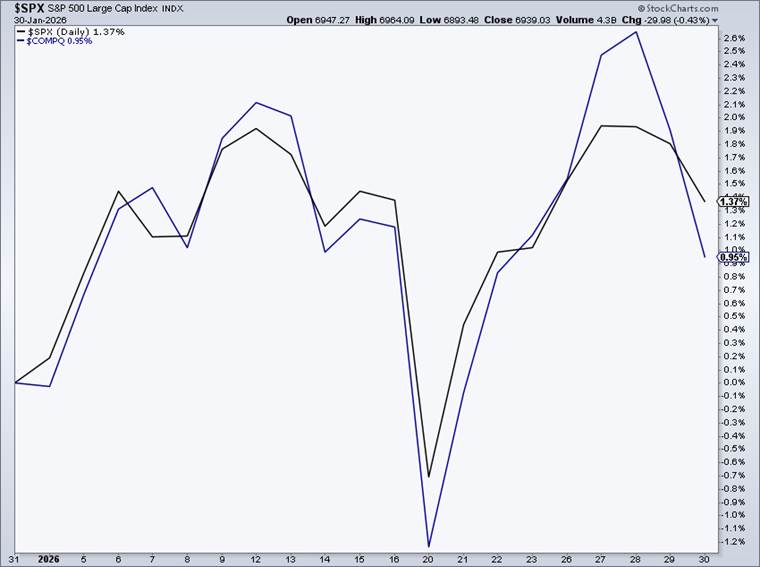

Despite the onslaught of macroeconomic volatility catalysts, the S&P 500 closed at another all-time monthly high, gaining 1.4%, while the Nasdaq recovered 1% after a couple of losing months to end January.

S&P 500 Solid Start to 2026, +1.4%

Source: Stockcharts.com

January Stock Market Performance Heat Map

Source: Finviz

Drama was indeed high on Capitol Hill and from the West Wing of the White House. We expect more of the same as the year unfolds, with key midterm elections ahead. It’s clear that the Trump administration has “affordability” top of mind with nine months until voters head to the polls.

Amid myriad headlines, the president directed Fannie Mae and Freddie Mac to buy up to $200 billion of mortgage-backed securities early last month, which helped keep a lid on long-term borrowing rates for homebuyers. The POTUS also aims to ban corporations from the residential real estate market.

Trump Floats 10% Credit Card Interest Rate Cap

Source: CNBC

Another affordability push was seen in the Health Care sector. Late in January, the Centers for Medicare & Medicaid Services (CMS) announced a 2027 Medicare Advantage pay increase of just 0.09%. That’s a boon for users of government-sponsored services, but a heavy cost to bear for insurance companies.

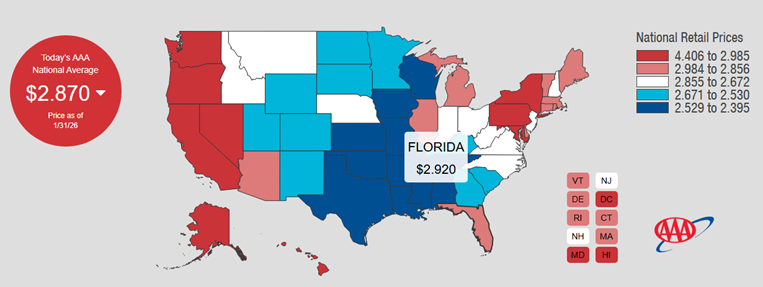

Of course, the administration’s “drill, baby, drill” M.O. within the Energy sector has worked for Americans. In January, prices at the pump fell to five-year lows before increasing slightly into early February.

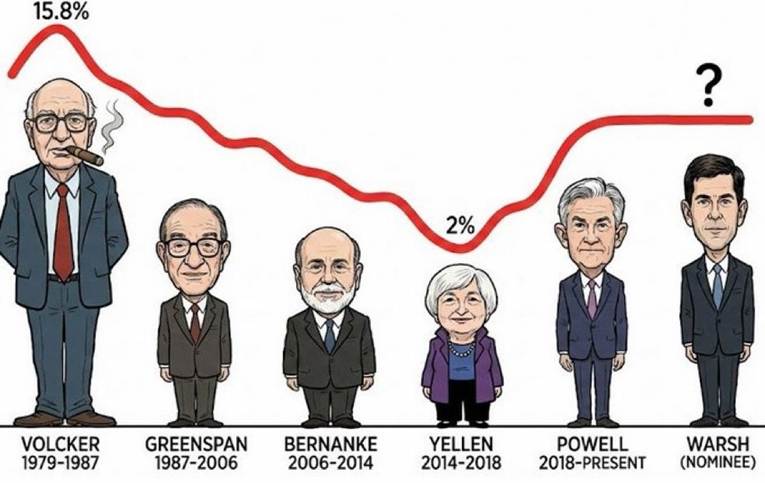

Affordability is also at the heart of President Trump’s choice to lead the Federal Reserve once current chief Jerome Powell’s term is up in mid-May. On Friday, January 30, former Fed Governor Kevin Warsh was nominated to be the next Fed chair.

Warsh’s extensive monetary policy experience and Wall Street background are seen as positives, but critics argue that his views shifted only once he vied for the Fed chair role, turning from “hawkish” on inflation to a “dove.” A harsh Fed critic over much of his career, some of Warsh’s economic predictions turned out to be off base coming out of the 2008 Great Financial Crisis.

Who is Kevin Warsh?

Source: Bloomberg

Where Will Interest Rates Go Under a Chair Warsh?

Source: Joe Weisenthal, X

Trump obviously seeks lower interest rates to help the Main Street economy—he continues chastising Powell for not dropping the Fed’s policy rate fast enough. For Warsh (assuming he is confirmed by the Senate later this quarter), he will face a tricky balancing act.

Surely the Stanford lecturer and Duquesne Capital executive will wish to appease the president, but he will be just one of 12 voting members on the Federal Open Market Committee (FOMC). Herding the Fed cats to usher in a series of rate cuts will be no easy task—and economic conditions could even warrant a rate hike early in his chairmanship.

Lastly, regarding all the Fed hoopla, we’ve seen that a lower policy rate doesn’t necessarily translate to cheaper consumer borrowing levels. The benchmark 10-year Treasury note yield has risen since the Fed began cutting in September 2024.

Mortgage Rates Down Sharply YoY, But Up Since the Fed Started Cutting Rates

Source: Kevin Gordon, Schwab, Bloomberg

The Fed plays a role in how markets perform, but it’s like a supporting actor—despite how much the media talks up its relevance. Ultimately, corporate earnings and consumer activity steal the show. Both of those x-factors are strong, even in the face of dire media stories and unstable macro developments. Let’s unpack why that’s so.

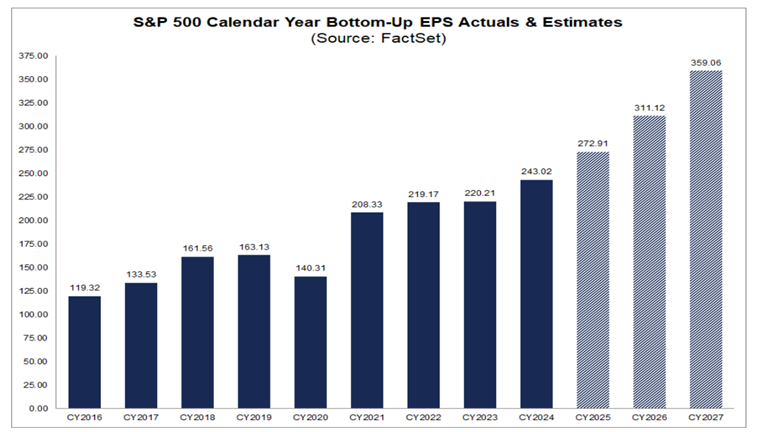

First, we are in the heart of the Q4 earnings season. So far, it’s yet another stellar stretch for S&P 500 profit gains. According to FactSet, the current 11.9% bottom-line growth rate marks a fifth consecutive quarter of double-digit earnings increases. Since 2023, large U.S. companies have churned out about 14% annualized earnings per share (EPS) growth, led by big tech.

Some strategists grew concerned about the concentration of profits, focused among the Magnificent Seven stocks and AI-related firms. Those fears are being relieved somewhat, as other sectors and industries are seeing bottom-line boosts.

Intense S&P 500 Earnings Growth Since 2023

Source: FactSet

As it stands, analysts predict a stellar 14.3% S&P 500 EPS growth rate this year. That figure will adjust, of course, but it’s important to consider that today’s companies are battle-tested—they endured the COVID shock six years ago, made it through a protracted bear market in 2022, and navigated tariff uncertainty last year.

In short, CEOs have weathered many storms, proving their nimbleness and adaptability in generating profits for shareholders’ benefit. That’s critical to keep in mind at a time when there is so much macro uncertainty and a media focus on all that could go wrong.

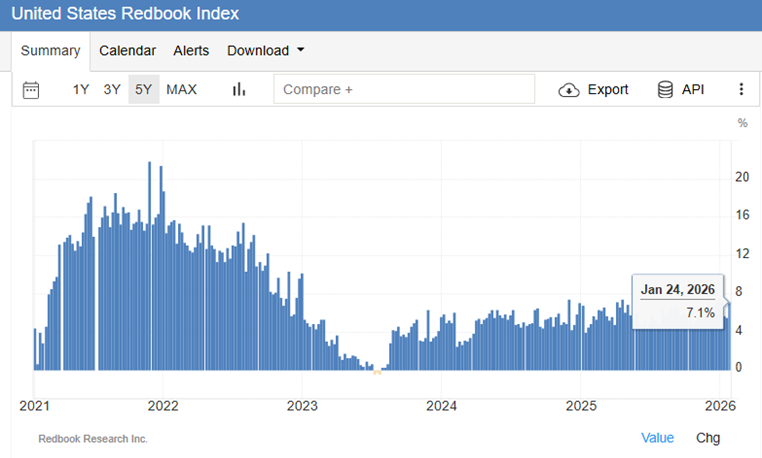

But what about the consumer and that “K-shaped” economy everyone is talking about? Once again, reality is different from the trope. The latest read on weekly U.S. household spending growth is a stout 7.1% year-over-year. That’s more than four percentage points above the inflation rate.

Are some consumers angry about the state of political affairs and still reeling from inflation? Absolutely. Are they spending on both staples and discretionary items? Oh yeah they are.

Redbook Retail Sales +7.1% YoY

Source: Trading Economics

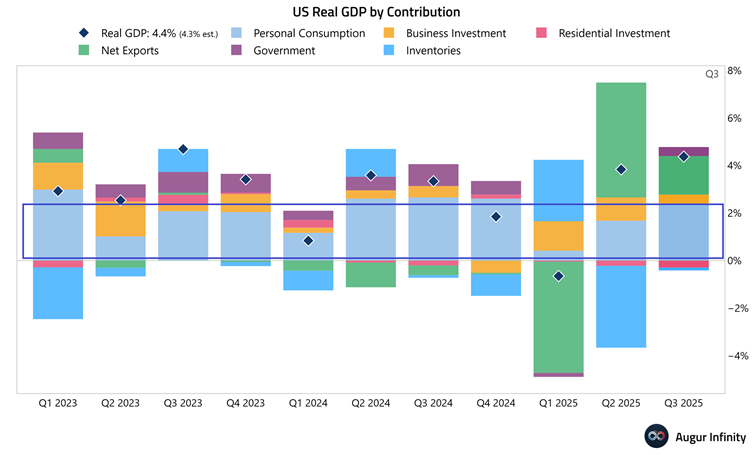

Consumption accounts for roughly two-thirds of GDP growth, and that core piece of the economy has been remarkably steady for the past few years. Earnings reports last week from the likes of American Express, Visa, and Mastercard also confirmed robust year-end 2025 retail trends—something we discussed leading into the holiday shopping season.

Analysts might even take a signal from Apple’s quarterly iPhone sales figures, which smashed records over the October-through-December period.

Volatile GDP, But Strong Consumer Spending Since 2023

Source: Augur Infinity

To recap, earnings growth relies on a solid economy, which is driven by healthy consumer spending. It begs the question: what could upend household spending today? Many pundits point to the employment situation.

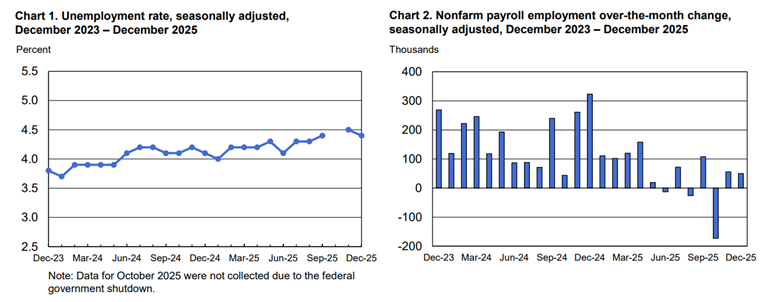

The December jobs report, published in early January, painted a mixed picture. The 50,000-payroll gain was below forecasts, but the unemployment rate fell a notable 0.16 percentage points to 4.38% from November. Markets didn’t react much to the data, as it largely confirmed what we knew—the labor market is stagnant.

“Slow hire, slow fire” is the mantra, and most of the net hiring is being done by so-called non-cyclical sectors, such as healthcare and education. More recently, however, weekly initial jobless claims data and recurring applications for unemployment benefits have declined, which is a good sign. We’ll get a fresh round of January jobs data this week.

Unemployment Rate Edges Down, Monthly Job Growth Remains Soft

Source: BLS

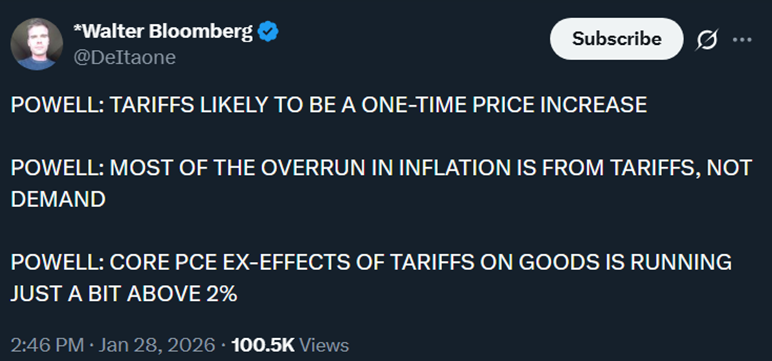

The elephant in the room is inflation, and it has been for the past four years. The Consumer Price Index (CPI) rate is stubbornly elevated at 2.7%, above the Fed’s 2.0% target. Yes, tariffs have put upward pressure on prices, but only to the tune of about 0.5% to 0.7%, according to the Fed. Additionally, tariffs will begin rolling off the year-over-year view come springtime, which will flatter the CPI rate downward.

CPI itself is a bit of a flawed measure, too. As outgoing Fed Governor Stephen Miran often points out, CPI uses badly lagged housing and rental price data. At the same time, the Fed’s preferred inflation gauge—the Personal Consumption Expenditures (PCE) Price Index—strangely weights investment management enough that it has resulted in nearly 0.3 percentage points of additional inflation YoY.

Bottom line: inflation is still a risk, but it’s probably yesterday’s worry.

Powell: Inflation ex-Tariffs Running “A Bit Above 2%”

Source: X

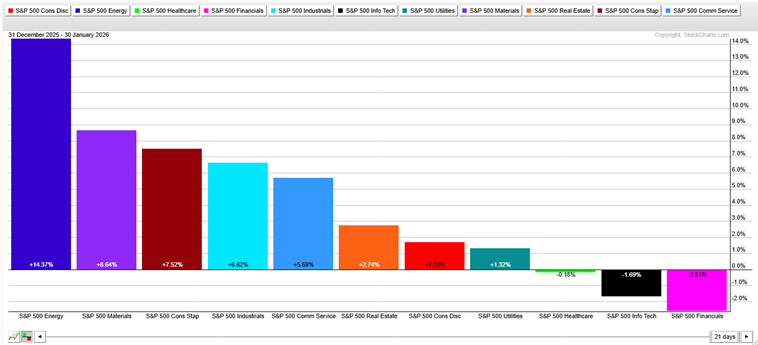

Wrapping up, we must assess all that played out in markets to kick off the year. The S&P 500 reached a new record high, led not by tech and AI, but by Energy and Materials stocks. Rising oil and metals prices boosted the resources sectors, and volatility was the word of the month.

Gold gained 20% in just the first few weeks of 2026 trading, while silver soared to a peak of $122 per ounce. Then, last Friday’s price action was outright historic. The yellow metal plunged below $5,000, and silver crashed to $74 at its low. Remarkably, gold ended January with a 13% gain. Silver was up 18% year to date, despite its worst session since March 1980, to close the month.

Silver’s Historic Rally & Plunge, Still +18% YTD

Source: Stockcharts.com

Oil was the sleeper. A barrel of crude climbed 14%, actually outpacing gold. There’s a good chance that retail gas prices will keep creeping higher through the first half of the year, too. But given the global oil supply glut, it’s unlikely that we’ll see sustained high prices in 2026.

Elsewhere in Energy, natural gas surged amid a series of winter storms—good news for Gulf Coast producers, bad news for consumers who already face mounting monthly electricity bills.

USA Gas Prices Below $3/Gallon

Source: AAA

Big banks and Financials lagged to begin the year. The aforementioned credit card interest rate crackdown pressured the likes of Visa, Mastercard, JPMorgan Chase, and others. The floated rule also let the air out of some airline and hotel stocks, which operate more like credit card issuers based on how they generate profits.

Within the Magnificent Seven, it was arguably the quietest month we’ve seen in years. Google and Meta led, up 8–9%, while Microsoft was the worst performer, down 11%. Bullish fervor was more apparent in legacy memory and storage stocks, including SanDisk, Western Digital, and Seagate Technology.

Energy & Materials Best in January, Financials Worst

Source: Stockcharts.com

Beyond the S&P 500, U.S. small- and mid-cap stocks outperformed, much to the delight of diversified investors. Furthermore, international markets beat domestic indices. The U.S. Dollar Index dipped 1%, but that was enough weakness for ex-U.S. ETFs to tally 5–6% January gains, continuing the theme of international outperformance that began in 2025.

“Sell America,” “debasement trade,” and chatter of a dollar collapse have made the rounds, but we believe those dramatic taglines are overblown. Go back 30–40 years, and you’ll see that the U.S. Dollar Index has ranged from 70 to 120, making today’s 97 level look very normal. In fact, it could fall to 90 and still be in line with historical norms.

Dollar weakness can be an economic tailwind, too, since it boosts net exports and increases GDP. The downside is that higher inflation often comes with a cheaper greenback—there are always two sides to a macro coin.

US Dollar Index: Middle of its Long-Term Range

Source: Stockcharts.com

The Bottom Line

2026 greeted investors with a warm handshake and solid returns. Well, the latter part of that statement is true, but the former is far from it. Jarring headlines came left and right, keeping Wall Street strategists busy and already rewriting their year-ahead outlooks.

Diversified investors benefited from strength across stock styles and segments, while the bond market was ironically quiet. Metals soared, bitcoin tumbled, and oil crept higher from the mid-$50s to the mid-$60s. We begin February close to record highs in the S&P 500, with more market-moving White House announcements surely to come.