Shutdown? The Market Didn’t Get the Memo. Stocks Hit New Records.

- The S&P 500 rallied 3.5% in September and built upon those gains as the federal government closed its doors to begin Q4.

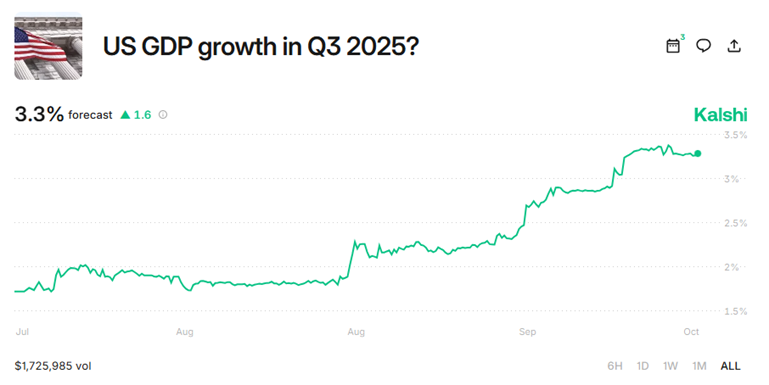

- An AI supercycle and corporate dealmaking underpin 3%-plus GDP growth, along with consumer strength.

- The jobs market is weak, though, and more Fed rate cuts are likely on the way.

Shutdown? Party on. The S&P 500 tallied its 31st record-high close of the year on Day 3 of the federal government shutdown. Wall Street traders and Main Street investors alike looked past all the D.C. drama, and early-October gains came on the heels of an unusually strong September.

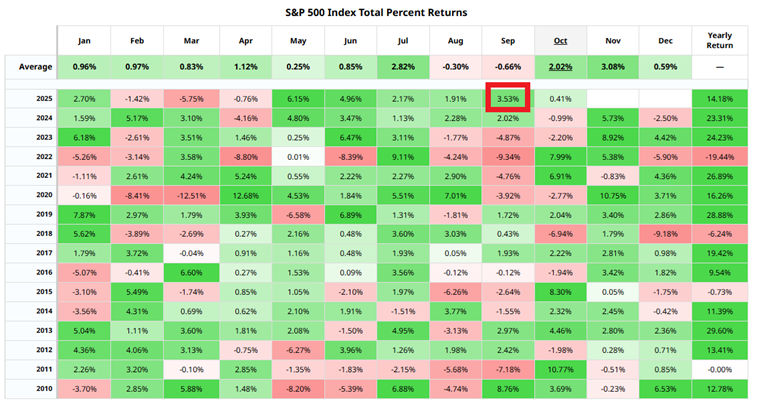

Last month, the S&P 500 climbed 3.5%, its best September since 2010. Historically, the final month of the third quarter has been dominated by the bears, with downward price action and heightened volatility (each September from 2020 through 2023 was negative by at least 3.7%). But not this year. Not this time.

September Returns: S&P 500 +3.5%, Nasdaq +5.6%, Small Caps +3.2%

Source: Stockcharts.com

S&P 500 Monthly Returns: Best September since 2010

Source: Barchart

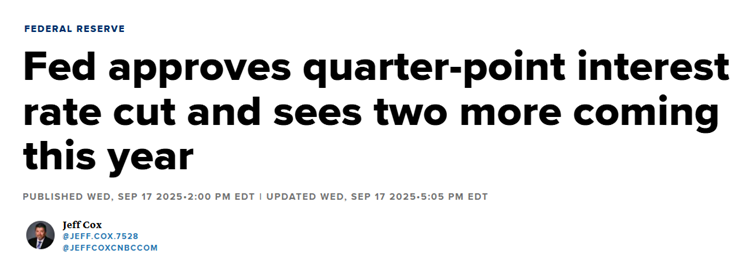

Markets kept chugging higher courtesy of two primary catalysts. The first was a carryover from August, back when Federal Reserve Chair Jerome Powell signaled to markets that the Federal Open Market Committee (FOMC) would resume its rate-cutting cycle that went on pause in late 2024. The FOMC indeed lowered its policy rate by a quarter point at the September 17 gathering.

At the meeting was a fresh face. Stephen Miran, on leave from the White House team after serving in his previous role as chair of the Council of Economic Advisers, is a temporary Fed voting member. A Trump loyalist, Miran was the lone dissenter in last month’s interest rate decision. He voted for a jumbo 50-basis-point cut, whereas the other 11 Fed officials voted for a more standard quarter-point ease.

It being the final FOMC meeting of the quarter, the Committee provided its “dot plot,” which is a macro forecast of where it sees interest rates heading in the months and years ahead. Miran’s dots were much more “dovish,” calling for expedited lowering of the policy rate, than the FOMC writ large.

While there is political discourse related to the Fed today, the reality is that short-term interest rates are likely on the way down. Bond traders price in another two quarter-point cuts by year-end, with further easing throughout 2026. As a result, the path of least resistance for stocks in September was up.

A Fed Rate Cut Helped Boost Stocks in September

Source: CNBC

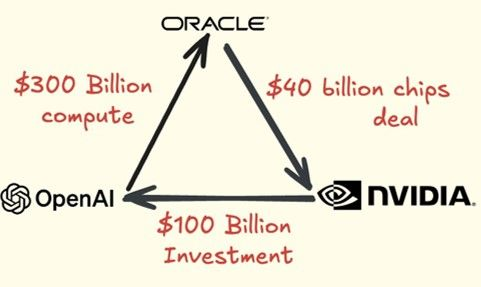

But it’s not all about the Fed. Perhaps more impactful is the earnings power of large corporations, particularly those related to artificial intelligence (AI). This is the second bullish catalyst. While September didn’t feature many quarterly profit reports, there was a slew of major deals announced by the likes of NVIDIA (NVDA), Oracle (ORCL), and other tech firms. It’s turning into a bullish cycle in which cash-rich stalwarts like NVIDIA are financing the operations of high-growth AI developers, who then use those funds to purchase chips from NVIDIA.

Just a few days ago, OpenAI was valued in the private markets at more than $500 billion. That would put it in the top 15 largest S&P 500 companies if it were to go public. Sam Altman’s OpenAI, the company behind ChatGPT, inked deals with NVIDIA, Oracle, CoreWeave (CRWV), and Broadcom (AVGO) in recent weeks. The spate of investments from that name alone indicates the fervor surrounding AI as year-end nears.

It’s also possible that (pending the government reopening) we could see OpenAI (and others) seek to go public via an IPO. Other behemoths, such as Elon Musk’s SpaceX, Anthropic (developer of the Claude large language model), or Perplexity (another AI tool), may also pursue IPOs.

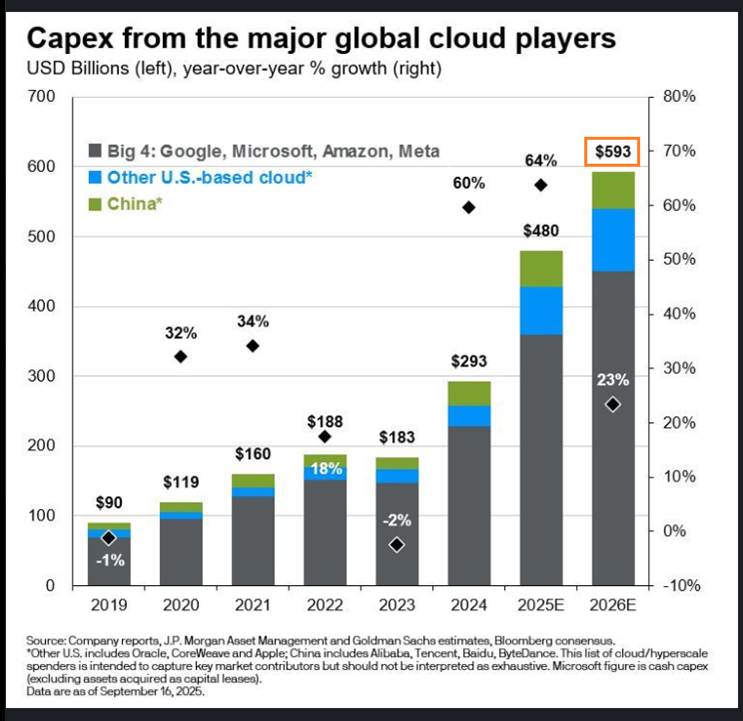

Bigger picture, AI hyperscalers and cloud-storage companies may collectively invest more than half a trillion dollars in the AI megatrend next year. Consider that ChatGPT launched in November 2022—this is indeed a supercycle that is already reshaping the global economy.

AI Capex Boom in Progress

Source: J.P. Morgan Asset Management

Our take? Yes, the Fed matters, but it’s merely steering the massive ship that is the U.S. economy. And the global economy is being powered by AI investment and real corporate profits. To be clear, there are risks—even immediate cautionary flags.

For instance, the sort of “vendor financing” deals announced in September evoked late-90s vibes. When one company “invests” in one of its customers to ensure it receives more orders in the period ahead, that should raise some eyebrows. We didn’t see this kind of financial engineering three years ago, when the bull market began.

Tech Bubble Clue? Vendor Financing is Back.

Source: Peter Shi

Could AI be a bubble like the Dot-Com Boom was a bit over a quarter-century ago? Sure. Does it mean the stock market is about to crash? It’s hard to make that case. Here’s why: Today’s most prominent companies are backed by durable earnings and high cash flow, which could not be said for many of the late-90s leaders.

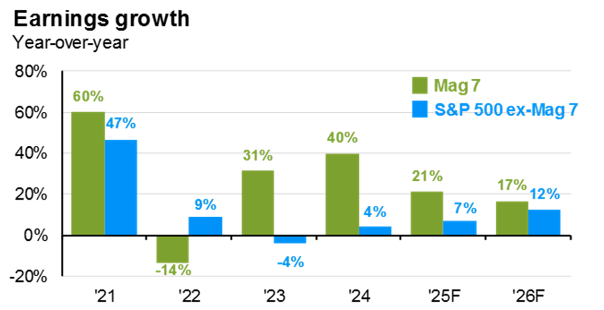

The stock market’s price-to-earnings (P/E) ratio suggests that equities are valued at a premium to the historical average, but multiples could sustain at elevated levels as profit growth broadens to non-tech and smaller companies.

S&P 500 P/E Ratio Hits 23x, the Highest Since the Year 2000

Source: Goldman Sachs

In fact, earnings growth among the so-called “Other 493,” which is the S&P 500 ex the Magnificent Seven, is forecast to increase for a third consecutive year in 2026. A 12% annual jump would bring the group of blue chips closer in line with the Mag 7’s 17% projected earnings per share (EPS) climb.

And, according to Goldman Sachs, small-company EPS could soar by 41% next year. So, the bull-market narrative no longer hinges on just a handful of mega-cap tech companies. More stocks are participating, and profit growth is expanding.

Earnings Growth Expected to Broaden to the Other 493 in 2026

Source: J.P. Morgan Asset Management

Investors like you and me are generally doing well. The S&P 500 was up 13.7% year-to-date through September. The Nasdaq Composite had scored a 17.3% climb. Foreign stocks, buoyed by a 10% decline in the value of the U.S. dollar, were up 26%. More gains were tacked on in early October, but what’s also on the rise is the unemployment rate.

YTD Through October 5: S&P 500 +15%, Nasdaq +18%, International Stocks +28%

Source: Stockcharts.com

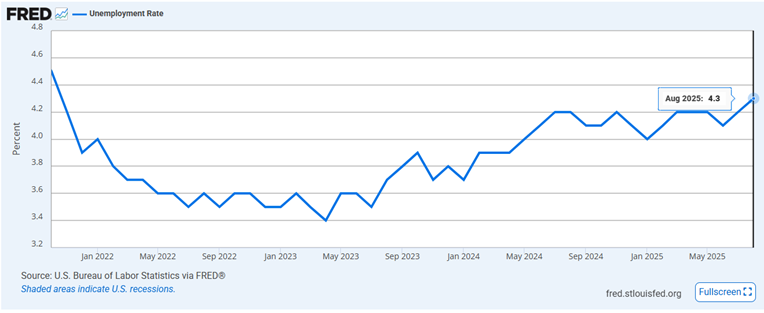

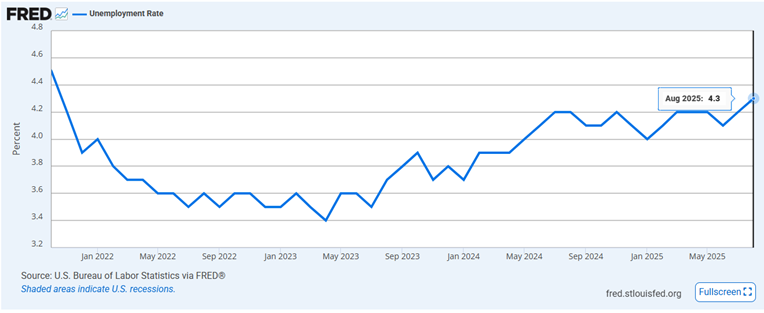

The government shutdown meant that the September jobs report is on ice until the Republicans and Democrats come together, but the data are clear: fragility is the labor market’s password. The August unemployment rate rose to 4.32%, the highest since October 2021. A tepid 22,000 jobs were created that month.

Just a few days after that report came out, the U.S. Bureau of Labor Statistics (BLS) published its Quarterly Census of Employment and Wages (QCEW), an annual benchmark revision to jobs data. The QCEW made headlines as it revealed that employment from March 2024 through March 2025 was overestimated by a whopping 911,000 positions. So, the labor market was significantly weaker than we previously thought.

The Unemployment Rate Rose to 4.32% in August, Highest Since October 2021

Source: BLS, FRED

Annual Labor Market Revision Nixed 911,000 Positions from the Books

Source: The Wall Street Journal

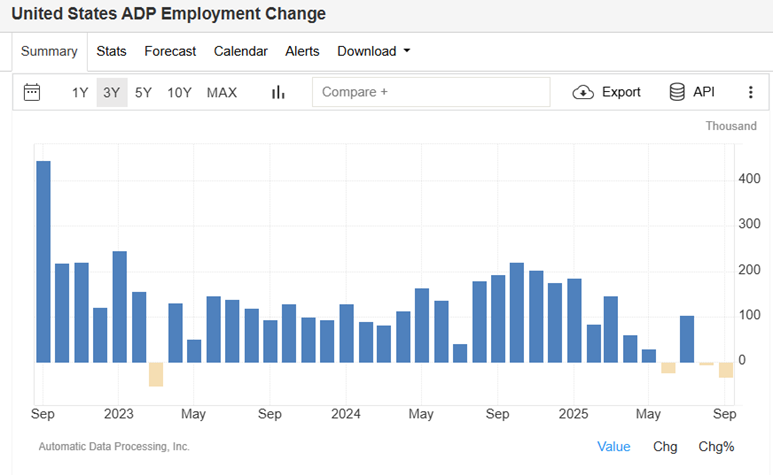

The Fed didn’t explicitly say it, but September’s QCEW likely played a role in its rate cut a few weeks ago. Amid the shutdown, policymakers, economists, and investors are flying blind to an extent regarding the very latest macro data. Without a jobs report last Friday, the market paid more attention to private-sector publications on the state of the economy.

For instance, the monthly ADP Private Payrolls report, usually released two days before the Department of Labor’s jobs survey, showed a drop of 32,000 positions. It marked the third month of net job losses in the last four. As much as AI investment is boosting U.S. GDP, a stalled employment situation supports the case for the Fed to cut rates.

ADP Private Payrolls: -32,000 Jobs in September

Source: ADP

And then there’s inflation. We haven’t mentioned “tariffs” yet, and maybe for good reason. The data suggest that higher import duties are impacting prices on store shelves, but the added retail cost isn’t all that significant yet.

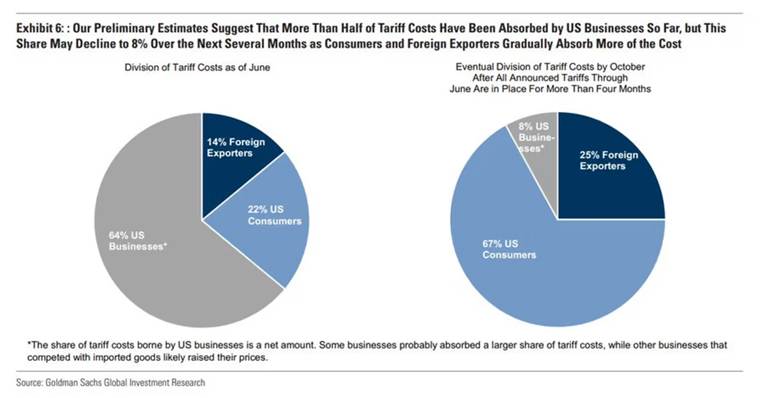

Goldman Sachs estimated that more than half of the tariff costs had been absorbed by U.S. businesses through June. President Trump’s higher reciprocal tariffs didn’t go into full effect until early August, though. As a result, the concern is that the levies may hit with more force just in time for Christmas.

Who Was Paying the Tariffs in Q2? U.S. Businesses.

Source: Goldman Sachs

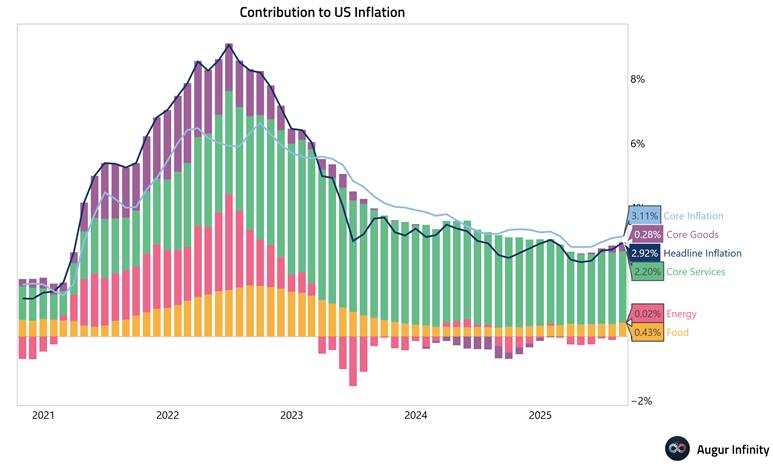

We’ll see how it all pans out. As it stands, so-called “core goods” inflation (which should be most impacted by the tariffs) has ticked up from -1.8% year-over-year in June 2024 to +1.5% as of the latest August 2025 read. Now, its ascent began before tariffs were put in place, but the upward trajectory is likely to persist into 2026.

Core Goods Adds to the Overall Inflation Rate

Source: Augur Infinity

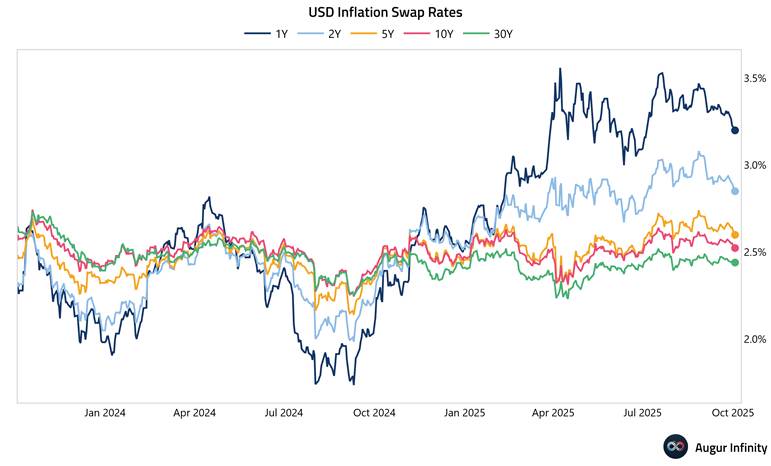

For clues on where inflation may land in the years ahead, we can look to derivatives markets—financial instruments price in a 3.2% U.S. inflation rate over the next 12 months. The two-year inflation swap is near 2.85%.

The upshot is that while there is much concern about how high retail prices may go due to tariffs, expected inflation may be only slightly higher than the average of the past few decades (and nothing like what we all experienced in 2021 and 2022).

Inflation Indicators Suggest 2-3% Inflation Annually Over the Next Two Years

Source: Augur Infinity

Finally, amid all the worries about the jobs market and inflation situation, consumers keep spending. The August Retail Sales report issued last month was much better than expected. Timelier weekly updates from Johnson Redbook confirmed a stout level of household spending.

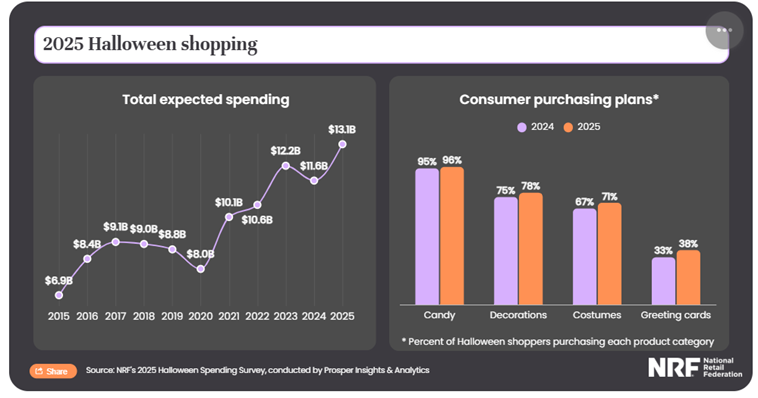

Moreover, the National Retail Federation expects record Halloween spending this season. Along with tech and AI, strong retail consumption trends help support the economy, which now may be growing at a very healthy clip of 3%-plus.

Boo! Halloween Spending May Not Be Ghoulish.

Source: National Retail Federation

U.S. Real GDP Growth Seen Strong at 3.3% in Q3

Source: Kalshi

The Bottom Line

Stocks rallied to new records in September and to kick off the fourth quarter. AI is hotter than ever, and the Fed is on the market’s side as it probably tacks on a couple more rate cuts in the next few months. The jobs market is the clear weak spot right now.

Amid the government shutdown, policymakers are left waiting for a reopening to gauge the latest officially produced data. Inflation still runs hotter than what the Fed wants, but consumers don’t seem worried if you pay attention to what they do and not what they say.

As the bull market turns three years old, we expect broad market momentum to continue through Q4.