Stocks Stumble to Begin August, Recession Fears Stoke Investor Concerns

- The S&P 500 fell hard after a disappointing July jobs report and a slew of disturbing macro headlines

- But earnings matter most, and the Q2 reporting season has been very strong, confirming that businesses are making do amid uncertainty

- Stocks are up nicely in 2025, and this remains among the most underappreciated rallies in recent memory

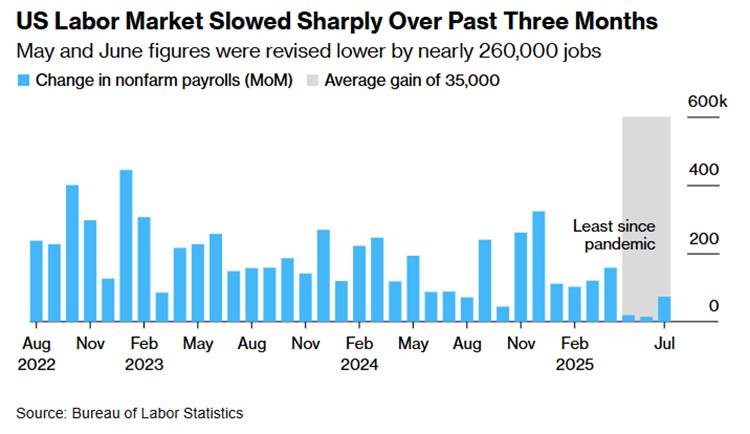

A month ago, we detailed how resilient stocks were. Battle-tested markets now face a new challenge: another recession scare. Last Friday, the July jobs report was much weaker than expected. The headline employment gain of 73,000 positions fell well shy of what economists were expecting, and the unemployment rate ticked up, but the devil was in the details.

The Bureau of Labor Statistics (BLS) confirmed that the economy created 258,000 fewer jobs in May and June than was previously reported. Outside of the COVID crash timeframe, it was the largest negative payrolls revision going back to the late 1970s. The dismal labor market data was bad enough to prompt President Trump to fire BLS Commissioner Erika McEntarfer, sending yet another shock to markets on the first trading day of August.

Weakest Labor Market Since 2020

Source: Bloomberg

President Trump Fires BLS Chief

Source: CNBC

Sure enough, the media machine got going early. Over the weekend, there were countless articles warning of the next recession, calling out the POTUS for his impulsive decision to shake things up at the Department of Labor. Trump was indeed busy on August 1; he also addressed Russia’s nuclear saber-rattling by ordering two submarines to move close to Putin’s country. That breaking news put the oil market back in the spotlight.

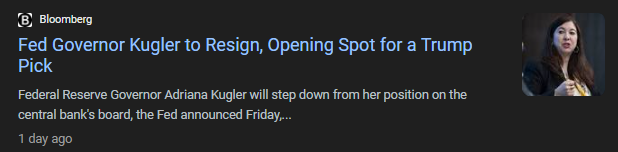

The drama wasn’t done. Only eight days after the president toured the Fed’s headquarters in Washington, DC, FOMC voting member and Fed governor Adriana Kugler announced she will resign from her monetary policy post effective August 8. That means Trump has the opportunity to nominate someone new, presumably a person who will align with his preference to cut interest rates sooner rather than later.

A Fed Vacancy Increases the Chance for a September Rate Cut

Source: Bloomberg

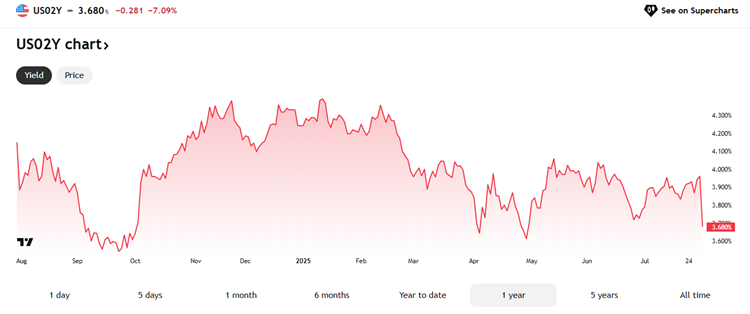

All of that just on Friday. How did markets respond? Stocks dropped 1.6%, the first 1% decline since June 13, while the US Dollar Index (DXY) shed 1.3% in one of its worst sessions since late 2022. Interest rates cratered, which often happens when recession jitters come about. The yield on the 2-year Treasury note plunged by 0.28 percentage points in a major “flight to safety” move. Expectations for a Fed rate cut swelled from 20% to above 80% following the litany of macro headlines.

2-Year Treasury Yield Plummets More than a Quarter Point Post the Jobs Report

Source: TradingView

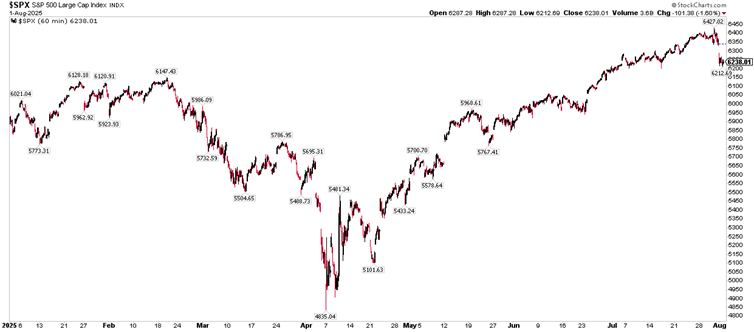

So, if you were to solely analyze all that happened last Friday, you might be freaked out. We all know that’s the wrong way to view it, though. Zoom out, and it’s clear that the market has dealt with this before. The obvious example is the much more dramatic events of this past April, when the S&P 500 fell off a cliff immediately after Liberation Day, April 2.

Stocks bottomed within a week of the White House Rose Garden announcement, and they really haven’t looked back. A 33% rally took place from April 7 to July 31. Could a little volatility be in store during August and September? For sure. Does it change the positive long-term economic backdrop? Nope.

S&P 500 +33% From the April low to the July Peak

Source: Stockcharts.com

But let’s go back further. Twelve months, to be exact. Early August 2024 was much like what we appear to be going through today. The July jobs report a year ago was bad on most accounts, international developments were edgy (historic volatility in the Japanese currency market back then), and uncertainty grew regarding the strength of corporate earnings.

If you have a hard time recalling that outright fear that cascaded across global stock markets, I don’t blame you. As fast as the volatility came about then, investors stepped in and bought the dip. It was a minor blemish in an excellent year for US stocks.

Formidable returns may be shaping up in 2025, too. Even with Friday’s drop, the S&P 500 has returned 6.9%, and the Nasdaq 100 ETF (QQQ) sports an 8.6% gain, dividends included. International stocks retain their YTD lead, up about 17% through August 1, while the bond market has provided decent diversification benefits and a respectable 4.7% total return.

S&P 500 +7% in 2025, Nasdaq 100 +9%

Source: Stockcharts.com

Digging into the sectors, Industrials leads with a 13.6% advance. Also strong are Utilities and Communication Services. Information Technology is fourth best, with an 11% gain.

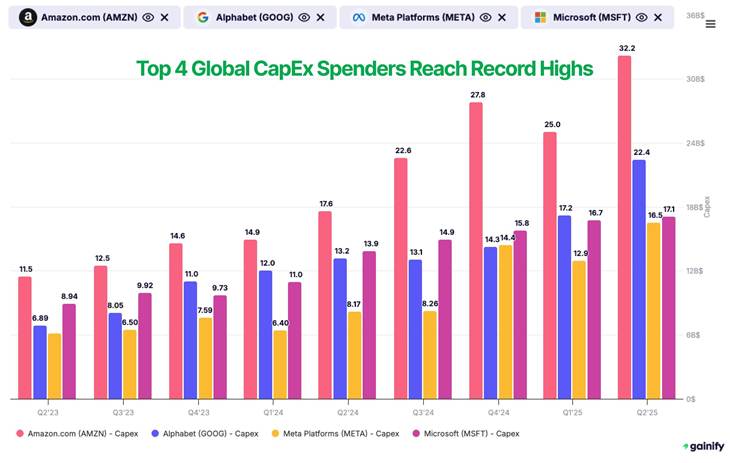

Now, what theme spans those four areas? AI, of course. Artificial intelligence seems to be the irresistible force sending stocks higher. There have been bumps along the way, including the January China DeepSeek AI announcement, but US companies just keep investing in the AI revolution.

The ongoing second-quarter earnings season demonstrates that reality. Last week, Microsoft (MSFT), Meta Platforms (META), Apple (AAPL), and Amazon (AMZN) all reported strong Q2 numbers with almost unfathomable AI capital expenditure plans.

Mega Tech Stocks Investing Heavily in AI

Source: Gainify

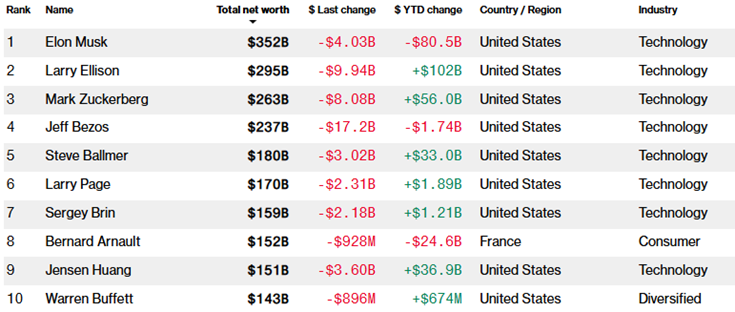

Microsoft’s Azure cloud services business is growing at a stunning 39% annual clip—even after monster growth in 2023 and 2024. The star of the earnings show was Meta. Mark Zuckerberg’s company is tossing money at AI like crazy, including signing key talent as if they were high-profile athletes. Meta’s overall revenue grew 22% from the same period a year earlier, and its 2025 capex is expected to be $114-$118 billion (more than most S&P 500 companies’ entire market value).

Apple is tougher to slice. Now the world’s third most valuable company, it has not pounced on AI. Pressure grows on CEO Tim Cook to make big moves, such as buying Perplexity AI, one of the many large language models that has emerged as a go-to AI tool. Still, Apple continues to reward shareholders with big stock buybacks and a growing dividend.

Amazon was the dark blot in the string of solid reports. Shares fell hard after the firm reported disappointing numbers with its Amazon Web Services (AWS) business; it’s important to remember that AWS is the driver of Amazon’s performance, not so much its online retail segment.

Zuckerberg Approaching Elon Musk in Net Worth

Source: Bloomberg

Alphabet, parent company of Google, also posted significant growth in its Google Cloud, swiping share from AWS. The stock rallied into and after the Q2 report. As for NVIDIA, we won’t hear from Jensen Huang and Co until later this month, but given the beefy AI investment dollars committed by most of the Magnificent Seven companies, confidence is high that another record quarter is in the offing for the chip designer.

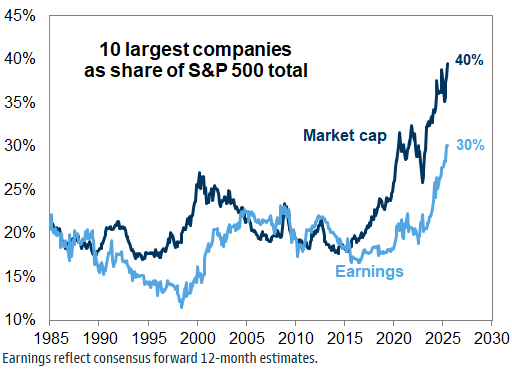

We could go deeper into earnings and macro outlooks from companies of other sectors and industries, but they simply don’t matter all that much. You see, the top 10 S&P 500 constituents now account for 40% of the index’s total value and 30% of the index’s aggregate earnings. The large have grown larger, and investors betting on a sudden reversal of that trend have lost out on significant gains.

S&P 500 Top 10 Stocks Account for 40% of the Index’s Weight, 30% of Earnings

Source: Goldman Sachs

Nobody knows what the future holds, though. Maintaining a diversified portfolio is key to long-term success, and that includes owning shares of small and medium-sized companies, as well as international stocks. Bond yields are also much more attractive today compared to a few years ago. Crypto, meanwhile, has done well in 2025, along with gold.

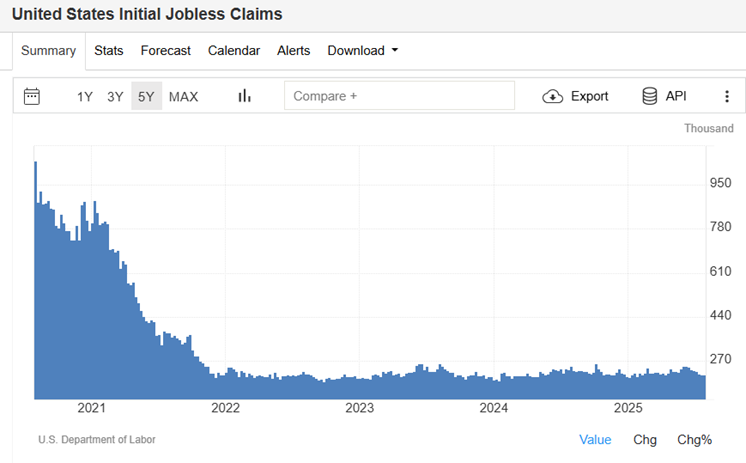

Looking ahead, stocks are going to take their cue from macro developments, now that most second-quarter earnings releases are in the books. Jobs data will be critical; the weekly Initial Claims report usually provides a real-time read on the employment situation, but it seemed to miss the labor-market slowdown that apparently began in May. Continuing Claims, or recurring applications for unemployment benefits, remain near their highest level since late 2021, portraying a “slow to hire, slow to fire” corporate mindset.

Initial Jobless Claims Remain Subdued

Source: Trading Economics

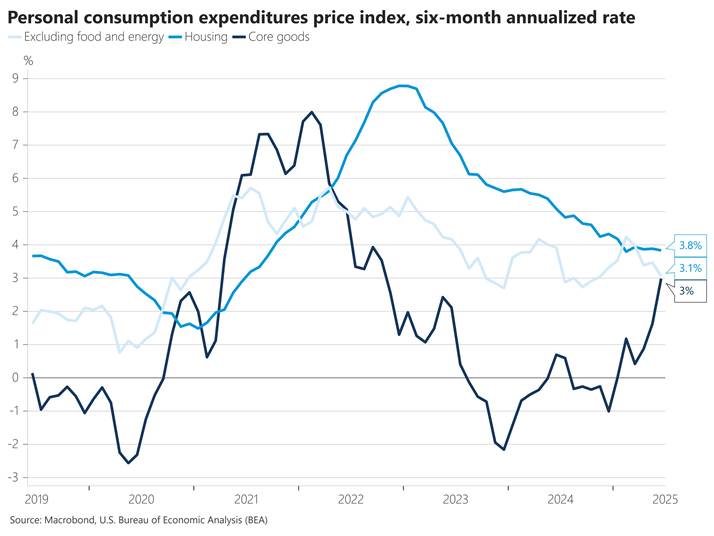

Inflation is another worry. We haven’t mentioned Trump’s tariffs yet or the important trade agreements announced over the past few weeks, but higher import duties are making their way to retail store shelves. July’s Personal Consumption Expenditure (PCE) Price Index, the Fed’s favorite inflation barometer, was slightly higher than expected.

The “Core Goods” component jumped again, and that’s where tariffs hit (“Core Services” inflation actually ticked down). While inflation is inching back up, the pace of consumer price increases is nothing like what we all endured in 2022. Markets expect 2025 inflation to be just above 3%.

Core Goods Inflation on the Rise

Source: Nick Timiraos, WSJ

Along with inflation, retail spending must be monitored. So long as folks have jobs and are earning wage gains above the prevailing inflation rate, they are going to keep investing and spending. It’s really that simple. If the unemployment rate jumps from its current 4.25% level to, say, 4.75%, then households likely tighten their purse strings. Worries are rising on that front. The June PCE report also revealed that inflation-adjusted consumer spending was about flat in July, and it has been nearly stagnant for most of this year.

Retailers like Walmart, Target, and Best Buy report quarterly earnings right after the July Retail Sales report is released on August 15. Those will be particularly colorful and helpful for painting an accurate picture of household and small-business spending trends. For now, “don’t underestimate the American consumer” should be the default take. Companies like Delta Airlines, JP Morgan Chase, Bank of America, Visa, and Netflix were all sanguine on overall spending trends in their respective Q2 reports.

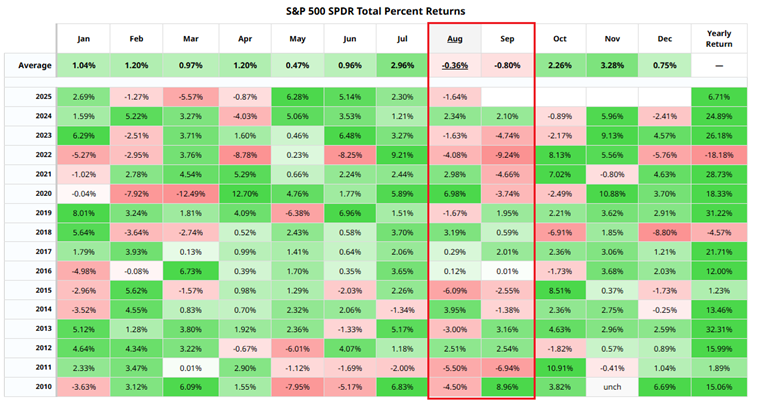

S&P 500: Weak August-September Trends

Source: Barchart

The Bottom Line

‘Tis the season for markets to turn sketchy. August and September are the only two months that have averaged negative returns for the S&P 500 since 2010. The July jobs data underscored fresh macro worries, but Q2 earnings reports showcase the health of the world’s most important companies.

Even with a much higher effective tariff rate (from 3% at the beginning of 2025 to 15% today), firms are executing well, and consumers are holding up. Investors must stay on target and stick to their long-term investing plans.