Battle-Tested Stocks Lift to Record Levels to Begin Q3

- The S&P 500 reached fresh all-time highs ahead of the Independence Day holiday weekend

- In the face of unknowns around tariffs and interest rate uncertainty, investors appear to be pricing in a positive economic outcome

- A “buy the dip” mentality has propelled markets since mid-April, but there are volatility catalysts on tap in July

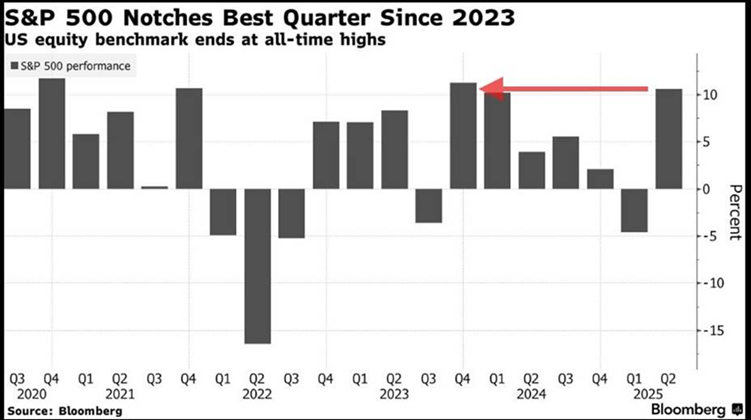

There were fireworks on Wall Street to begin the second half. After a remarkable comeback off the April low to the close of the second quarter, with the S&P 500 rising 28% from April 7 to June 30, stocks continued to march higher ahead of the 4th of July weekend. A solid jobs report catalyzed yet another all-time high for the US large-cap index. Eyes are now set on all that might unfold in the second half.

More than a month ago, we highlighted that “buy in May and say hooray!” was the mid-quarter mantra. The vibes haven’t changed since the start of June. From the first of last month through the holiday-shortened trading week to begin July, the S&P 500 has rallied 6.2%, eclipsing the 6000 level, rising above the February 19 previous all-time high, and setting daily records to start the third quarter.

The S&P 500’s Best Quarter Since Q4 2023

Source: Bloomberg via Neil Sethi

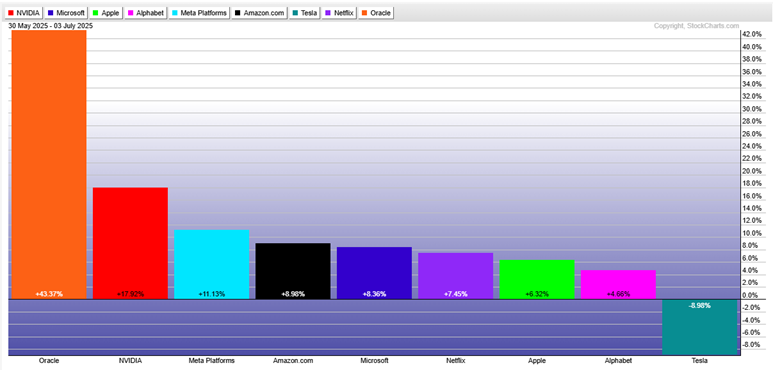

The Nasdaq Composite has outperformed, tacking on 7.8% since June 1. The Magnificent Seven stocks performed well, but it’s a mixed bag.

NVIDIA (NVDA) is the clear winner, rising 18% over that stretch and reclaiming its crown as the world’s most valuable publicly traded company. Meta Platforms (META) is next best, up 11%, while Amazon (AMZN) and Microsoft (MSFT) only modestly beat the Nasdaq. Underperforming have been Apple (AAPL) and Alphabet (GOOGL), both up about 5%. Tesla (TSLA) soared from mid-April through May, but it shed 9% from June 1 to July 3.

Three-Month Performance Heat Map: Major Mag 7 Gains

Source: Finviz

There may be new kids on the Mag 7 block. Well, one sorta new kid and one old dude. Netflix (NFLX) is among the best stocks in the S&P 500 year to date, up 46%, as it takes aim at perhaps becoming the next tech-related $1 trillion market cap company.

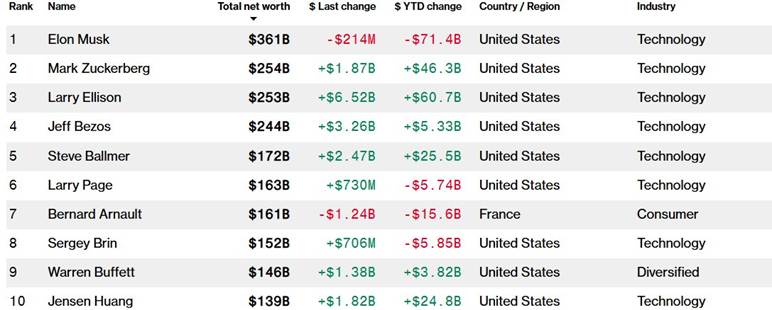

But how about Oracle (ORCL)? The once boring software company gained 43% over June and the first three trading days of July, good enough to make its former CEO, Larry Ellison, the world’s third-richest person.

Oracle’s Renaissance Dwarfs Mag 7 Returns Since June 1

Source: Stockcharts.com

Larry Ellison Now No. 3 on the World’s Richest List

Source: Bloomberg

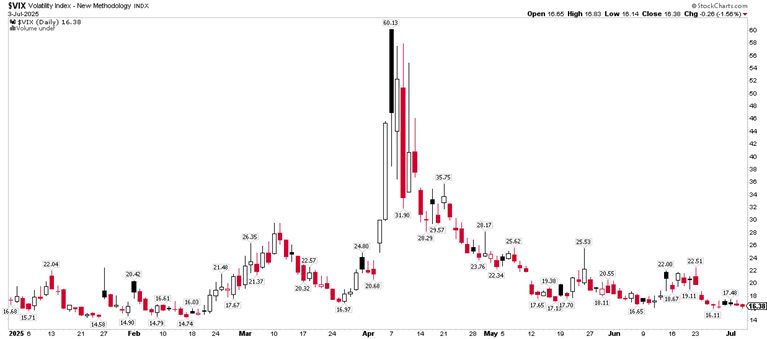

Bigger picture, volatility has come out of the market in the past three months. Recall that the Cboe Volatility Index (VIX), Wall Street’s “fear gauge,” spiked to a panic level of 60 right after President Trump brought out that posterboard of extremely high reciprocal tariff rates in early April. The VIX is now under 18 and very close to the historical norm.

Indeed, stocks have stair-stepped higher from the April 7 intraday low, which has certainly frustrated the bears. Market timing is a fool’s errand, and investors were offered a narrow window to buy near the lows; sitting in cash today after selling due to fear earlier this year proved to be a costly strategy.

VIX: Above 60 on April 7, Under 17 on July 3

Source: Stockcharts.com

Always Ignore the Talking Heads. “Black Monday” Didn’t Materialize.

Source: Google

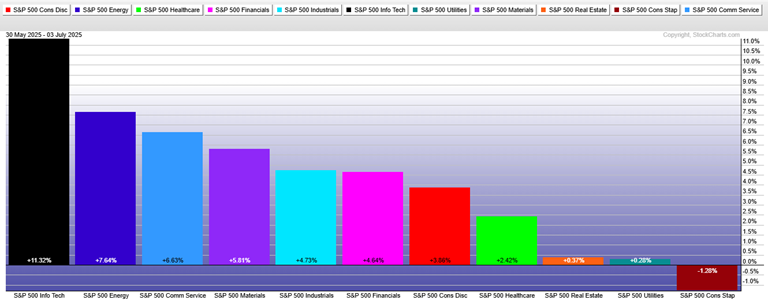

Digging into the sectors, Information Technology (XLK) has been the clear winner going back to June’s beginning. Up 11.3%, the rally has been piloted by Jensen Huang’s NVIDIA. But I bet you won’t guess what the second-best sector has been…Energy (XLE).

The oil and gas space rallied leading into the 12-day Israel-Iran war, and though oil prices dropped back, stocks in the sector have held up. Elsewhere, Communication Services (XLC), powered higher by META and NFLX, has been an outperformer, along with the resource and commodity-related Materials sector (XLB).

Bringing up the rear are a trio of defensive niches, each a small slice of the US stock market. Real Estate (XLRE) was actually dinged from the self-proclaimed socialist Zohran Mamdani winning the New York City mayoral primary election, Utilities (XLU) was left in tech’s dust, and Consumer Staples (XLP) has not been the best place to be amid a “risk-on” environment. That trio has been about flat since June.

June 1-July 3 Sector Performance: Tech Led, Defensive Areas Lagged

Source: Stockcharts.com

Elsewhere, US small- and mid-cap stocks have done well. The Russell 2000 ETF (IWM), which tracks domestic small caps, has outperformed the S&P 500 Index since the April bottom; it’s up 9% since June 1. Mid-caps lagged, higher by 6.5%. International equities, meanwhile, cooled off a bit from a hot start to the year. Over the past five weeks, the Vanguard FTSE All-World ex-US ETF (VEU) has returned just 4.3%, but it’s still at a record high.

Over in the bond market, things are conspicuously quiet. The yield on the benchmark 10-year Treasury note finished last week at 4.35%, smack-dab in the middle of its range going back to October 2024. Interest rates jumped big in the days after President Trump announced a delay to his reciprocal tariffs (April 9), and the bond bears came out once more when the House of Representatives passed the One Big, Beautiful Bill Act (OBBBA) on May 22.

Remember how the bond market works: when prices go up, yields go down. Interest rates eased throughout June, which was a confidence boost for stocks. The first three sessions of July featured rising rates, although that was due to improved sentiment about the economy.

10-Year Treasury Yield: Bouncing Around from 3.9% to 4.8% Since Q4 2024

Source: Stockcharts.com

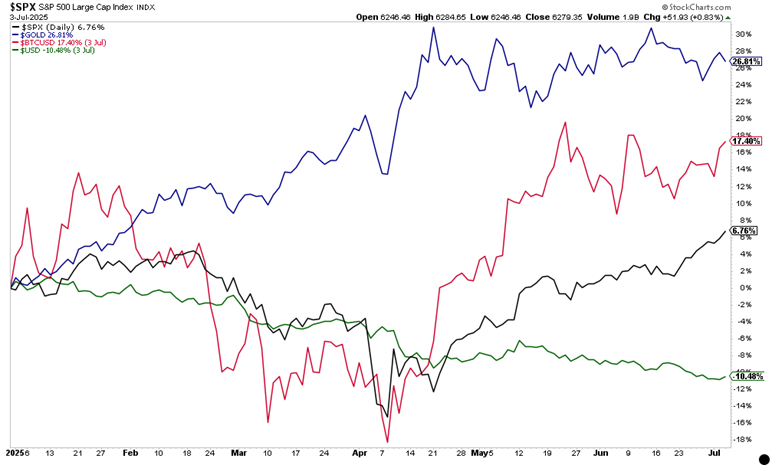

Away from stocks and bonds, bitcoin hovered close to record levels as the fireworks went off last Friday night, around $109,000, up 17% for the year. Gold is steady with a +27% YTD gain. The US Dollar Index, however, has been slapped around. The greenback posted its worst first-half performance since 1973, off by more than 10%.

Gold Leading Bitcoin and the S&P 500 YTD, Dollar Down 10.5%

Source: Stockcharts.com

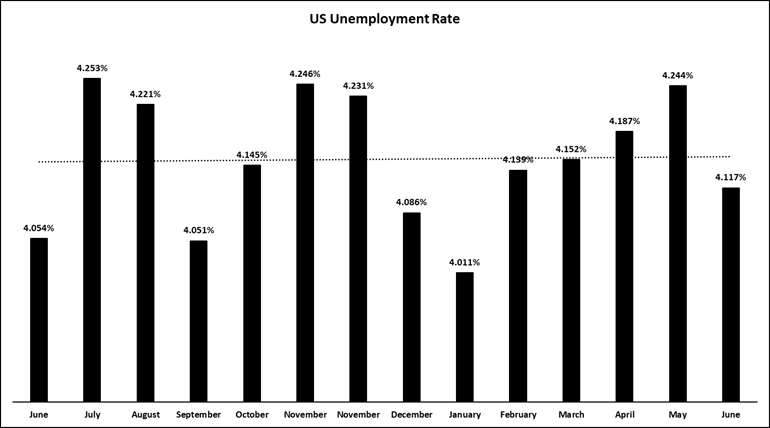

Turning to the economy, the June jobs report released last Thursday was much better than expected. 147,000 positions were created, well above the consensus forecast of 106,000 and an improvement from May’s upwardly revised 144,000 gain. Also encouraging was a steep drop in the unemployment rate. It fell from 4.24% to 4.12%, the biggest monthly decline since last December.

Unemployment Rate Steady

Source: BLS

But it wasn’t a perfect report. Wage growth slowed, with average hourly earnings coming in at just 0.2% month-over-month, below the 0.3% forecast by economists, bringing the annual increase to 3.7% (still well above the inflation rate). What concerned experts was that the bulk of June’s job gain was due to government hires (likely teachers at the state and local levels); private payrolls rose by a soft 74,000.

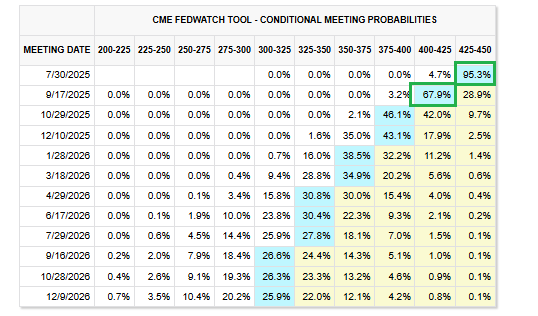

It’s usually best to interpret big data points like that by monitoring how prices react. Stocks rallied, interest rates increased, and the dollar nudged up a bit. Expectations for a July Fed rate cut were dashed, too. All that points to investors viewing the June labor market as being on a “solid” footing, a word that Fed Chair Powell has used repeatedly to describe the employment situation. Let’s go there.

95% Chance the Fed Holds Rates Steady in July, 68% Chance of a September Ease

Source: CME Fed Watch Tool

As if President Trump wasn’t busy enough with effectively bringing an end to the Israel-Iran conflict and pushing the OBBBA through Congress, he berated Powell with increasing frequency in June and so far this month. The POTUS described the Fed chief as a “stupid person,” moron,” and “numbskull,” to go along with his pet name of “Too Late Powell,” but it could be worse.

“Too Late” Powell

Source: Truth Social, Fundstrat

In 1965, President Lyndon Johnson notoriously summoned then-chair William McChesney Martin to his Texas ranch to discuss monetary policy. The conversation turned heated, and Johnson physically beat up Martin for refusing to lower interest rates. Other presidents have verbally attacked Fed chairs, too, including President Reagan, who criticized Paul Volcker in 1982.

Alas, Powell’s days as head of the Federal Open Market Committee (FOMC) are numbered. His term ends next May, and Trump already has “two or three” candidates in mind to replace him. As a sign of the times, there’s a Polymarket betting page for folks to place wagers on who will be the 17th chair of the Federal Reserve. Current Treasury Secretary Scott Bessent and former Fed member Kevin Warsh are slight favorites. Ah, monetary policy drama…enough to put you to sleep…but fun for market junkies.

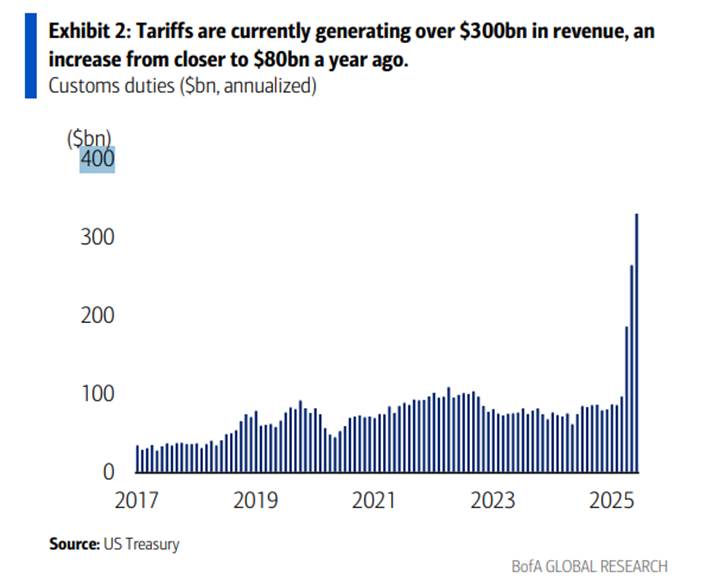

In other news, all eyes are on how tariffs will impact the economy. Despite higher tariff rates going into effect shortly after Liberation Day (April 2), we haven’t seen much in the way of higher price tags. Supposedly, experts predict that higher consumer prices will come about later this summer, perhaps just in time for the all-important back-to-school shopping period (which is the second-biggest spending stretch of the year). Who knows…but consumers are beginning to hold back, it appears.

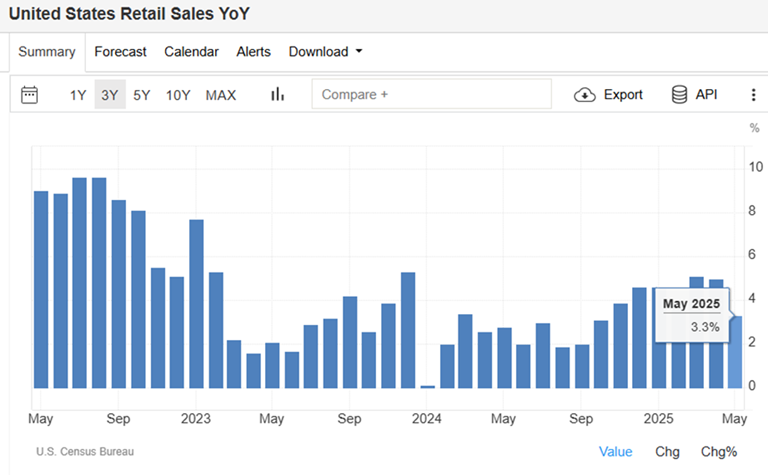

The May Retail Sales report was light, suggesting that households and businesses were on edge amid so much tariff talk. We’ll get the June update on July 17, two days after the Consumer Price Index (CPI) inflation report is released.

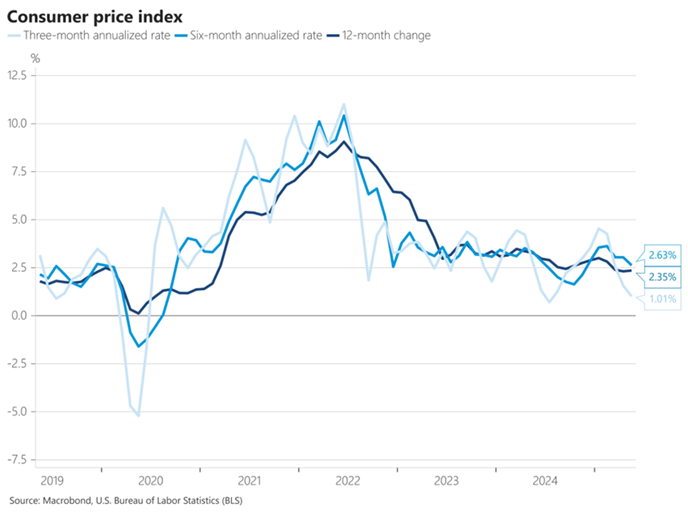

Speaking of inflation, recent data has been tame. Both the CPI and Producer Price Index (PPI) wholesale price reports were below forecasts, surprising economists who expected tariffs to show up with more oomph. All the while, the federal government is collecting huge amounts of import duty revenue.

US Retail Sales Growth Eased to +3.3% YoY in May

Source: Trading Economics

US CPI Rate: Steady Between 2-3%

Source: Nick Timiraos, WSJ

So, if it’s not showing up much on store shelves, where is the tariff money coming from? It gets down to Economics 101 and the incidence of the tax burden. It’s likely that, so far, exporting companies and importers are footing the bill. The risk there is that corporate profit margins could be dinged.

US Tariff Revenue Surges

Source: BofA Global Research

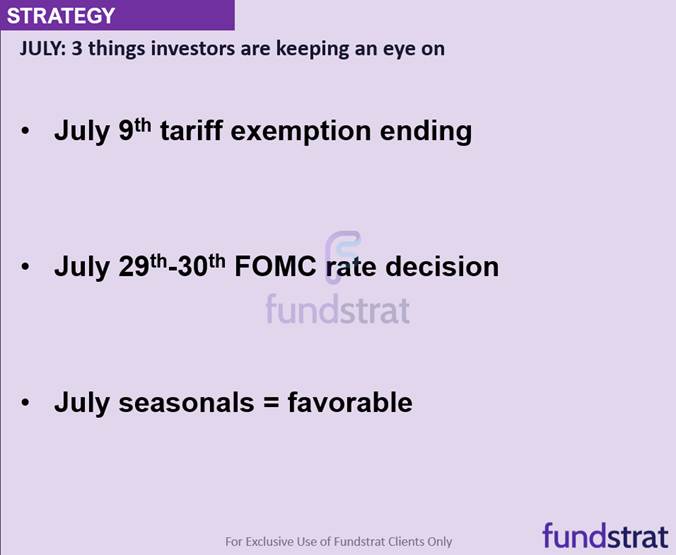

The upshot: We’ll just have to wait and see how the tariff saga unfolds, particularly with the July 9 reciprocal tariff relief deadline coming and going this week. Finally, companies will have their say—the Q2 earnings season begins July 15, so quarterly conference calls may be particularly interesting.

Dates to Watch

Source: Fundstrat

The Bottom Line

Stocks began the second half on a high note. The S&P 500 and Nasdaq Composite hit fresh records as investors left April’s volatility confined to the history books. Tariff uncertainty remains high, and there are unknowns about what the Fed may do, but companies continue to churn out big profits. Battle-tested stocks have momentum on their side. We expect dips to be shallow as 2025 presses on.