Why Americans Still Love Real Estate—and What They’re Missing

This week’s insight dives into a new Gallup poll on what investors want.

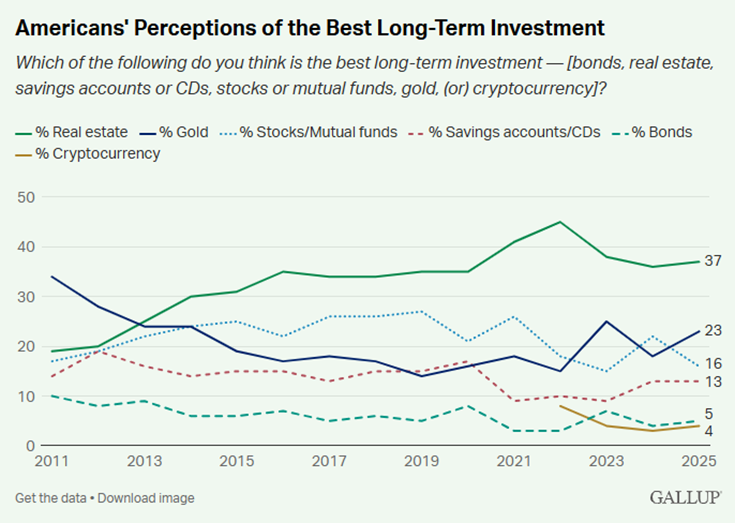

In a survey conducted during the throes of the sharp stock market selloff of early April, it was found that Americans still love their real estate and, perhaps not surprisingly, have turned more upbeat on gold. Thirty-seven percent of respondents believe that real estate is the best long-term asset class, while just 16% perceive stocks as the way to wealth. Gold, which had soared from $1,614 per troy ounce in late 2022 to $3,500 two months ago, is now considered the second-best investment, as illustrated below.

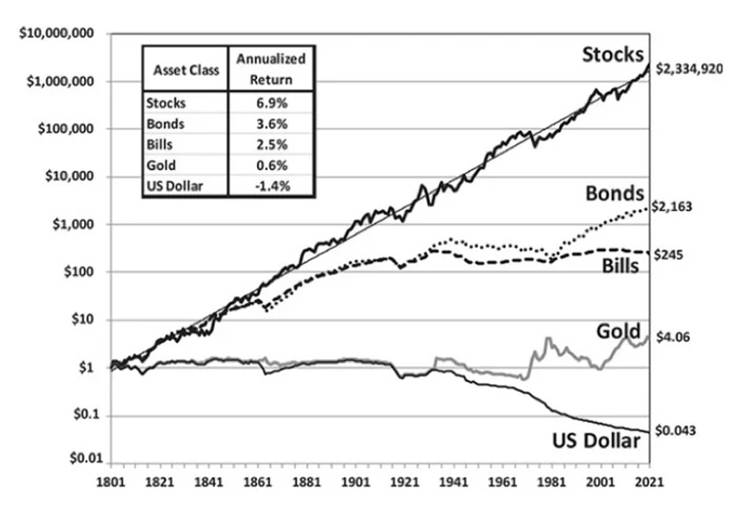

The findings underscore a learning opportunity (we’ll call it) about where to put money to work to gain wealth. Data put together by Wharton Professor Jeremy Siegel clearly prove that stocks provide superior returns over long periods. Real estate typically performs just a percentage point or two above inflation, though it offers diversification and tax advantages.

Stocks, on the other hand, have produced much better average annual “real” returns of 6.9%, while bonds have returned about half that, based on data from 1801 to 2021. If we were to update the figures to include the great bond market and inflation turmoil of 2022, fixed income would look materially worse.

I suppose the good news is that folks rightly don’t place much faith in savings accounts and CDs. That asset group was rated highest by just 1 in 20 respondents.

One area of concern is the gap between gold and cryptocurrency in the survey results. While gold doesn’t generate cash flows, it has a longstanding reputation as a store of value and can serve as a hedge against global fiscal instability. We believe bitcoin could serve a similar role, with the added benefit of real-world utility as blockchain adoption grows. Both assets can help diversify a portfolio centered on stocks, especially for those who already have significant real estate holdings.

For many in the bottom half of US wealth distribution, there remains a lack of understanding about building wealth. Owning your own home isn’t enough to get you there. Seeking first an empire of rental properties is also not the best approach. Rather, regularly investing in low-cost, stock-heavy funds through tax-advantaged accounts is key. Making use of employer 401(k) and HSA matches and contributing to a Roth IRA each month are practical steps that can help many middle-class Americans get ahead.

2025 Survey: Stocks Fall, Gold Rises; Real Estate Still Best Perceived Investment

Source: Gallup

Stocks Produce the Best Long-Term Returns

Source: Stocks for the Long Run