Buy in May and Say Hooray! Stocks Post Biggest Monthly Gain Since Mid-2023

- The S&P 500 built on its post-Liberation Day low, led by the Mag 7 stocks

- Global equities hit all-time highs, while the bond market steadied itself after a shaky start to May

- A tax-cut extension, strong corporate earnings, and softer tariff expectations support the rally

Stocks soared in May amid revived excitement surrounding the AI trade and cooler heads prevailing regarding tariffs. The S&P 500 rallied 6.15%, good enough for its best May since 1990 and the biggest monthly gain since November of 2023.

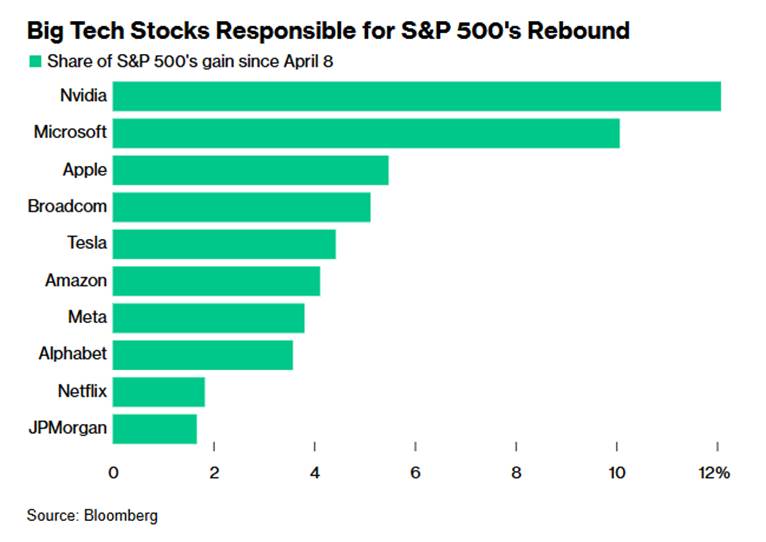

Leading the charge were our old friends—the Magnificent Seven stocks. NVIDIA (NVDA) and Tesla (TSLA) were each up by more than 20%, while the likes of Meta Platforms (META), Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) notched healthy climbs. There was just one bad apple…yes, AAPL, which fell 5%.

May Performance Heat Map: Big-Cap Tech Lifted the S&P 500 in May

Source: Finviz

Thank You, Big Tech, For Big Gains

Source: Bloomberg

In all, the Nasdaq Composite scored a 9.6% advance, its best month going back to November of 2023. Indeed, the Information Technology sector (XLK) was best among the 11 S&P 500 groups with a 10% surge, but not far behind was the economically sensitive Industrials space (XLI). Industrials is interesting because it houses two industries that have been nothing short of on fire: Aerospace & Defense and Specialty Industrial Machinery.

The former is obvious—GE Aerospace (GE), Boeing (BA), and the lesser-known Howmet Aerospace (HWM) are clear winners from the One Big, Beautiful Bill Act (OBBBA) and global investments into defense. The latter is a direct beneficiary of AI’s revival after a respite from February to early April. Eaton (ETN), GE Vernova (GEV), and Emerson Electric (EMR) were just a few of the stocks that showed significant gains last month.

Bull Market: Aerospace & Defense ETF (ITA) Soars to an All-Time High

Source: TradingView

The huge laggard last month was Health Care (XLV). UnitedHealth Group (UNH), the biggest component in the Dow Jones Industrial Average not long ago, made headlines for all the wrong reasons. The insurance giant was reportedly the target of a Department of Justice (DOJ) probe for its Medicare billing practices. Its CEO then resigned on May 13, citing personal reasons, but investors took that as a vote of dis-confidence; shares had their worst month since 2009. Elsewhere, Eli Lilly (LLY), the maker of popular GLP-1 weight-loss wonder drugs, shed 18%. LLY is the largest component of the Health Care sector.

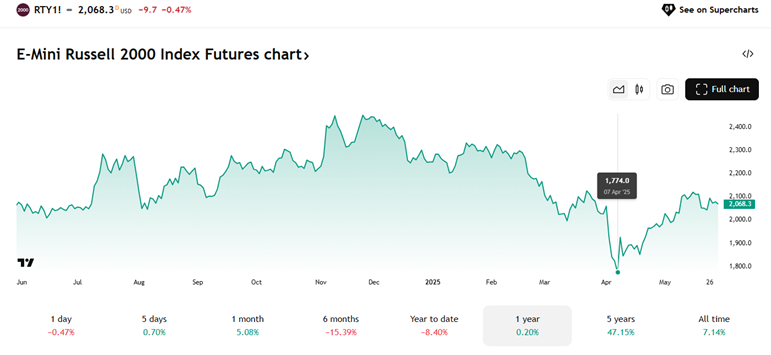

Zooming out and aside from Health Care, it was everyone in the bullish pool—both US mid-cap stocks and the Russell 2000 Index of small caps rose 5% or more. A broad risk-on environment prevailed despite numerous calls for a pullback from doubters suggesting that stocks had come too far, too fast off the post-Liberation Day bottom.

Russell 2000 Index: Underperforming, But Up Sharply from April 7

Source: TradingView

We called out last time that there was still upside potential for stocks, even after the powerful snapback since April 7. We continue to see positive signs, and markets may be more attractive today compared to the highs reached in February.

Shares are battle-tested today, and when the Cboe Volatility Index (VIX) catapulted to 60 just eight weeks ago, that potentially marked the beginning of a new bull market. One step at a time, though, as there are still plenty of possible stumbling blocks as we head into the summer.

VIX Index: Wall Street’s Fear Gauge Tagged 60 in April, Indicating Capitulation-Level Selling

Source: Stockcharts.com

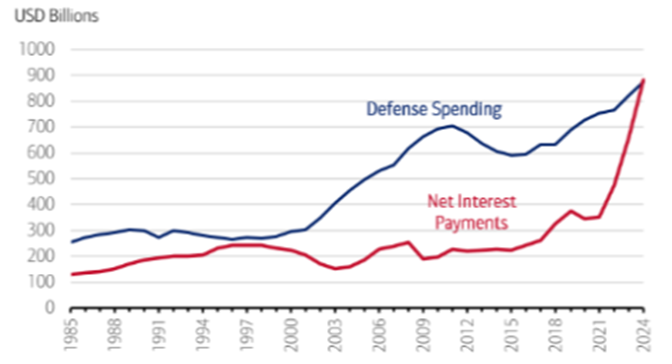

One such landmine could be found under the bond market’s surface. When the House passed the OBBBA, interest rates spiked. The yield on the 30-year Treasury bond ascended to above 5.1%, near its loftiest level since 2007. That momentarily spooked stocks, given the growing national debt and enormous annual budget deficits in the past few years. Interest owed on federal borrowings now exceeds spending on the military and defense.

If interest rates climb much further, it will overwhelm the budget, casting further doubt on the government’s ability to fulfill its financial obligations.

Budget Woes: Interest Costs Now Greater than Defense Spending

Source: Bank of America Merrill Lynch

It’s a real potential problem, but US economic growth could save the day. Assuming the tax cuts are enacted into law starting this year, along with the promise of AI, they could work together to drive higher domestic GDP growth in the years ahead.

It’s disappointing to see that the Department of Government Efficiency (DOGE) has (so far) been unable to make a real dent in streamlining federal government finances, so pro-growth policies and private-sector-led developments will be crucial.

Elon Musk Departs DOGE, Focuses on Leading His Ventures

Source: CNBC

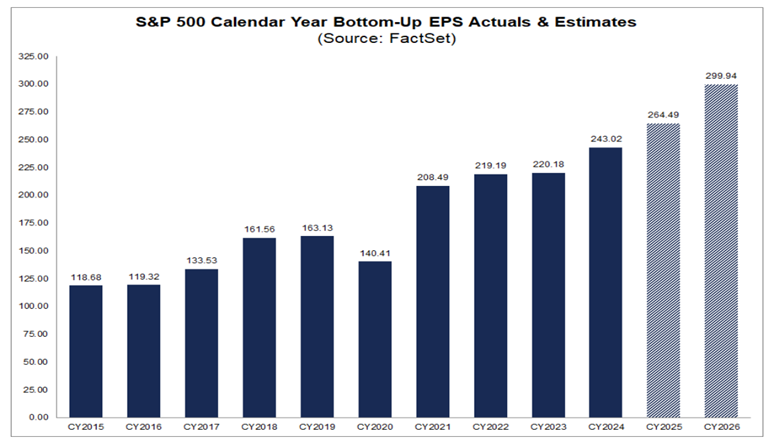

The good news is that the United States is home to the world’s most dynamic companies. The Mag 7 names continue to churn out incredible profits for shareholders while tallying record earnings per share (EPS). To wit, the first-quarter reporting season turned out much better than expected. The S&P 500’s EPS growth rate was close to 14%, although that was before tariffs were implemented.

But FactSet noted companies that beat on earnings saw their share prices rise more than usual, while those missing bottom-line forecasts were punished less than normal. That’s a positive sign, particularly as many firms shied away from providing full-year profit outlooks due to high uncertainty around trade policy.

S&P 500 EPS Growth Still Sturdy

Source: FactSet

It was particularly interesting to hear from the retailers. Sellers of both staples and luxury goods are at the center of the tariff storm. Some companies, like Dick’s Sporting Goods (DKS) and Ulta Beauty (ULTA), were downright sanguine about where things stand. Others, such as Best Buy (BBY) and The Gap (GAP), were not as optimistic.

But the big guys—Walmart (WMT) and Costco (COST) issued impressive numbers to begin the year, proving that the US consumer remains resilient. We see that in macro spending data, too. April’s Retail Sales report was a smidgen below estimates. Still, the headline consumption increase of 5.2% proved that amid in-your-face media narratives of imminent economic turmoil, households and businesses just kept spending as they had before.

Retail Handwringing: Executives Making Due

Source: Wall Street Journal

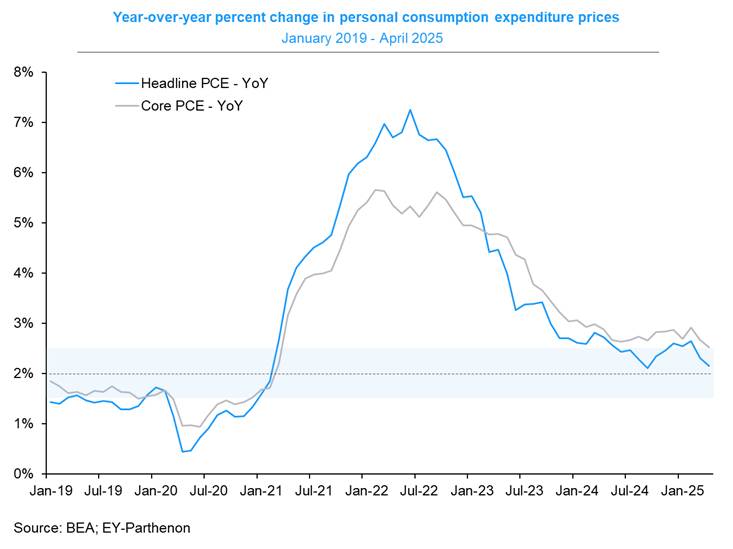

Other economic data points hung in there. Last Friday, the US Bureau of Economic Analysis reported that inflation had cooled to 2.1% on a year-over-year basis. The Personal Consumption Expenditure (PCE) Price Index annual change dipped to a four-year low, though the Consumer Price Index (CPI) inflation rate remains significantly above the Fed’s 2% target.

Looking ahead, we’re going to see an uptick in both the PCE Price Index and CPI thanks to tariffs, but it shouldn’t be enough to send the economy tail-spinning into a recession.

PCE Inflation Has Cooled Considerably

Source: EY-Parthenon

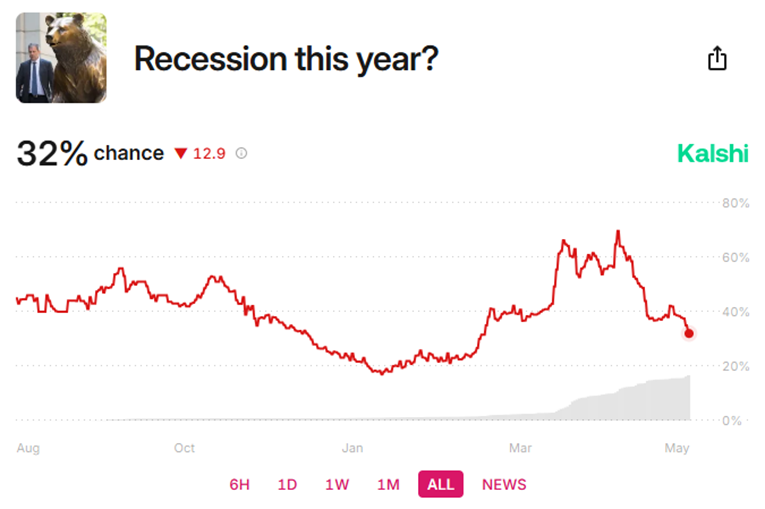

As it stands, prediction markets price in a 3.4% inflation rate for 2025, a far cry from the 9% we endured just three years ago. What’s more, there’s now just a 1-in-3 probability of a technical recession (two consecutive quarters of declining GDP growth), down from 70% at the end of April. Trouble to come? Perhaps, but manageable.

Recession Odds Tumbled in May

Source: Kalshi

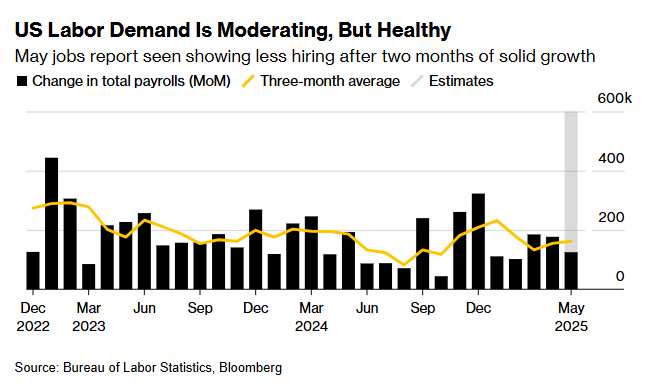

It all depends on the jobs situation. For now, the unemployment rate is steady at 4.2%, while monthly payroll increases have been decent—the March and April jobs numbers have been close to 200,000, which falls in the “good, not great” category. With immigration tapering off, the supposed neutral monthly employment change is likely to be in the range of 50,000 to 100,000.

As long as we remain above that level, the labor market backdrop should support a growing economy. We’ll know more this Friday when the May figures cross the wires—economists call for a 130,000 payroll increase with an unchanged 4.2% unemployment rate.

Healthy Job Growth Last Two Months

Source: Bloomberg

The upshot of it all is that if folks are employed and earning above-inflation wage gains, they (we) will continue to spend despite the dramatic tales of empty store shelves and 2022-level inflation. The “hard” economic data (like Retail Sales, jobs reports, and inflation readouts) simply isn’t jibing with all those spook-job media stories.

We have even begun to see a positive shift in the “soft” survey data, such as Consumer Confidence and certain business surveys. Just recently, the box office tallied a record Memorial Day weekend, and TSA checkpoint data confirmed an all-time high number of folks flying the friendly skies. All that bodes well for impressive summertime spending.

The Bottom Line

It was tough to be a bull in April, but we encouraged clients and readers to stay the course and even turn up the dial, given the sudden drop in stocks. That resolved well—the S&P 500 is up 18% from its low less than two months ago, bitcoin touched a new all-time high last week, and a now battle-tested equity market sets up well heading into the summer months.