From TikTok Tips to True Wealth: Guiding Gen Z Beyond Finfluencers

This week’s insight is about an old man yelling at a cloud, in a manner of speaking.

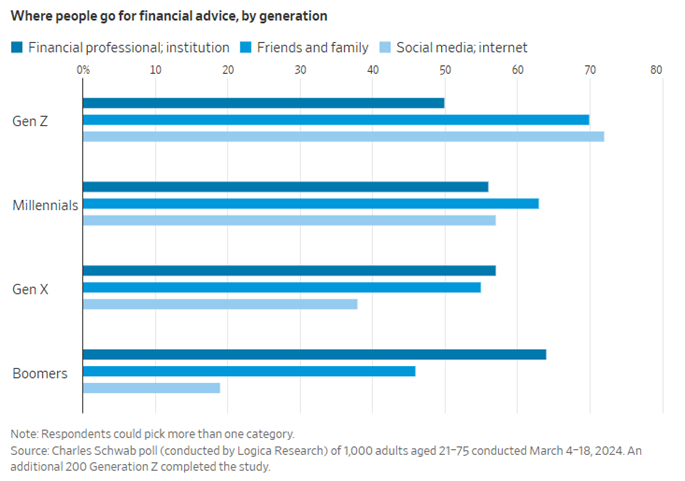

A recent Wall Street Journal article profiled “finfluencers,” also known as social media stars who talk finance and investments. It turns out that, according to a Schwab survey, 72% of Gen Z whip out their phones for stock picks. I say “stock picks,” not wealth management or even financial advice, because the quality of wisdom they get from TikTok and Instagram is sometimes poor, never personalized, and potentially harmful to their personal financial situations.

I won’t go full-boomer here, since some exposure to the stock market is probably a good thing, but eventually, the next generation must get serious about managing and growing their net worths. Traditional milestones, such as getting married, buying a house, and having kids, are getting pushed off due to the very high cost of living and much steeper borrowing costs today. Student debt lingers, so-called “lazy girl jobs” (a less stressful, often lower-pay white-collar position born out of the hustle culture post-pandemic) are still in vogue, and making high-risk bets in the stock market is no way to compound wealth.

Finfluencers may scratch Gen Z’s itch for risk-taking, and it’s my hope their wild side translates into small-business creation in the years and decades ahead. Dreams of a 1000% return on a penny stock are enticing to ponder, but true wealth often stems from calculated risk-taking and careful assessment of what the economy needs, wants, and desires; starting a business has much better potential.

Perhaps you have a son or daughter swept up in the social-media financial guidance craze. It can be a useful start, and some of the younger folks have struck it rich thanks to big gains in bitcoin, and the like. Unlike most other qualified financial advisors, Clear Harbor embraces innovative tech and cryptocurrency.

My thought is, don’t wave fingers at Gen Z for them seeking accessible financial advice, but use the trend (which probably isn’t going anywhere) as an opportunity to transition their interest into real wealth management strategies. After all, the sooner they invest for the long haul, the longer compounding can work in their favor. With discipline and the right strategy, they can reach financial independence faster.

But go about it with a credentialed and experienced planner—not via social media savants seeking likes, hearts, and eyeballs.

Source: Wall Street Journal