Markets Wobble in February: Growth Scare and Sector Shifts Keep Investors on Edge

A Growth Scare Spooks Stocks, But February Losses Held In Check

- US large caps fell slightly last month after rising in January

- Markets have chopped around since mid-November 2024, and early-year rotation has benefitted diversified investors

- A soft patch in economic data could lead to Fed rate cuts sooner than previously thought

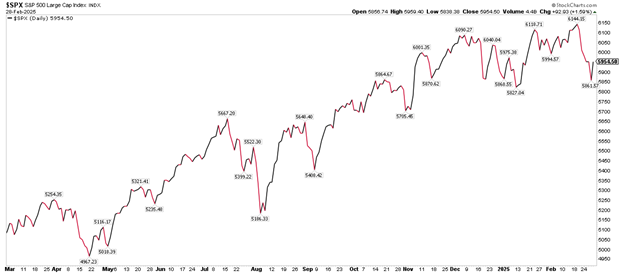

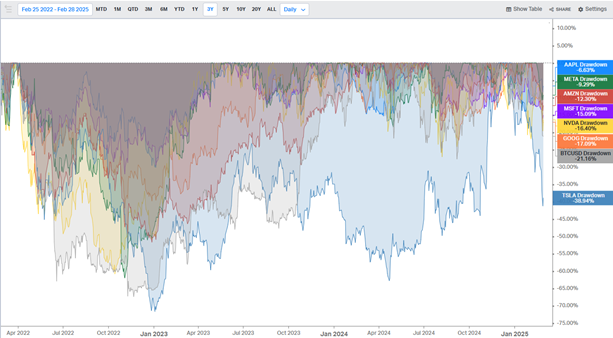

Stocks stumbled in February, giving back a chunk of its early-year gains. The S&P 500 ETF (SPY) fell 1.3% during a rocky month that featured softening economic data and volatility induced by tariff headlines. The Nasdaq 100 ETF (QQQ) underperformed with a –2.7% return—a handful of the Magnificent Seven stocks endured their own bouts of selling pressure, particularly over the back half of the month. NVIDIA (NVDA) dropped 8% after its earnings report, while Tesla (TSLA) is now down almost 40% from its all-time high last December.

Small caps endured the sharpest past. The Russell 2000 Index ETF (IWM) gave back 5.2% despite a drop in Treasury rates. The market’s little guys had previously struggled with rising interest rates, but emerging economic growth concerns now plague that more cyclical area of the stock market.

It wasn’t a sea of red, though. International stocks posted modest gains in February. Foreign developed markets, as measured by the Vanguard FTSE Developed Markets ETF (VEA) rallied 2.3% on the heels of a drop in the dollar’s value, and Emerging Markets (VWO) added about 1%, helped by price strength in China.

Also in the green were bonds. The yield on the benchmark 10-year Treasury note cratered by more than 0.3 percentage points; when rates fall, bond prices rise. The US Aggregate Bond ETF (AGG) returned 2.2% in February.

The S&P 500 Has Given Back Much of Its Post-Election Rally

Source: Stockcharts.com

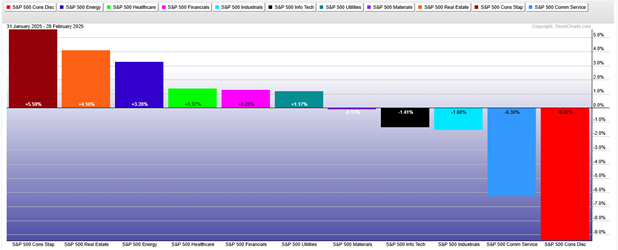

Turning to the sectors, there was a defensive tone shift in February. Consumer Staples posted the biggest gain, rallying 5.6%, as investors flocked to the bluest of blue chips. Coca-Cola (KO) and Procter & Gamble (PG) rallied nicely. Walmart (WMT) and Costco (COST), which now sport tech-like valuations, were also up. Food companies like Hershey (HSY) and Mondelez (MDLZ) (formerly part of Kraft) led too.

Diversified investors were happy to see that the Real Estate sector notched a big rise. Up 4.1%, property stocks benefitted from lower interest rates and perhaps downbeat expectations coming into 2025. Elsewhere, despite a fall in oil prices, the Energy sector notched a 3.3% gain.

Absent from the list of sector winners were tech stocks. The Information Technology slice of the market fell 1.4%, and losses were greater in the Communications Services area and within Consumer Discretionary. Amazon (AMZN) shed 11% and TSLA plunged 28%, hurting the discretionary space. Despite a 20-day winning streak from January into February for Meta Platforms (META), Mark Zuckerberg’s company fell 3% in February. Alphabet (GOOG), the parent of Google, quietly lost 17% for its worst month in almost three years.

Lastly, bitcoin fell from its high on Inauguration Day above $109,000 to below $80,000 for a time on the morning of February 28. It recovered to above $90,000 by the weekend.

February Sector Performances: Staples Soars, Discretionary Drags

Source: Stockcharts.com

Magnificent Seven Stocks & Bitcoin Down from Their All-Time Highs. TSLA –39%.

Source: Koyfin Charts

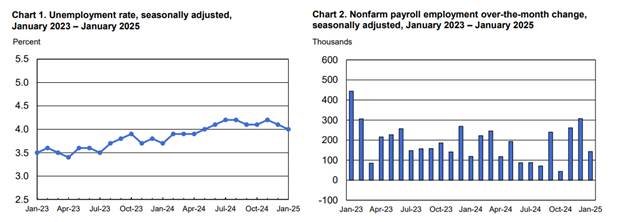

So, why so much defensive price action in February? Some might blame it all on the Tariff Man residing at 1600 Pennsylvania Avenue, but broader macro jitters cooled all that early-year optimism. The month began with a jobs report that was actually pretty good. The economy added 143,000 positions during the first month of 2025, and the unemployment rate almost dropped below 4% for the first time since Q2 of last year.

Within the report, workers’ earnings were strong, though there may have been distortions due to the LA wildfires and that big-time cold snap in our neck of the woods that brought several inches of snow to the Gulf of America (there, I said it) coast.

All eyes will be on this Friday’s labor market report. Another decent jobs gain is expected, but there’s uncertainty about how the rest of the year will go given DOGE’s efforts and a slew of recent company layoff announcements.

US Unemployment Rate & Monthly Job Change: Steady as She Goes

Source: BLS

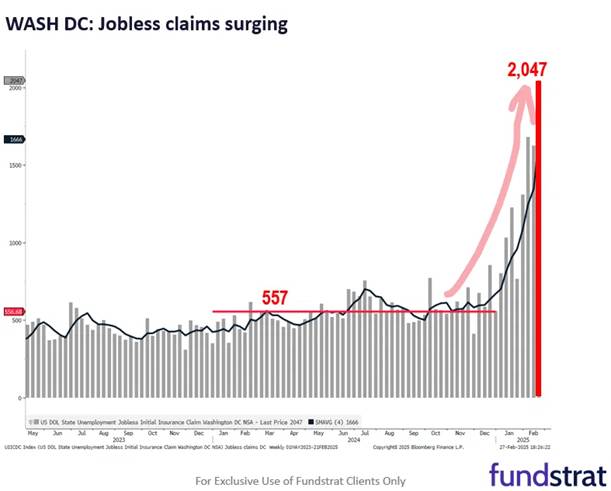

DOGE Drives a DC Jobless Claims Spike

Source: Fundstrat

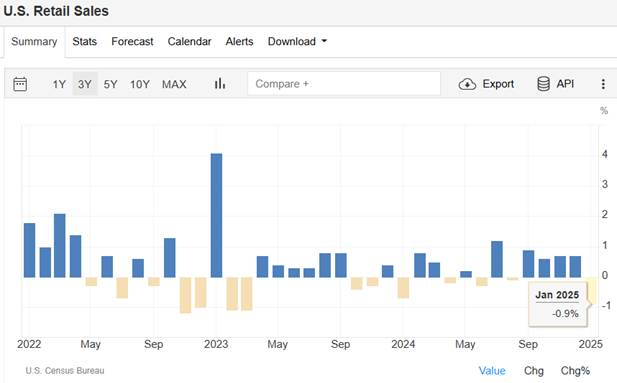

While the employment situation remains on a ‘good, not great’ footing, the January Retail Sales report put out by the Census Bureau revealed a surprisingly sharp pullback in consumer spending. The 0.9% drop from December’s torrid shopping pace was the worst monthly change since March 2023.

Once again, weather played a role, but the bigger factor was simply that households took a breather from a huge holiday shopping spree. Additional data came last Friday via the Personal Spending report that backed up the Retail Sales update—January spending was –0.2% on a monthly basis.

US Retail Sales Dropped in January

Source: Trading Economics

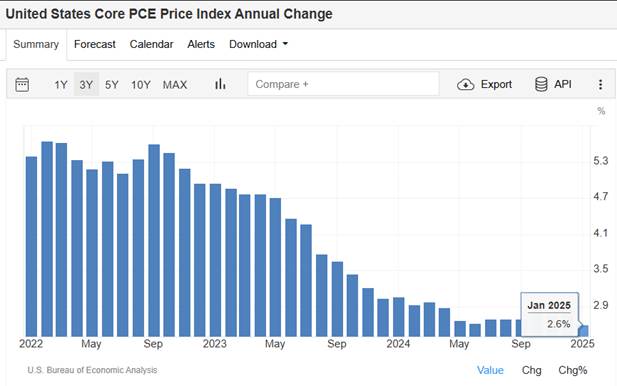

On the inflation front, the rearview mirror appears decent. Recent Consumer Price Index (CPI) trends are on track, as are the latest Personal Consumption Expenditure (PCE) Price Index figures. While not yet at the Fed’s 2% inflation goal, we are not far off; the fear lies in the future.

February featured stark rises in consumer inflation expectations. Both the University of Michigan Surveys of Consumers and The Conference Board’s Consumer Confidence Index pointed to worries that the cost of goods and services economy-wide will rise due to tariffs. Just this week, import duties on goods from Mexico and Canada begin, and we could see another round of tariffs for European imports in April. Whether all that is put into effect for an extended duration is still up in the air. That uncertainty caused volatility across markets at times last month.

Then on the final day of February, a whopper of a trade balance figure was reported. Now, this gets into the macroeconomic weeds, but the bottom line is that businesses stockpiled in Q4 2024 ahead of possible tariffs.

US Inflation Steadies Above the Fed’s 2% Target

Source: Trading Economics

Tariff Time (At Least for Now), Trump’s Address to the Nation is Tuesday Night

Source: Fundstrat

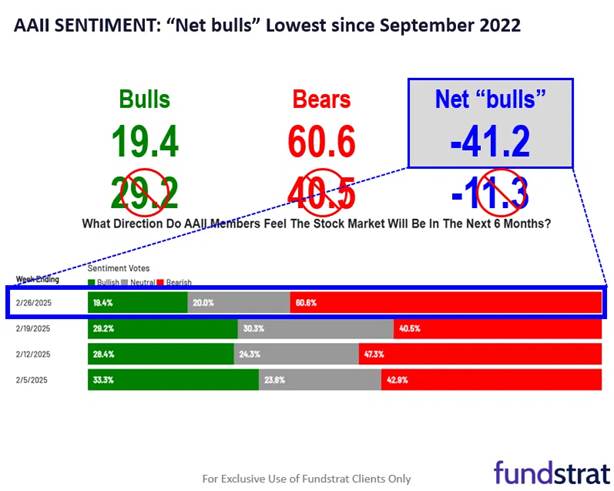

Sour Sentiment: Big Fall in “Net Bulls” Per the AAII Survey

Source: Fundstrat

A consumer slowdown coupled with a large amount of net imports means Q1 GDP will be light. It’s early, but the prediction market pegs the first quarter’s expansion pace at just 1.2%. That would be the slowest growth since the second quarter of 2022.

Q1 US GDP Seen Near 1%

Source: Kalshi

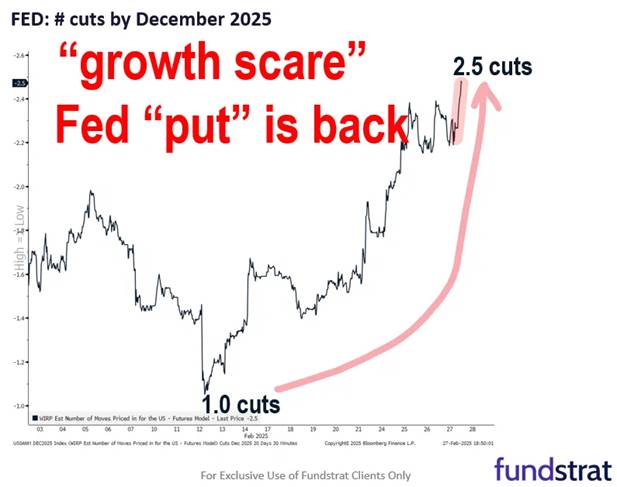

Amid all these macro crosscurrents (a more cautious consumer, a surge in inflation expectations, and softer overall GDP growth), the Fed members have their work cut out for them. As it stands, two or three quarter-point eases are expected over the next 12 months. That is an increase in the anticipated cutting pace from a few weeks ago. In a sense, the Fed can backstop the market if we see sharper pain.

Many pundits dubbed the modest turn south in recent data as a “growth scare,” suggesting that recession risks have inched up. The offset to that is what’s known as the “Fed put,” asserting that if the economy does slow meaningfully, then Fed rate cuts will be delivered.

Also keep in mind that President Trump does not want to tank the economy, so if upcoming data is weak, we might get a softer economic tone from the White House.

February’s Weaker Macro Data Have Increased the Expected Number of Fed Rate Cuts

Source: Fundstrat

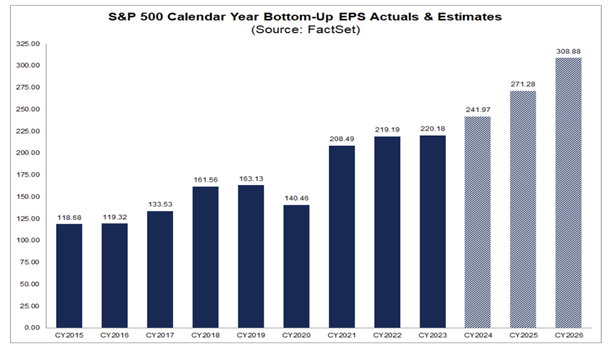

But let’s not lose the forest for the trees. Stock prices are driven by corporate earnings, and Q4 last year was a humdinger of a profit period. S&P 500 companies delivered just shy of 20% earnings per share growth—the best quarter in three years. Estimates for 2025 point to a solid 12% rate of increase.

If we see lower interest rates, a dip in the value of the US dollar, and (eventually) pro-growth policies, such as deregulation and tax cuts, earnings could be even higher. Now, estimates tend to fall as the year progresses, but the S&P 500’s 17% rise over the last 12 months is absolutely backed up by what companies are delivering on the bottom line.

S&P 500 EPS Growth Forecast to Continue

Source: Factset

Finally, the start of 2025, while shaky at times, has been favorable to diversified investors. While we continue to like tech stocks, the AI revolution, and innovation, it’s encouraging to see some outperformance from old-school value stocks, international markets, bonds, and even left-for-dead industry niches. It has been hard for the average investor to keep up with the S&P 500 since late 2022. To wit, the global 60/40 stock/bond ETF had its highest monthly close ever last Friday.

The Bottom Line

The S&P 500 posted a small February decline as the Magnificent Seven stocks collectively dragged on the market. Small caps stumbled, but international equities inched up. Bonds delivered a notable gain amid volatility in the SPX.

Looking ahead, corporate earnings growth is strong, the March-July period has historically been bullish for stocks, and as concerns about the economy rise, the Fed and the White House have an interest in supporting markets if things turn a whole lot worse. We remain bullish and welcome the sentiment reset.