January Stock Surge Signals Strong 2025: Economic Growth, Earnings, and Risks Ahead

Stocks Jump in January on Solid Economic Data & Earnings, A Good Sign For 2025

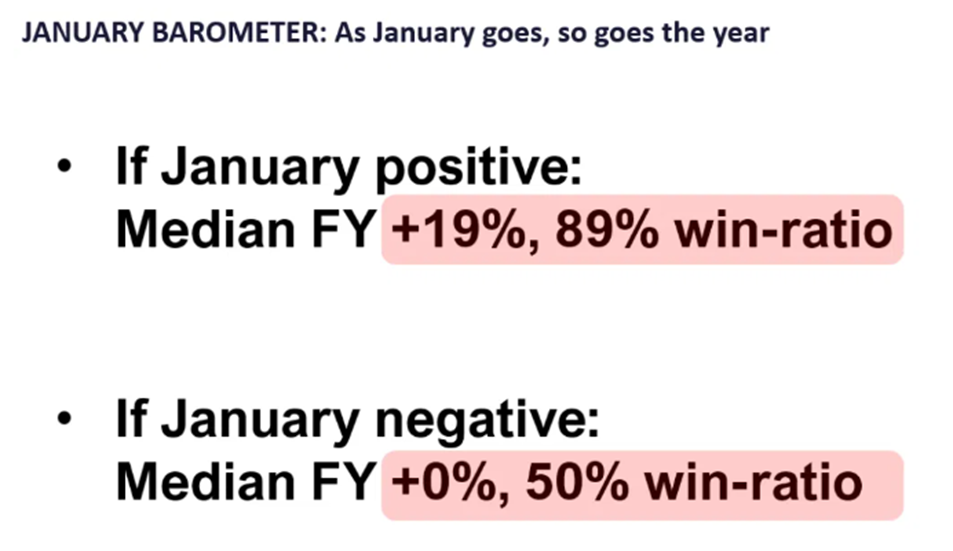

- The “January Barometer” predicts more gains this year

- Growth, inflation, and corporate profits are on track to support stock prices in the months ahead

- Risks surround tariffs, immigration, and unknowns in the race for AI dominance between the US and China

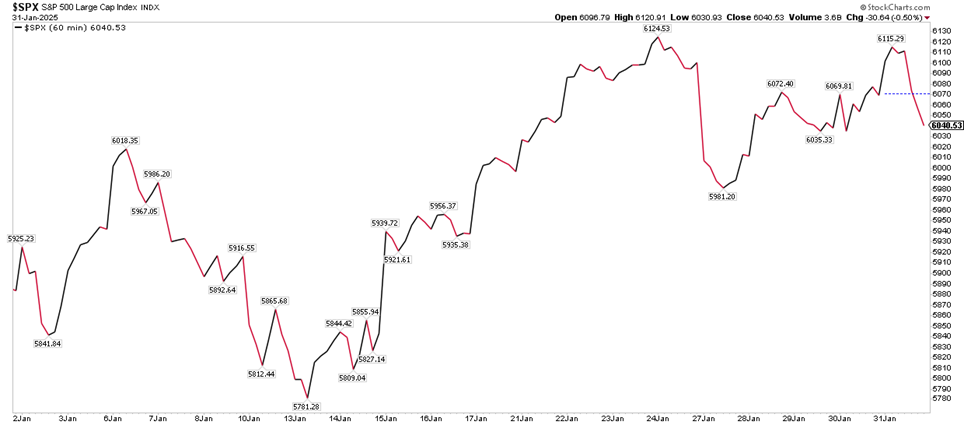

Santa didn’t show up on Wall Street to close out 2024, but the stock market delivered an early-year present to investors. The S&P 500 (SPY) rose 2.7% in January on the back of solid economic data and impressive corporate earnings. Despite constant chatter about the risks of tariffs and other political hot-button issues, US large caps closed at their highest monthly level in history.

Gains were broad-based, too, as the Nasdaq 100 ETF (QQQ) rose 2.2% and the S&P 500 Equal-Weight ETF (RSP) outperformed with a 3.4% return. Small Caps, as measured by the Russell 2000 ETF (IWM) are off to a healthy +2.5% start as well. As for international stocks, which struggled relative to the S&P 500 in 2024, the Vanguard FTSE All-World Ex-US ETF (VEU) edged out the S&P 500 with a 3.4% advance.

The bond market wobbled over the year’s first handful of weeks. Policy uncertainty was high, but macro data was generally what the Fed was looking for. The yield on the benchmark 10-year Treasury note touched its highest mark since Q4 2023 mid-month, but then eased back, finishing January at 4.57%. That resulted in a small 0.5% gain in the Aggregate Bond ETF (AGG).

Bitcoin crept up to a record high on Inauguration Day, above $109,000, before retreating to near $101,000 (still up 9% to begin the year). Gold crossed $2800, also a record. Finally, oil prices are nothing to write home about – still near $72 per barrel, so gas prices should be steady in February.

S&P 500 Reaches a Record High in January

Source: Stockcharts.com

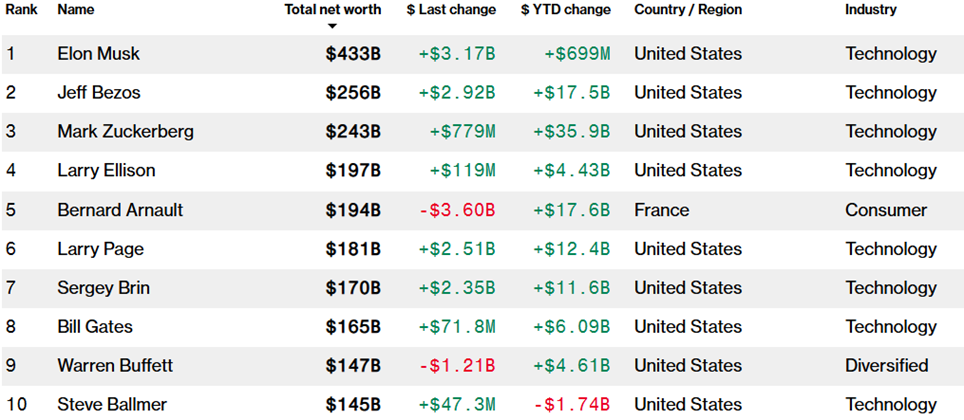

Digging into the sectors, Communication Services (which is sort of ‘tech light’) was up the most, tacking on 9%, and good enough for a record high. The standout there was Meta Platforms (META). Mark Zuckerberg’s company was up 18% in January and has returned a whopping 678% from its November 2022 low. Zuck is now the world’s third-richest person with a net worth of $243 billion, only shy of Amazon’s Jeff Bezos and Tesla’s Elon Musk. Alphabet (GOOGL) and Netflix (NFLX) also performed well last month helping to boost the Comm Services space.

World’s Richest List: Musk Atop, But Zuckerberg Coming On Strong

Source: Bloomberg

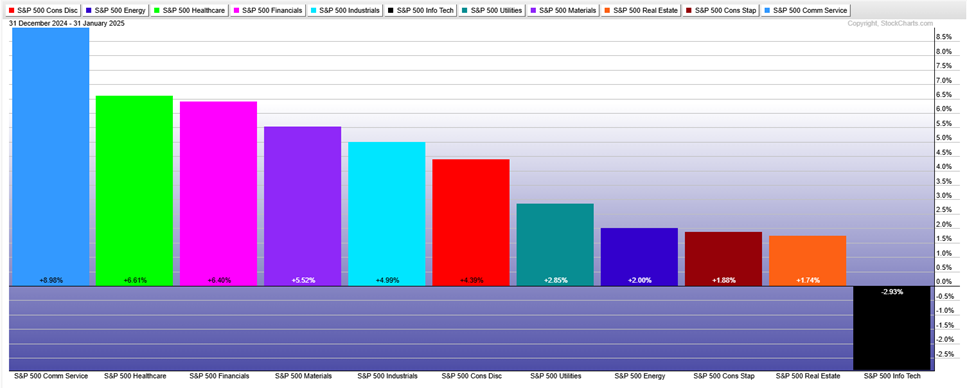

Information Technology was the only down sector. An 11% drop in NVIDIA (NVDA), and Apple’s (AAPL) -6% January return, weighed on the mega-cap space. Microsoft (MSFT), another of the Magnificent Seven names, was down 2%. The good news is that corporate earnings among the world’s most valuable companies have come in well so far. We’ll hear from GOOGL and Amazon (AMZN) this week and NVDA later in the month.

Elsewhere, the other nine S&P 500 sectors were up. Health Care, a notable 2024 laggard, rallied 7% thanks to rebounds in Eli Lilly (LLY), UnitedHealth Group (UNH), and Johnson & Johnson (JNJ). Financials tacked on another 6%, building upon its stellar election-year performance. The big banks began the Q4 earnings season with a clean sweep of major bottom-line beats which helped to send shares of JP Morgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), and Citigroup (C) up big.

January’s S&P 500 Sector Returns: Comm Services Led, Tech Down

Source: Stockcharts.com

S&P 500 January Performance Heat Map: AAPL, NVDA Down, META, AMZN, GOOGL Up

Source: Finviz

Stocks love to climb a wall of worry. That’s an old Wall Street adage suggesting that if there’s a degree of unease and looming risks, it keeps animal spirits in check enough so that a bull market can continue without getting out of control. That’s sort of what January felt like.

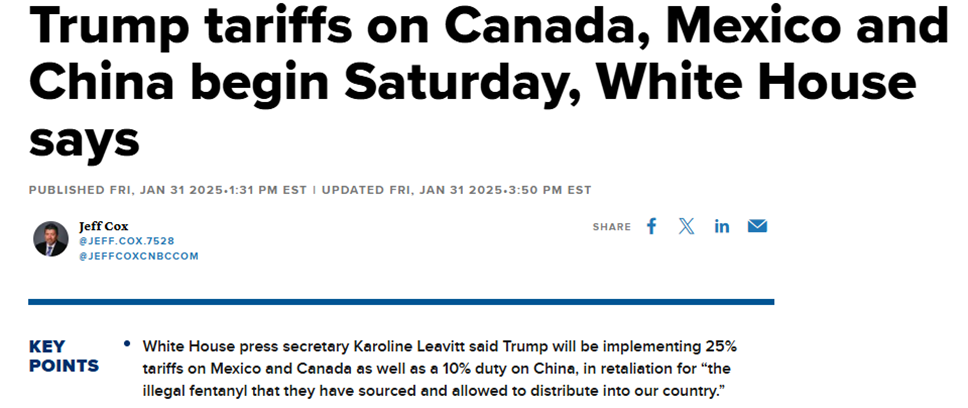

There’s no doubt that uncertainty around President Trump’s policies is high. The bears point to threats to the economy from tariffs and resulting trade wars, deportations, and the deficit. The bulls assert that deregulation and lower taxes can more than offset hiccups to the macro. The focus right now, though, is on tariffs.

On January 31, the president announced a 25% tax on imports from Canada and Mexico as well as a 10% duty on China. Upon that announcement last Friday afternoon, stocks naturally felt some pain. But losses were held in check, and January ended up being a good month.

Trade Jitters Perk Up

Source: CNBC

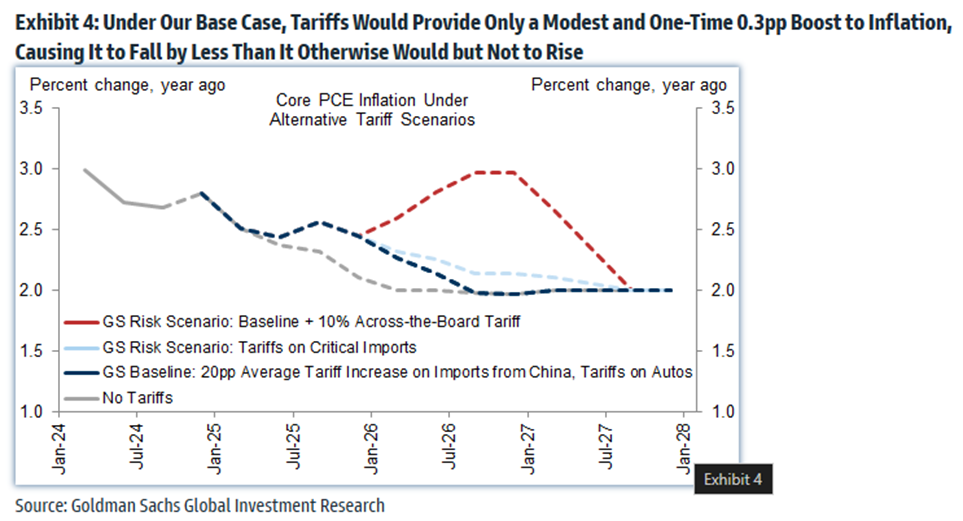

The wall of worry depends on an enduring fear that permeates investors’ psyche. Trade spats fit that bill, but there are potential consequences. Goldman Sachs believes broad-based tariffs could add 0.3 percentage points to inflation while shaving 0.5 percentage points off GDP in 2025. That’s all speculation at this point; what we know is that real data reported last month was favorable, laying the foundation for another year of economic expansion.

Goldman Sachs: Tariffs Would Provide a One-Time Inflation Boost

Source: Goldman Sachs

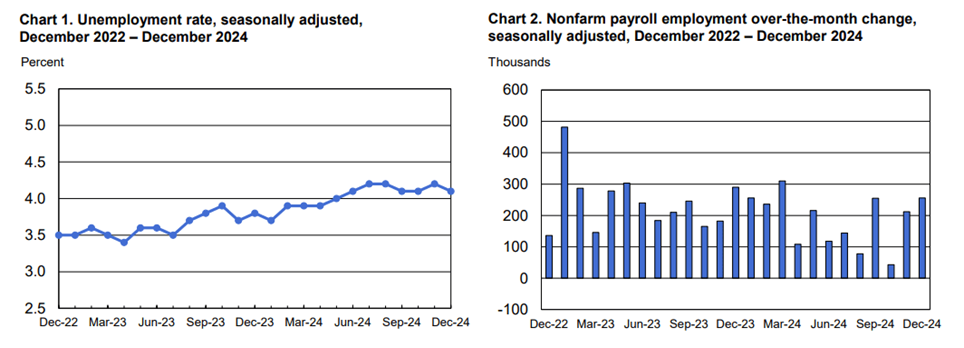

The sanguine macro story began with an outright Goldilocks December employment report. The US economy added 256,000 jobs in 2024’s final month, sharply above economists’ expectations. The unemployment rate ticked down to 4.09%, below estimates. The kicker was average hourly earnings which rose by under 4% on a year-on-year basis; that was a good thing as it pointed to limited inflation risk. Shortly after the payrolls report hit the tape, the S&P 500 made its low for the month. More good news was on the way.

Unemployment Rate Dipped in December, Job Growth Accelerated

Source: BLS

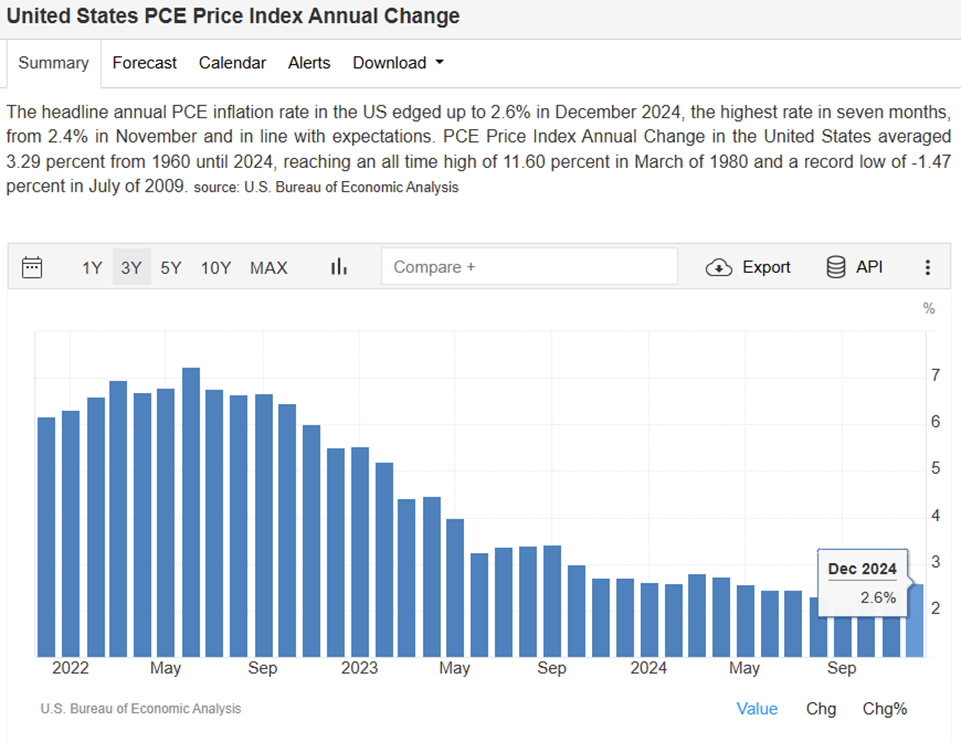

Both the Consumer Price Index (CPI) and Producer Price Index (PPI) for December were tame, which helped to stymie the interest rate rise that was seen ever since the Fed began lowering rates last September. Then, the Retail Sales report that spanned the holiday shopping season came in very strong, confirming what a lot of real-time data suggested. Finally, the end-of-month Personal Consumption Expenditure (PCE) Price Index, another inflation gauge, was benign.

PCE Inflation Ticked Up to 2.6% in December, Above the Fed’s 2% Target

Source: Trading Economics

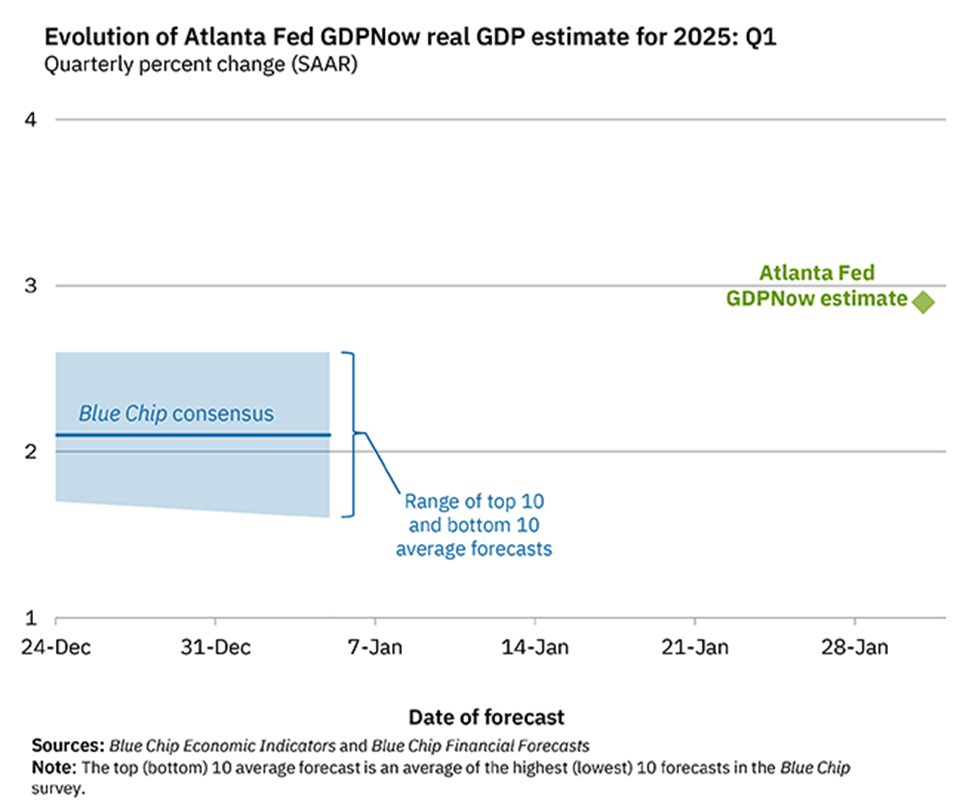

The upshot? The economy is more than fine right now. That could of course change, but the GDP growth rate appears to be near 3% (above its long-term trend) and inflation is likely to retreat as 2025 progresses. It really boils down to the reality that people have jobs, they are earning positive inflation-adjusted wage gains, and they are spending money. That’s a recipe for economic strength.

Q1 US Real GDP Growth Seen Near 3%

Source: Atlanta Federal Reserve

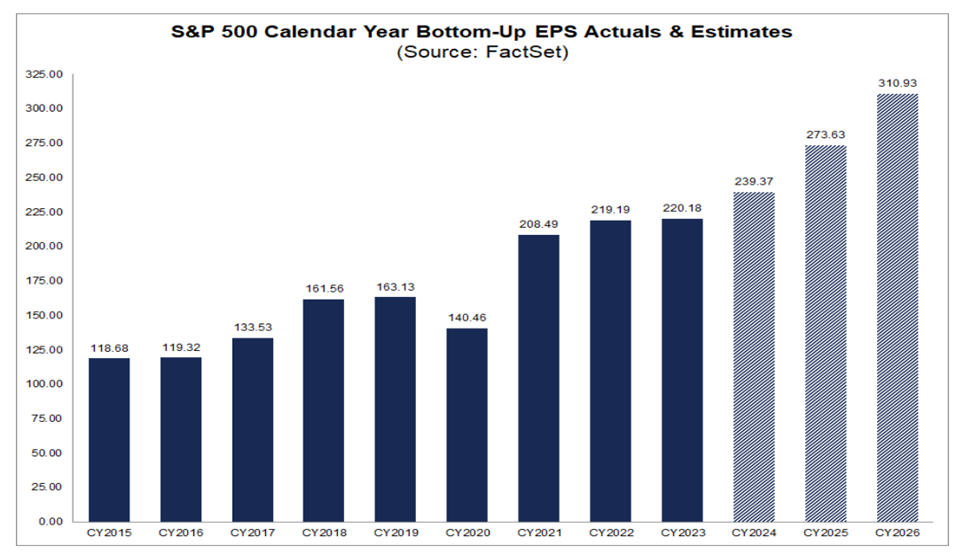

Corporations are flexing their muscles, too. Through last week, about one-third of the S&P 500 had reported Q4 earnings, and the bottom-line beat rate was high at 79%. Those that have topped analyst estimates have beaten by a median of 6%. So, firms are reporting record profits – even above the high levels the experts were predicting. Bull markets depend on rising earnings per share, and it’s looking more likely that profits may rise north of 10% this year, maybe as high as 14%.

S&P 500 Earnings Growth Takes Off in 2025

Source: FactSet

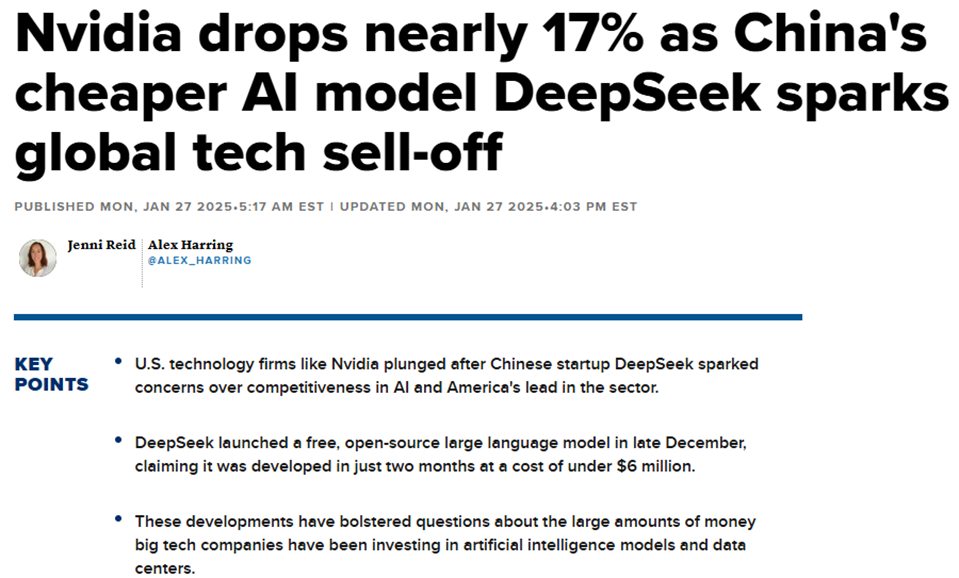

Fueling the earnings engine is AI. Investments by the Mag 7 and other large companies are like a flywheel for innovation and shareholder returns. Competition is high, as evidenced by China’s DeepSeek AI that rattled chipmakers like NVDA back on January 27. Though it’s of geopolitical concern, when companies duke it out, prices come down and consumers end up benefitting. We’ll continue to watch how that plays out.

DeepSeek AI Spurs a One-Day Chip-Stock Rout

Source: CNBC

Big picture, with the macro on a firm footing, stocks are priced at 22 times earnings, which is a lofty valuation, but not so much when you consider the earnings growth trajectory. Moreover, the median US stock has a price-to-earnings ratio of just 17 – certainly not a nosebleed figure.

With the backdrop of reasonable valuations, positive macro data, and a Fed that might cut one or two more times this year, merely the fact that the S&P 500 was up in January points to more gains for the balance of 2025. The “January Barometer” posits that as January goes, so goes the year. If the first month is up, the median full-year return has historically been 19% with an 89% win rate. Down Januarys have led to a 0% median return and just a 50% win ratio. So, we’ve got that going for us, which is nice.

Bullish January Barometer

Source: Fundstrat

The Bottom Line

Stocks were up to jump-start 2025. The S&P 500 rose about 3% while shares of small-cap and mid-cap companies also participated in the rally. Foreign stocks outperformed, and the bond market was up, too. Job growth remains decent, the consumer keeps spending, and inflation continues on a general, albeit slow, path toward the Fed’s 2% target. The wall of worry is built on tariff and immigration unknowns, along with what may happen next in the AI race. Amid all that, company earnings are strong and the outlook for 2025 looks bright.