Joy to the Investment World: Stocks Hit New Highs Ahead of Christmas

- The S&P 500 and Nasdaq closed at record levels last week

- Interest rates have dipped as Trump’s cabinet takes shape

- Huge retail sales numbers and strong corporate earnings are positives with the Fed poised to issue one more rate cut in 2024

Markets consolidated post-election gains through the middle of November, but have since come rip-roaring back. Last week, following a decent November jobs report, both the S&P 500 and Nasdaq Composite closed at fresh peaks. For the S&P, Friday was the 57th all-time high daily close of the year, bringing the index to a return of almost 30%. That follows a 24% advance (dividends included) in 2023.

S&P 500 YTD: Merry and Bright

Source: Stockcharts.com

If historical trends hold this year, then we might get even more gains in the final weeks of 2024. The fundamental setup would appear to be in place for a year-end rally, too; the Fed is likely to cut interest rates on December 18, Q3 corporate earnings were strong, and the US economy keeps defying predictions for a slowdown.

What’s more, Wall Street seems to have given President-elect Trump’s Treasury secretary pick, Scott Bessent, a vote of confidence. The soon-to-be 47th POTUS has lined his proposed cabinet with free market advocates and real-world businesspeople. Optimism is seen most brightly in the crypto market. Since we last discussed returns immediately after the election, bitcoin has breached the $100,000 mark.

Let’s dive into how markets look with Santa’s big seen just a couple of weeks away and perhaps get clues on what to expect in 2025.

Stocks wobbled in the week or two after the election. There was a massive post-November 5th rally, but the knee-jerk up-move met some selling pressure heading into the middle of November. Interest rates drifted a bit too high for comfort as the 10-year Treasury yield bucked up against 4.5% – up about 0.7 percentage points on the year.

10-Year Treasury Rate Falls Following the Bessent Pick

Source: TradingView

The bullish tide shift came when Trump announced that hedge fund veteran and pragmatist Scott Bessent was his nominee for Secretary of the Treasury. With the backdrop of a soaring national debt and trillion-dollar-plus annual deficits, the bond market welcomed the down-to-earth Bessent to the Treasury secretary seat.

The 10-year rate began to ease, and stocks lifted ahead of Thanksgiving. The Bessent pick aligns with other cabinet nominees and appointments that are generally seen as pro-business. Howard Lutnick, CEO of Cantor Fitzgerald, will likely be the Commerce secretary, Paul Atkins is set to replace the anti-crypto Gary Gensler at the SEC, and Kevin Hassett, another somewhat mainstream candidate, is tapped to be the Director of the White House National Economic Council.

Bessent Seen as Pro-Business

Source: Google

Of course, nobody knows with certainty how policy will play out in year 1 of Trump 2.0. What we have a pretty good beat on, though, is that the economy is coming into the new year with a head of steam. Third quarter GDP grew at an inflation-adjusted annual rate of 2.8%, which is considered above trend, and early clues on the Q4 expansion rate point to a possible 3%+ print.

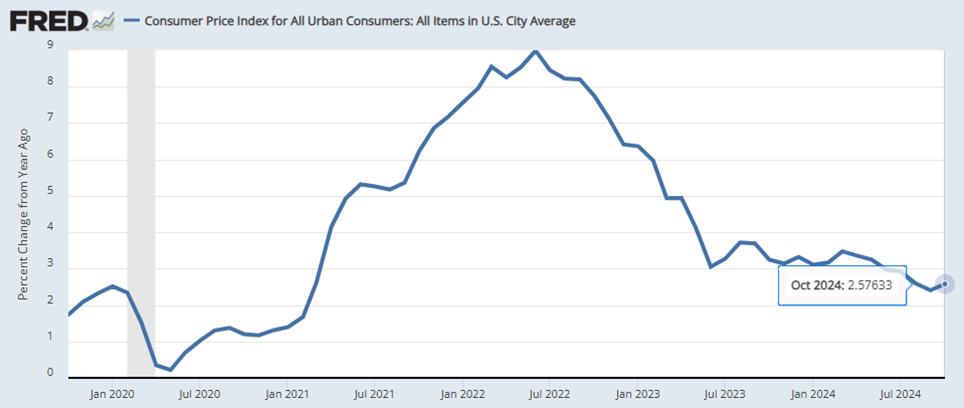

Inflation remains slightly higher than where the Fed wants it – we’ve transitioned from a “disinflation” trend to a more sideways inflation movement. There are concerns that Trump’s tariff threats – if turned into reality – could hit households with a notable one-time increase in prices. The good news is that even if we have, say, 2.5% inflation over the quarters ahead, wage growth is humming along at an even higher 4%.

CPI Inflation Rate Holding Above 2%

Source: St. Louis Federal Reserve

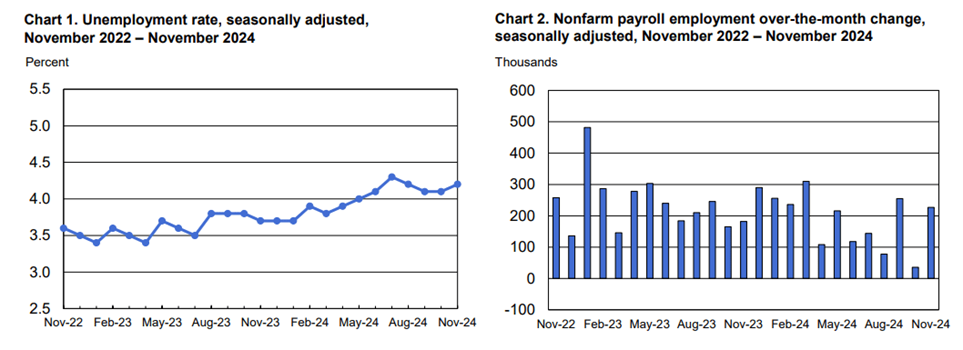

Speaking of the labor market, the November jobs report released last week showed an encouraging recovery in payrolls. The economy added 227,000 jobs, which was close to economists’ expectations. Average hourly earnings grew by a firm 0.4% for a second straight month, but the unemployment rate rose from 4.145% to 4.246% – very close to the high-water mark of the cycle from July.

On net, it was a ‘good, not great’ employment snapshot, which means the Fed is likely to cut interest rates by another quarter-point at its next meeting on December 18. That would mark a full percentage point of central bank easing since it began lowering rates in September. Looking out to 2025, perhaps another three cuts are in the cards.

Unemployment Rate Ticks Up, Job Growth Rises in November

Source: BLS

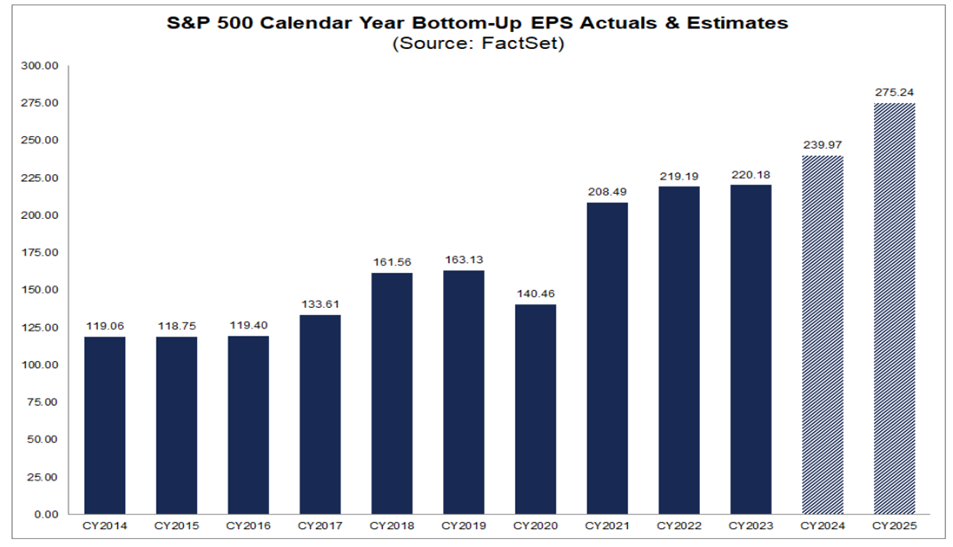

With the background of a pro-growth policy team climbing aboard within the executive branch, a solid employment backdrop, and a Fed that’s willing to keep on lowering interest rates, it continues to be a healthy macro setup for stocks. Indeed, S&P 500 earnings are likely to print a new all-time high this year, maybe near $240 per share, up 9% from 2023.

Analysts predict a profits acceleration in 2025 with S&P 500 EPS soaring to $275. That might be a tad too sanguine, but with merry consumer spending ongoing and the other macro tailwinds at play, further economic strength would make sense.

S&P 500 Earnings Per Share: Big Growth Expected in 2025

Source: FactSet

And let’s talk about the consumer. Y’all just keep doin your thing (my family included). According to Adobe Analytics, shoppers spent 8.9% more on Thanksgiving this year than last year. Black Friday sales rose 10.2% in 2024 while Cyber Monday was another blowout, with total retail spending soaring 7.3%. Season-to-date holiday activity tracks +9% versus last year.

The National Retail Federation, meanwhile, notes that the average holiday gift spend is up 3.5% annually. Retailers put up early-season promotions to attract shoppers since there’s a relatively short window between Thanksgiving (which fell on November 28) and Christmas. We’ll know more later this month when the Census Bureau issues its November Retail Sales report.

Hey Big Spender: Holiday Shopping Trends Point to Big Sales Activity

Data Source | Details |

Overall Trends | Early promotions, e-commerce (eCom), and AI drove strong holiday sales; shoppers responsive to discounts despite inflation. |

Online Sales (Adobe) | +8.9% y/y on Thanksgiving, +10.2% y/y on Black Friday, and +7.3% y/y on Cyber Monday. Total Cyber Week: +8.2% y/y. Nov 1–Dec 31 to-date: +9.0% y/y. |

In-Store vs. Online (NRF) | Black Friday online sales -7.4%, in-store +3.8%. Avg. holiday gift spend: $235 (+3.5% y/y). Holiday season forecast: +2.5–3.5% growth y/y. |

Key Purchase Categories | Clothing/accessories (49%), toys (31%), gift cards (27%), food/candy (23%), and personal care (23%). |

BNPL Growth (Adobe) | Buy Now, Pay Later usage increased +5.5% y/y. |

MasterCard | Black Friday retail sales (ex-autos): +3.4% y/y, eCom: +14.6%, in-store: +0.7%. Total US holiday forecast: +3.2% y/y (eCom: +7.1%). |

Salesforce | U.S. online sales: +8% y/y (Thanksgiving), +7% (Black Friday), +3% (Cyber Monday). Strongest growth in home appliances (+20%), footwear/handbags (+18%). |

Discount Trends | U.S. avg. discount rate: 28% (-1% y/y). Top discounts in apparel, beauty, home. |

Physical Store Traffic | RetailNext: Black Friday traffic -3.2% (NE region strongest). Sensormatic: Holiday week visits -2.3% y/y. |

Shopify | Sales: +24% y/y with avg. cart size of $108.56 (+0.4% y/y). Leading categories: clothing, cosmetics, fitness/nutrition. |

Source: Goldman Sachs

Along with huge spending at stores, the TSA reported record checkpoint numbers on the Sunday after Thanksgiving. At the box office, “Moana 2” and “Wicked” produced monster ticket sales, big enough for AMC to notch its best-ever Thanksgiving weekend. No matter how to slice it, the US economy is showing its might with year-end on the doorstep.

Box Office Bounce Back: Record Thanksgiving Weekend

Source: AMC

Getting back to stocks, the S&P 500 recently rose through 6000 and 6100. We think 6300 could be in the works by Dec 31, but a few macro events could stir up modest volatility. This week’s CPI report and next week’s Fed meeting might keep traders on edge before the stage clears for the usual end-of-year rally period. The so-called “Santa Claus Rally” is technically the final five days of the current year and the first pair of sessions of the new year.

Traders will pay particular attention to the Fed’s quarterly Summary of Economic Projections (SEP) on December 18 to get a sense of where the Committee sees policy heading in 2025 and beyond.

Could the Bulls Come Down the Chimney? SPX 6300 In Play.

Source: Fundstrat

So long as there are no major surprises, the S&P 500 might return 30% or more for the year. Already up 29% with dividends, the US large-cap index could tally its best back-to-back years since 1997-98. The Nasdaq is up about the same YTD, but small caps have lagged. The Russell 2000 is higher by ‘just’ 20% as it struggles to hurdle its all-time high from November 2021. Foreign stocks have trailed badly – the Vanguard FTSE All-World Ex-US ETF (VEU) is up less than 10%. The bond market has a modest 3.5% total return through December 6.

Last by not least, bitcoin is up a whopping 136% in 2024. It had dipped to $67,000 before the election, but then busted through the previous all-time high on November 6th. The psychological $100,000 level was taken out earlier this month upon news that Atkins would potentially lead the SEC. As bitcoin straddles $100k, ether has been on the rise. The world’s second most valuable token has soared by 50% from right before Thanksgiving to last Friday. The crypto bull market presses on.

Bitcoin Bags Another Banner Year: +136% So Far

Source: TradingView

The Bottom Line

Stocks consolidated their election gains during the middle of November, but encouraging cabinet picks by Trump and big holiday-shopping numbers have propelled stocks to new highs. Interest rates have declined in the past three weeks and crypto has scored big gains. While markets are poised to register huge returns in 2024, we could see some near-term choppiness before the Santa Claus Rally period.