Stocks Soar Post-Election, Fed Rate Cuts Continue

- Investors were relieved by a decisive election outcome and the prospects of lower taxes and regulation under Trump 2.0

- The Federal Reserve also cut interest rates last week while allaying concerns about potential inflation risks

- With the bull market ongoing, more gains are likely into year-end if historical trends are a guide

Markets breathed a collective sigh of relief after last Tuesday’s election. Fears of a protracted battle with state recounts and courts determining the ultimate verdict of who would become the 47th president were quickly allayed as vote totals rolled in. It’s apparent that, along with former President Trump earning a second term, the Republicans will likely control both houses of Congress.

Stocks reacted favorably to that presumed scenario as Election Night unfolded. The futures markets ascended gradually, culminating with monster gains that lasted throughout the session on Wednesday the 6th. Small cap stocks rallied huge – they are seen as potentially benefitting under President-Elect Trump’s policy, which includes an extension of the 2017 Tax Cuts and Jobs Act, a lower corporate tax rate, increased tariffs (particularly on China imports), and a more business-friendly regulatory regime.

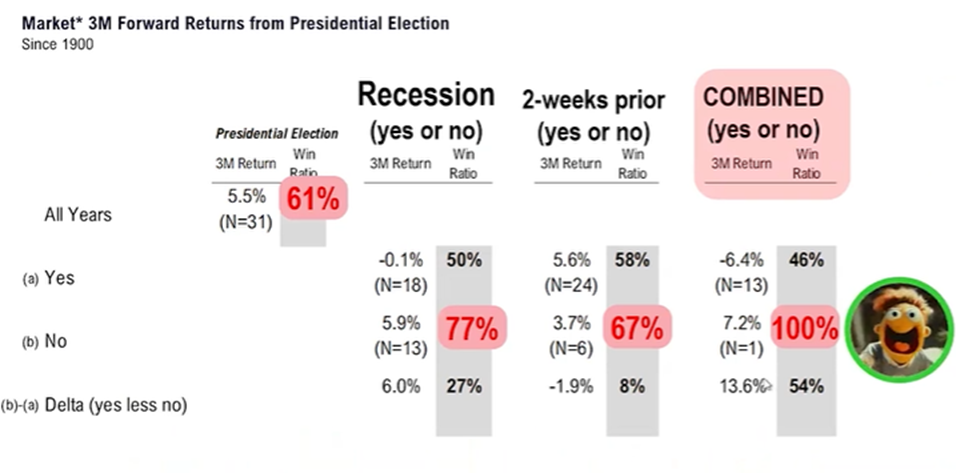

The S&P 500 Usually Rallies After Presidential Elections

Source: Fundstrat

The S&P 500 built on the initial spike, too. Gains were strong enough to bring the US large-cap index to new all-time highs, and the Nasdaq Composite also soared post-election. Taking it on the chin over the back half of last week was China and just about the entire international stock market; A stronger dollar and the threat of renewed trade wars did a number on ex-US equities. Making matters worse for the world’s second-largest economy was news of an unimpressive stimulus package from Chinese authorities last Friday which sent China ETFs plunging into the close of the week.

The election also had pronounced impacts on the bond market. As stocks took flight from Tuesday evening through the following morning, interest rates surged. (When rates rise, bond prices fall.) The yield on the benchmark 10-year Treasury note rose to its highest mark since July 1 by mid-week. Interestingly, buyers stepped into the battered fixed-income market from Wednesday morning through Friday. For the week, the 10-year yield actually fell modestly, which surprised many macroeconomic experts.

10-Year Treasury Rate: A Pop to 4.48% then a Drop to 4.31% by Friday’s Close

Source: Stockcharts.com

By the time the dust settled, the S&P 500 had posted its best week in more than a year while the small-cap index notched its best week going back to April 2020. It was particularly encouraging to see interest rates not get out of whack. Commodity prices were generally stable as the dollar’s value relative to other currencies gained 1% over the five-day stretch. All in all, I think investors will take it!

But last week wasn’t only about the election. Moreover, there were key happenings over the past month that are worthy of highlighting and putting in their proper context. Let’s begin by going over what took place at the recent Fed meeting.

Chair Jay Powell and the rest of the Federal Open Market Committee (FOMC) delayed its two-day policy gathering by a day due to the US election, but the rate decision was not a surprise. The central bank cut rates by a quarter point, which was widely expected. The S&P 500 responded with a bullish yawn – stocks added some to their post-election rally. The bond market took the news with more enthusiasm; the 10-year yield drifted lower during Powell’s Thursday afternoon press conference.

The Fed chief confirmed to reporters that future interest rate adjustments would be based on incoming economic data, not on speculation about policy changes put forward by the new Trump administration. The fear was that the Fed might have had to slow down its rate-cutting campaign in light of what’s likely to be a very pro-growth and possibly inflationary Trump economic agenda. That could still play out, and we’ll know more next month when the Fed provides its quarterly Summary of Economic Projections (SEP).

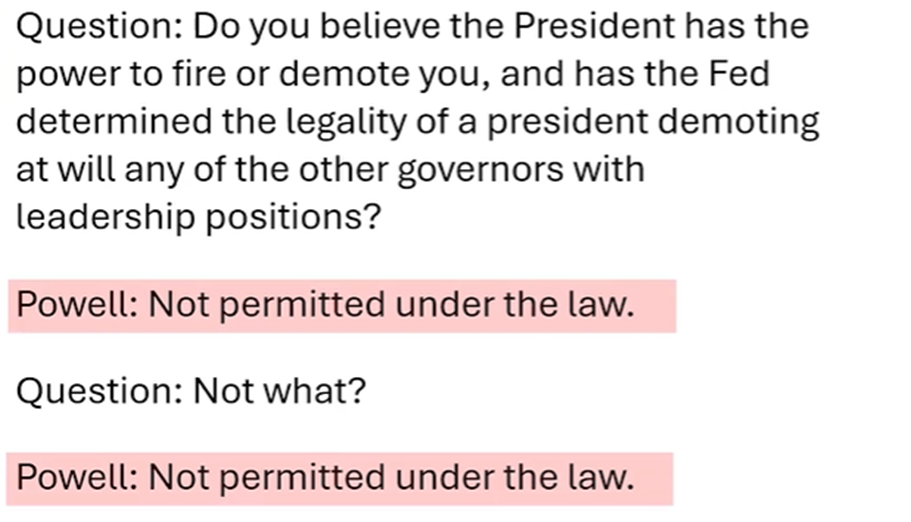

While few eyebrows were raised surrounding the interest rate decision, some feathers may have been ruffled when Powell was probed about whether he would step down amid pressure from Trump. In a word, “No.” The emphatic Fed Chair intends to stay on through his term which ends in May 2026. He doubled down on his straightforward response later too. A reporter asked if the incoming POTUS could fire any Fed governor. Powell responded, “Not permitted under the law.” Clearly, this scenario had been looked into by the FOMC and its lawyers!

Powell Plans on Staying at the Fed Helm

Source: Fundstrat

What’s ironic about a renewed professional battle between Trump and Powell is that the president-elect should thank Jay for partly causing the massive inflation that earned him a second term! The Fed was widely criticized for leaving interest rates far too low for far too long and continuing quantitative easing measures, including buying mortgage-related assets, to stimulate the economy. That’s history now, but part of Trump 2.0 may be more jawboning with the Fed.

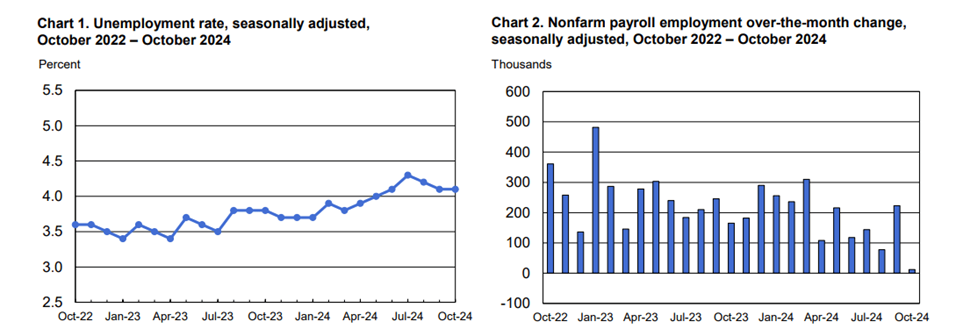

Believe it or not, other things are happening beyond politics and monetary policy. The jobs market remains “good, not great,” evidenced by rather low weekly initial jobless claims. Earlier this month, the BLS released the October employment report which showed a very weak pace of labor market growth. Just 12,000 positions were created last month, but that figure was distorted by negative impacts from Hurricanes Helene and Milton, worker strikes at Boeing, and one-off auto layoffs in Michigan.

What’s more, payroll processor ADP reported very healthy growth in private-sector employment for October. Given how jobless claim numbers trend right now, it’s likely that we’ll see a snapback in employment when we get the next report on December 6th.

Unemployment Rate About Steady, Fewer Jobs Created Lately

Source: BLS

As it stands, the unemployment rate at 4.14% remains above where it was a year ago, but workers’ average hourly earnings are strong (well above the inflation rate), and the broad trend of a rising labor force participation rate is an encouraging sign. Interestingly, the so-called “Sahm Rule,” a recession harbinger that triggered in August, un-triggered in October. So toss that recession warning out the window, along with the inverted yield curve, the bearish leading economic index (LEI), and poor sentiment surveys. All of those may have led investors astray during this epic stock market rally.

Since we last discussed the state of the stocks, the second anniversary of the bull market was celebrated. Since October 12, 2022, the S&P 500 is up 73% with dividends included. Over the past 25 months, the bears have tried to poke holes in the stock market run-up, but a resilient economy and robust corporate earnings keep sending shares higher for good reason.

S&P 500 ETF (SPY) +73% Since October 2022, Nasdaq 100 ETF (QQQ) +98%, Russell 2000 ETF (IWM) +46%

Source: Stockcharts.com

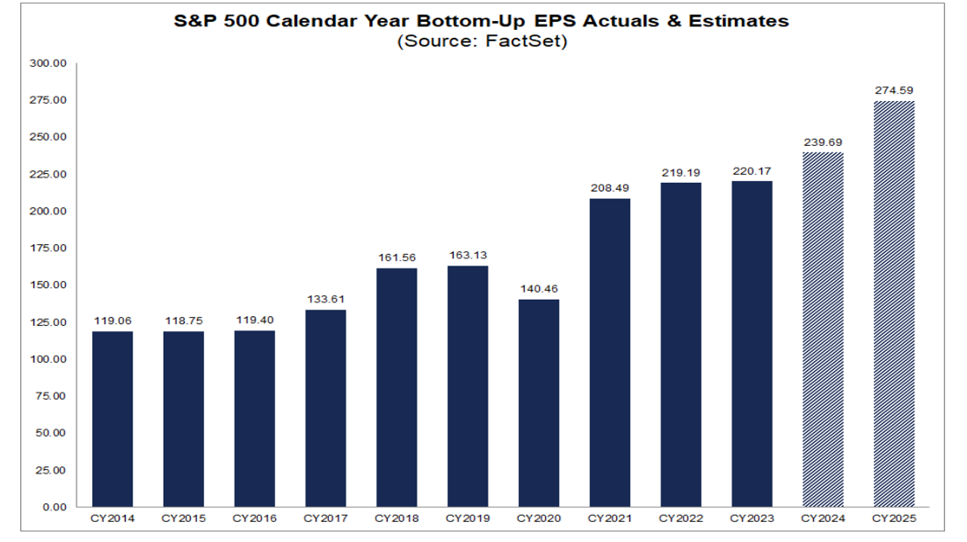

Speaking of earnings, the Q3 reporting season is wrapping up on Wall Street. Per-share profits are up about 5% from a year ago, marking a fifth consecutive rise. Going forward, analysts expect earnings to increase at a faster pace – potentially near 12% for the current quarter and just shy of 10% in 2025.

With the election in the rearview mirror, it’s possible that we could see a spending wave among households and a capex boom among corporations now that there’s certainty on the political front. Households and C-suites had tightened up a bit ahead of November 5th, but it would not be surprising to see more aggressive buying of discretionary items and durable goods along with an uptick in corporate merger and acquisition activity over the months ahead.

Record S&P 500 Earnings Per Share

Source: FactSet

Of course, inflation will have to be watched closely. Increased deficit spending is all but inevitable under a red-wave scenario. A key risk in 2025 is rising interest rates causing a continued surge in interest expense at the federal level. If investors are less willing to buy government bonds, then Congress and Trump could face problems meeting all the promises made on the campaign trail. We’ll monitor how all that unfolds.

The Bottom Line

Markets were pleased with Election Week and Fed Week. The S&P 500 rallied to a new high, marking its best four-day gain in two years. A pro-growth Trump agenda would appear to be bullish for stocks, but equity valuations and implications on the bond market will have to be watched. But with a friendly Fed and cheery seasonality on tap, there’s reason for continued optimism in the months to come.