Stocks Delivered the Best Rally Through Q3 Since 1997, On Watch for October Volatility

- The S&P 500 posted a positive September for the first time since 2019

- Utilities lead on the year as the bull market celebrates its second birthday later this week

- The macro is mixed with unease in the Middle East exciting the bears and monster China stimulus luring the bulls

- Companies, meanwhile, are producing record profits and big shareholder returns in 2024

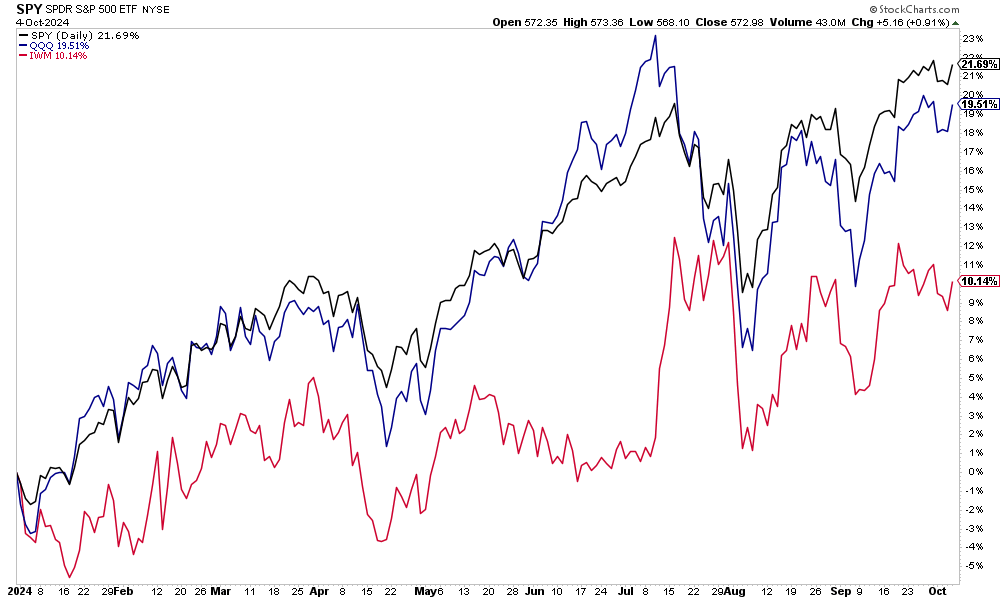

Stocks got over their “September scaries” (as we dubbed it last time) despite a slew of concerning macro happenings. The S&P 500 scored a 2% gain last month after stumbling to begin September. The Nasdaq Composite outperformed slightly while the Russell 2000 small cap index lagged modestly.

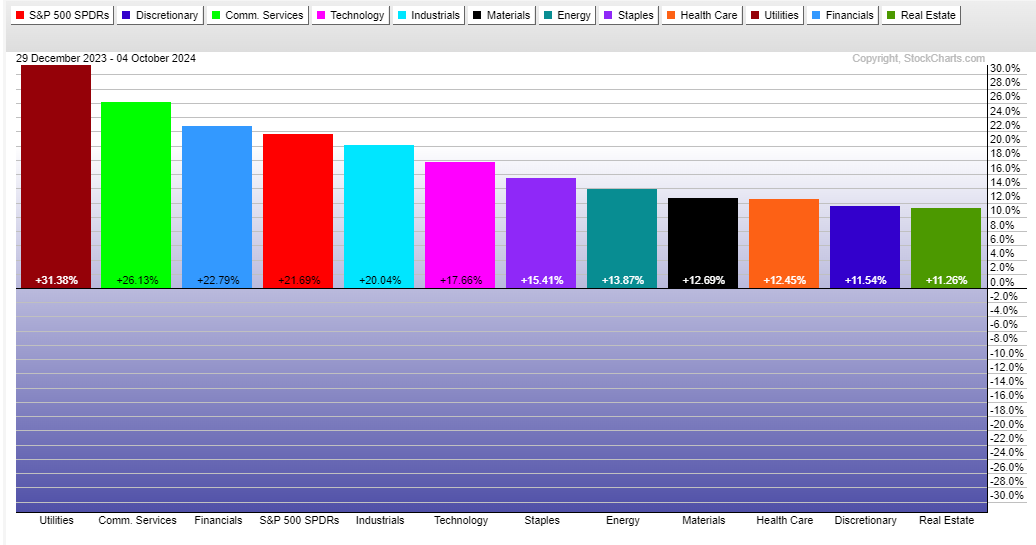

It was a fourth straight quarter of gains for the S&P 500, and if you toss in dividends, the index is higher by 22% on the year through last Friday. What’s been leading the charge of late has been an area not often talked about during bull markets: Utilities. The power-generating sector has returned more than 30% YTD for a couple of reasons.

YTD Returns: S&P 500 ETF +22%, Nasdaq 100 +20%, Small Caps +10%

Source: Stockcharts.com

First, interest rates have fallen hard since April. The yield on the benchmark 10-year Treasury note plunged from above 4.7% in April to a low of 3.6% the day before the Fed cut rates last month. Utilities benefit from cheaper borrowing costs, and Utilities stocks appear more attractive in the eyes of dividend investors when Treasury rates ease. Second, AI bullishness has seeped its way into power producers which are needed to fuel data center demand, not to mention the ongoing “reshoring” push.

Communication Services, led by huge gains from Meta Platforms (META), is the next-best sector, followed by Financials – another beneficiary of the ever-changing interest rate situation. The weakest areas haven’t been all that weak at all: Real Estate, Consumer Discretionary, Health Care, Materials, and Energy are all up double digits but have lost ground to the S&P 500.

YTD S&P 500 Sector Returns: Utilities All Charged Up

Source: Stockcharts.com

In the bond market, interest rates are down from year-ago levels when the 10-year yield was near 5%. An early-2024 inflation-reacceleration fear sent bonds into a small tailspin, but the reality that the CPI rate was on the mend and that Fed cuts were a matter of if, not when, resulted in a major summertime fixed income rally, benefitting traditional 60/40 stock/bond allocations.

10-Year Treasury Rate: Higher Since Mid-September, Still Down Versus Last Year

Source: Stockcharts.com

Commodities had a quiet year up until a couple of weeks ago. Crude oil traded close to $90 per barrel in October 2023, but concerns about China’s growth, record-high US production, and some tempering of geopolitical tensions in the Middle East led to generally lower oil prices in ‘24. Tranquility is fleeting overseas, however, and recent escalations between Israel and Iran send oil higher. Still, a barrel of crude is significantly below year-ago prices.

The big bullish narrative in commodities is gold. The precious metal has hit record high after record high in 2024, just as stocks have ascended. Central bank gold buying and concerns about the level of the US budget deficit are said to be the catalysts there.

Oil Jumps Amid Geopolitical Jitters

Source: Stockcharts.com

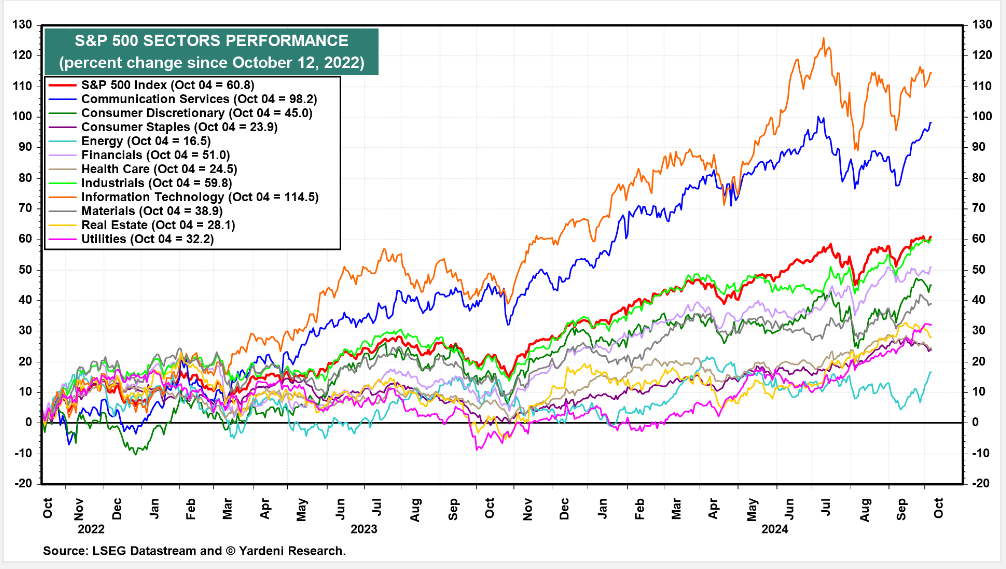

Now that we are into the final quarter of the year, taking stock of all that has transpired in 2024 helps us recalibrate. It’s also a useful exercise considering how strong the last year has been; the bond market bottomed almost 12 months ago. We can even go back to October 2022 for a broader perspective.

In the last 24 months, the S&P 500 has returned about 60%, led by tech stocks, but everything has been up. For some, it has been a life-changing wealth-building period, and it’s quite possible that there are more gains on the horizon – we might just have to get through an iffy October first.

Tech Has More Than Doubled from the Low in October 2022

Source: Yardeni Research

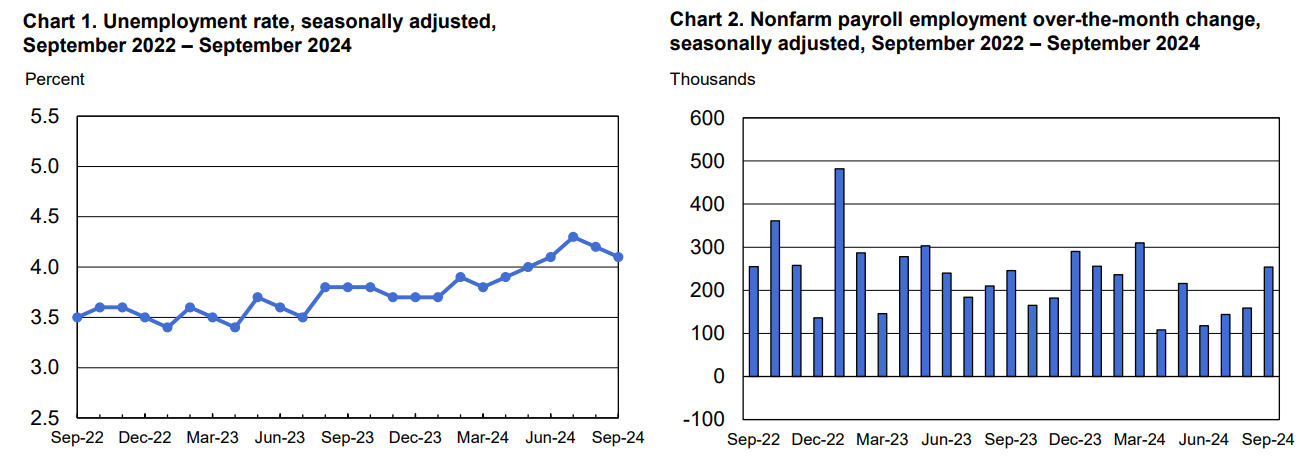

Zooming in on the state of the economy, the September jobs report was strong across the board. The headline 254,000 payrolls gain was more than 100,000 above the consensus estimate, while revisions to the previous two months were higher (which bucks the recent negative revision trend).

The unemployment rate fell significantly from 4.22% to 4.05%. Average hourly earnings came in hot at +0.4% compared to August and up 4.0% versus 12 months prior. The so-called “underemployment” rate ticked lower to 7.7% from 7.9%.

Stout September Jobs Report: Unemployment Rate Falls 0.17%, Biggest Payrolls Gain Since March

Source: BLS

The gangbuster report poured cold water on the bearish storyline that the jobs market would unravel once unemployment rose half a percentage point. The “Sahm Rule,” which asserted that a recession was likely given the jobless rate’s rise, made headlines in August when it triggered, but the fact is the labor market remains resilient. Other data to kick off October generally supported the healthy nonfarm payrolls figures; ADP produces a monthly survey of private sector employment, and it verified better than expected. Also, applications for unemployment benefits are far from recessionary levels.

Lost in the shuffle late last week was more good news, this time on the supply chain front. The port strike ended after just three days. Had the dispute lasted weeks, not days, then there was the risk of materially negative impacts, including higher food and other goods prices for consumers just as the big retail spending season begins. We’re now all good until January 15 on that topic.

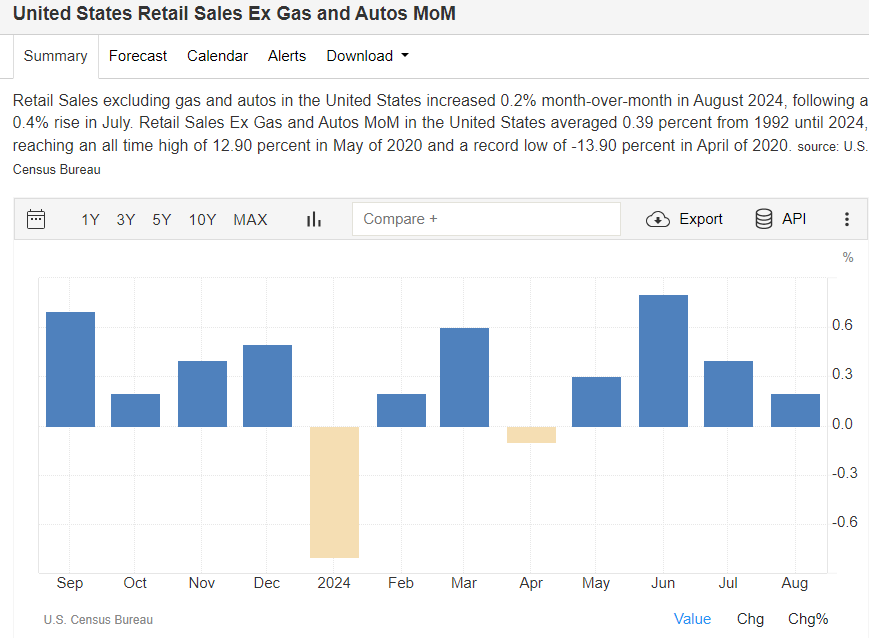

We will get inflation updates this week, but those have become less market moving as 2024 has progressed as it’s clear that both CPI and PCE (the Fed’s favorite gauge) rates will approach 2% in the months ahead. Surprising economists in the last handful of months has been consumer spending strength. Retail Sales reports since the summer underscore that so long as folks have jobs and are earning raises above the inflation rate, they are going to spend. Of course, the bulk of retail activity and non-essential splurges have come from high-income households.

Core Retail Sales Strong over the Summer

Source: Trading Economics

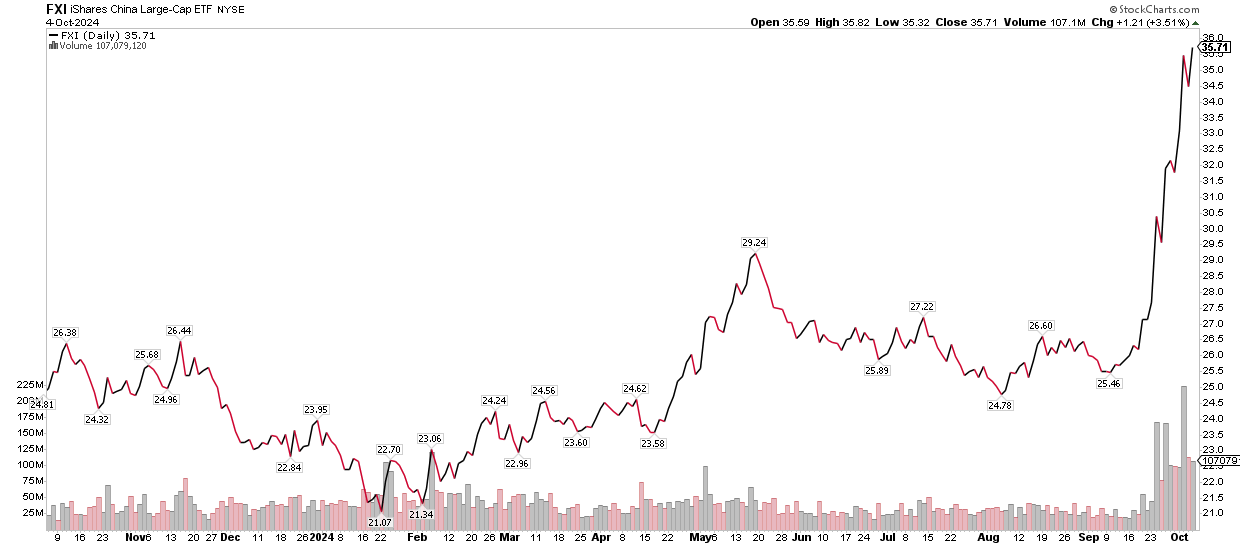

The big September surprise was a bazooka of stimulus China injected into its economy. The package is estimated to be about 6% of the country’s GDP, which is hefty. It came a bit out of left field considering that President Xi has been an authoritative ruler with constant crackdowns on the nation’s private sector (using that term loosely) and outright hostility toward his people and companies.

The stimulus targets corporations, households, China’s embattled real estate sector, and its banks. The tale of the tape is that China ETFs soared 40% from mid-September to last week’s close. For diversified investors, this could be a bullish story looking ahead to next year considering that China still trades with a low price-to-earnings ratio.

FXI China ETF Soars in Response to Big Stimulus News

Source: Stockcharts.com

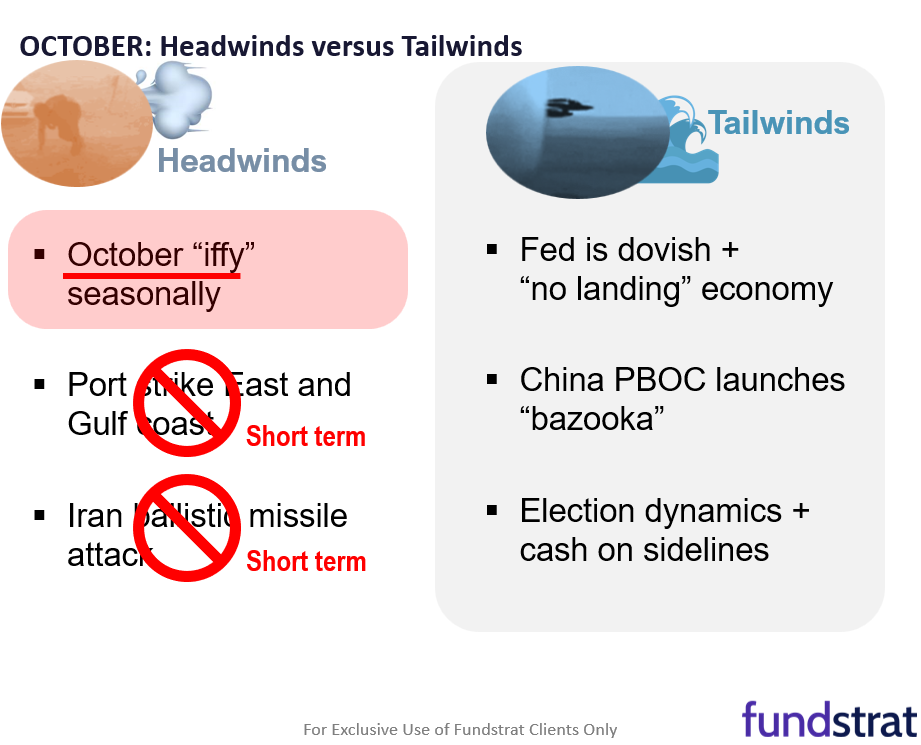

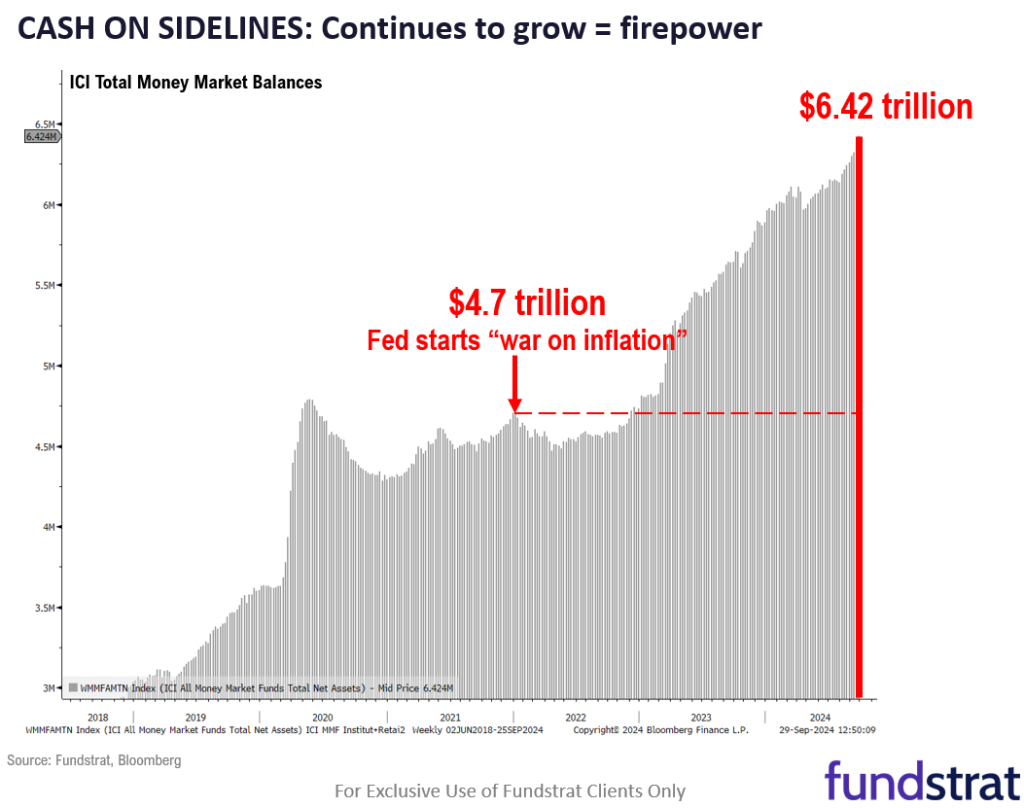

Stories like what’s going on in China and the reality that savings account yields are moving lower could augur well for the bull market’s extension. We see 6000 on the S&P 500 in the cards by year-end, bid up thanks to a possible deployment of a record level of cash still resting in money market mutual funds.

A solid Q3 earnings season could be the catalyst that gets us there, along with the much-loved Santa Claus Rally period that often rounds out a year. As the Fed is expected to slash its policy rate a couple more times in 2024, Wall Street analysts project 5% earnings growth for the quarter just ended with double-digit profit advancement by Q4 and through next year. Corporate earnings are stellar, dividends are big, and stock buybacks are at record levels. Not too bad if you’re a shareholder.

The Risk-Reward Scale

Source: Fundstrat

Record Cash Levels – A Bullish Catalyst for Stocks

Source: Fundstrat

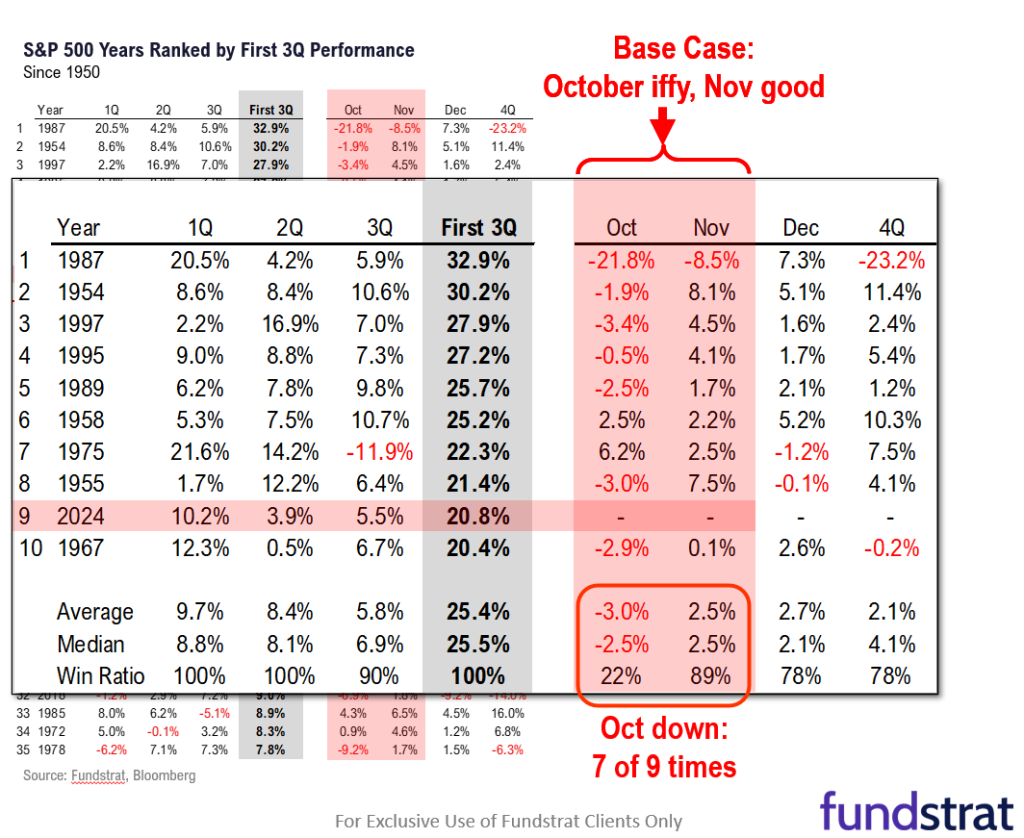

We are students of history, and we know that October can be spooky. The month has been down seven of nine times when the S&P 500 is up about as much as it was this year through Q3. Analysis of the Volatility Index (VIX) points to potential near-term equity weakness, while aggression in the Middle East is not the best backdrop. And then there’s the election wildcard which usually brings about some short-lived freakouts in October.

Data Junkies Rejoice: October Sometime Spooky

Source: Fundstrat

The Bottom Line

We see an iffy near term, but macro conditions appear sanguine looking further out. With the Fed in easing mode, hefty China stimulus in the works, and cash on the sidelines, there’s reason for optimism about stocks, particularly if we get an October dip.