Stocks Snapback After an All-Out Panic, Solid Earnings Amid Improving Macro Chatter

- The S&P 500 is up almost 20% from its April 7 low, led by tech stocks

- After another good jobs report, interest rates have stabilized

- Corporate earnings are notching new records as companies navigate a changing global economy

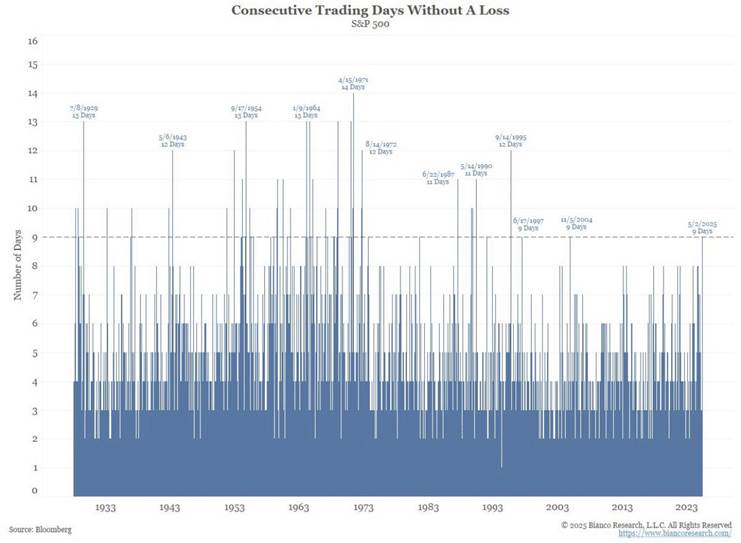

We are not in the prediction business, but stocks indeed launched higher once peak pessimism cascaded across markets. Through last Friday, the S&P 500 was higher in nine sessions running—the longest winning streak since 2004. After nearly dropping to technical bear-market territory, down 20% from peak to trough, on Monday, April 7, US large caps are up 18%.

In fact, the nine-day rally capped off by a strong US jobs report last Friday was the best such ascent since April 2020, back when we were in the recovery phase of the COVID bear market.

A Rare 9-Day Winning Streak

Source: Jim Bianco

It’s been a whirlwind for anyone following the stock market or the economy. Recession fears spiked during “Tariff Spring,” and macro worries took a leg higher just last week when the Commerce Department reported that the US economy shrank in the first quarter. We’ll get into it later, but the key thing to remember is that stocks discount the news. We underscored that truism in our previous market commentary, which bears repeating today. Still, after a fantastic run-up over the past four weeks, risks remain.

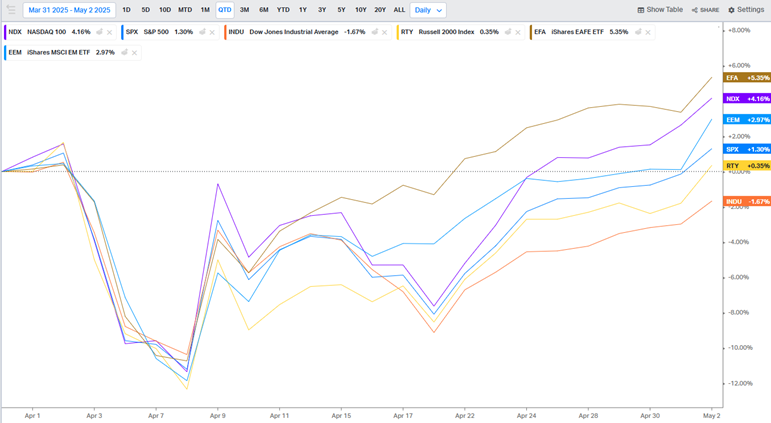

Let’s kick off like we usually do by reviewing where markets stand. Since April 2, when President Trump celebrated Liberation Day from the White House Rose Garden with a set of shockingly high reciprocal tariff rates, the S&P 500 is up modestly. If you went on a month-long island getaway and tucked your phone away, you wouldn’t know much happened. Tech stocks are collectively higher since early Q2, and the only major blemish is the Energy sector, which has dropped 13%, thanks to a sharp decline in global oil prices.

S&P 500 Up 1.3% In Q2. Ho Hum.

Source: Koyfin Charts

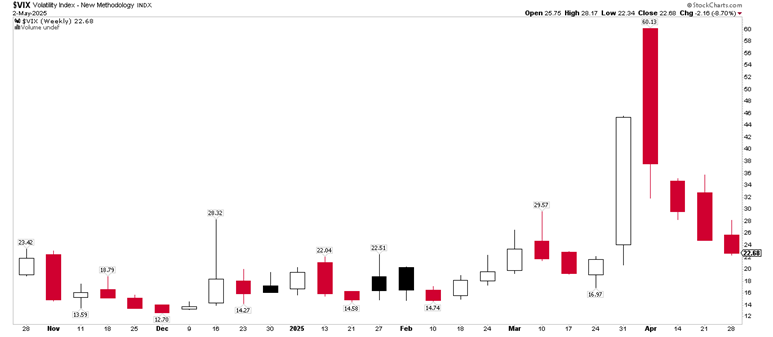

The Volatility Index (VIX), Wall Street’s “fear gauge,” rose to 60 then—a level not seen since the throes of the COVID Crash, and you’d have to go back to the 2008-09 Great Financial Crisis to find a comparable reading before that. That was an eternity ago, however—I’m talking a full four weeks in the rearview mirror. The VIX is down each week since then, now at a near-average 23. Fear remains in place, at least according to various sentiment surveys.

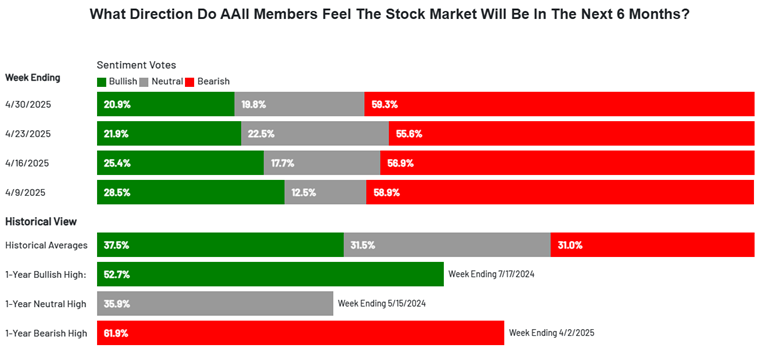

The American Association of Individual Investors (AAII) put out a weekly report gauging optimism about where the stock market is seen going over the subsequent six months. The latest view reveals that just 21% of respondents are bullish—a contrarian sign that many doubt the rally’s durability. It’s just one indicator, but the upshot is that the bulls might have more left in the tank as we head into the middle of the year.

Volatility Index: Down Big Last 4 Weeks

Source: Stockcharts.com

Investors Are Very Downbeat on Stocks

Source: AAII

And “the Pros” Are Bearish, Too

Source: Barron’s

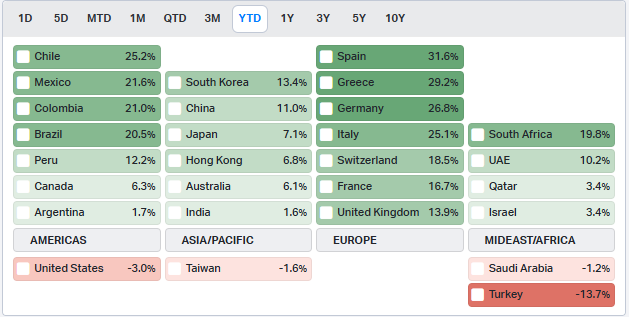

Beyond our borders, foreign markets have done particularly well. The broad ex-US index is up 4% over the past month, outperforming the S&P 500 by the same amount. A weaker US dollar generally helps international equities, and that has been the case lately. The greenback has lost almost 10% in value against a basket of other currencies. Money has been pouring into some specific regions, too.

European funds, for instance, closed last Friday at new all-time highs if you toss in dividends. The China stock market rose to begin May as rumors of some cooling off in US-China trade tensions. The best-performing country stock market since Liberation Day? Mexico, posting a 9% return, as Trump’s tariff focus shifted away from south of the border and toward the Far East.

Foreign Markets Have Been Strong in 2025

Source: Koyfin Charts

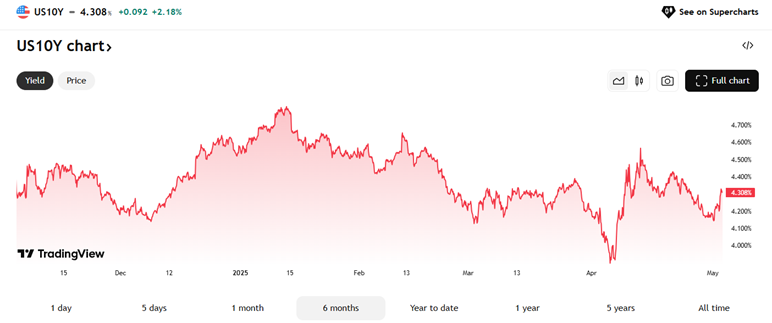

Turning to the bond market, much ink has been spilled and there’s been a lot of hand-wringing about the path of interest rates. At 4.31%, the benchmark 10-year Treasury note yield has hardly changed from on the two-month zoom and is actually down on the year and lower from 12 months ago. For a hot minute, there were fears that foreign investors were liquidating their Treasuries and dollar-denominated holdings because of politics, but that narrative vanished beginning in mid-April once interest rates retreated.

We seem to be in a sweet spot here between 4% and 4.5% on the 10-year, and barring a recession, it’s hard to see that general range breaking meaningfully. What’s more, the president and Treasury Secretary Scott Bessent have made it clear that they want rates to go no higher than current levels.

10-Year Treasury Rate Steadies Near 4.3%

Source: TradingView

The bond market is so important that it was arguably the impetus for President Trump’s Truth Social post heard ‘round the world in which he stated that a 90-day delay on reciprocal tariffs would be granted. That message, sent on the afternoon of Wednesday, April 9, resulted in a stunning 10% pop in stocks, perhaps cementing the previous Monday’s low as the bottom for the year. All eyes remain fixated on the POTUS’ Truth Social page (at least some memes are spliced in to lighten the mood).

We also called out sneaky strength in bitcoin in our previous missive. Again, we are not traders, but price action in cryptocurrency perhaps portended the broader jump in stocks. Bitcoin, after bottoming close to $75,000 on April 7, got within a stone’s throw of $100,000 late last week, outperforming tech stocks, which it usually shares a tight correlation with.

Another fascinating intermarket quirk is the dance bitcoin and gold are doing right now. Gold soared to an all-time high of $3,500 per ounce in April but then pulled back. As the precious metal consolidated its huge year-to-date gain, bitcoin climbed.

Bitcoin Rallies from Under $80k to Near $100k

Source: TradingView

Big picture, while we still prefer US stocks and the domestic tech story, diversification has shown off its benefits—from steady bond performance to relative strength in international stocks to significant gains in gold this year and bitcoin more recently.

Turning to the economy, people are very glum about tariffs. It makes sense. Nobody wants to pay more for everyday goods or see a 10% jump in some corners of the grocery store, but there appears to be flexibility in the president’s policies. In true Trump style, his opening tariff salvo was extreme—an over-the-top approach to begin dealmaking. We’ll see if new trade agreements are crafted, but there is a risk that higher inflation will come about this year. Moreover, if a tit-for-tat tariff ramp-up occurs, a recession is a real risk.

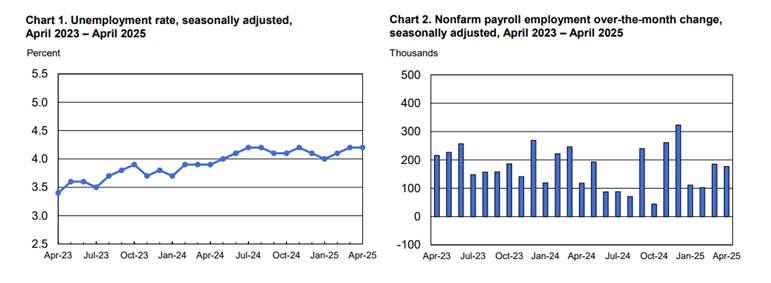

For now, though, the “hard” data has been decent. Last Friday, the Labor Department reported a better-than-expected April jobs report. The economy created 177,000 positions, above the 138,000-consensus forecast. The unemployment rate rose just 0.025% to 4.187%, while workers’ earnings rose by a solid, but too hot, 3.8% from a year earlier.

Before the labor market update, the US Census Bureau confirmed that consumer spending was robust in March. Of course, maybe you were among millions of Americans and business owners that stockpiled ahead of tariffs.

The Labor Market Is Hanging in There, Unemployment Rate Under 4.2%

Source: BLS

Pre-ordering was so strong that there was a record amount of net imports in Q1. That takes away from GDP, hence the economy contracted by 0.3% last quarter. It was the first negative growth print in three years.

Recall that a technical recession is when we experience two consecutive quarters of declining output, but an official recession is determined by an outfit called the National Bureau of Economic Research (NBER). Unless there’s a sharp deterioration in employment, an NBER recession is unlikely. Prediction markets peg the chance of a technical recession this year at 58%. Splitting hairs? Yeah, but it’s what we do in finance.

58% Recession Chance

Source: Polymarket

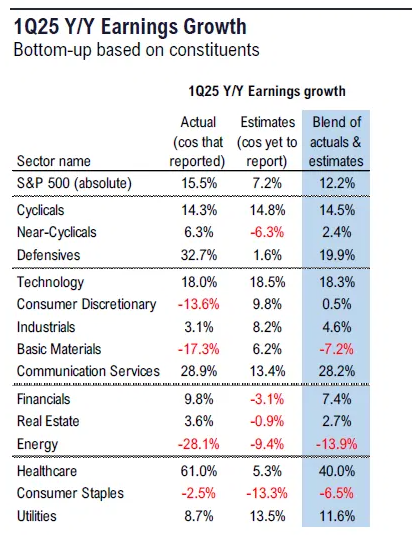

As the egg-head economists debate that one, corporate executives keep producing profits and spitting out dividends for shareholders. We are in the heart of the Q1 earnings season, and bottom lines have been beefy—particularly among the Mag 7 companies (six of which have reported). Collectively, earnings per share are now seen higher by more than 12% from a year ago, much higher than what Wall Street had been expecting as recently as March 31.

The private sector is an engine for growth, and tech giants are still leading the way. Coupled with positive macro data (the jobs report, softening inflation, and upbeat retail sales) with record-higher corporate profits, markets are in a better position compared to a month ago, supporting the huge S&P 500 rally.

12.2% Earnings Growth YoY

Source: Fundstrat

For clients, we got to work when everyone else was panicking. A month ago, we detailed the action plan: tactically rebalancing portfolios, buying the dip with cash, tax loss harvesting, and Roth conversions were quick wins. The worst thing people could have done was let political bias impact their investment decisions. We don’t do that.

The Bottom Line

It might have felt like the world was coming undone four weeks ago. The talking heads were predicting an imminent and long-lasting bear market, a potential depression, and the dollar losing its reserve-currency status. Fast forward to today, and the narrative has shifted somewhat, but doubt and uncertainty are still in vogue. That’s good! Yes, recession risks are real, and macro worries shouldn’t be downplayed too much, but as long as worry lingers, it often acts as a bullish catalyst. The market likes to “climb a wall of worry,” as they say.