Why Peace of Mind Is the Ultimate Financial Return

This week’s insight digs into the “why” behind financial planning. Results from a new survey may surprise you.

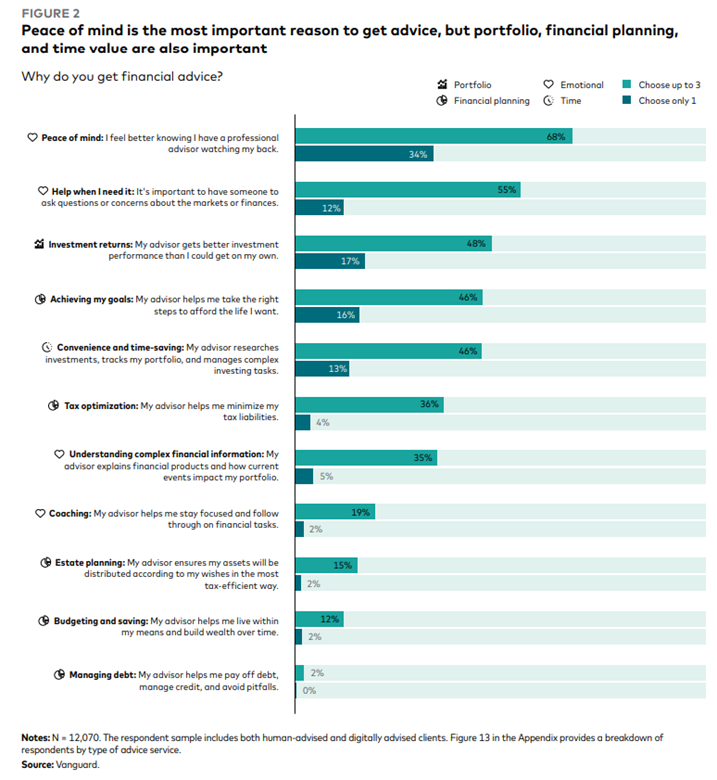

Most people reach out to financial advisors not to beat the market or even optimize their money situation. According to Vanguard Group’s How to Talk About the Value of Advice report, 68% of respondents said “peace of mind” was a top reason for getting financial guidance. For most people, they simply feel better knowing they have a professional watching their back.

It’s a sobering reminder that while the cold numbers, hard data, and snappy charts may be useful (and our team provides plenty of them), it’s those hard-to-measure, softer benefits that carry the most weight. Individuals, families, and small business owners may feel increasingly stressed today—not by the market, necessarily—but by all the uncertainty lying ahead in their lives.

The truth is, a quality wealth manager isn’t a person who makes the right market calls or gets you into the next NVIDIA before it skyrockets. That’d be great, but a true fiduciary is like your spotter on the financial racetrack—always seeing the risks and opportunities you may miss on your own.

Experience matters, and so too does an independent voice. That’s especially true for entrepreneurs. You see, when small business owners face critical decisions each day at the office or worksite, they must have fresh eyes looking after their financial plan. We all know that operating under stress all day, every day is a recipe for eventual burnout and suboptimal choices. But when partnering with an expert who has been in your shoes and has seen where others have succeeded and failed, there’s a layer of assurance that is hard to measure on a spreadsheet.

The No. 2 reason on the list? “Help when I need it.” Indeed, individuals often seek financial wisdom that they can’t get from an AI chatbot or a TikTok video. Their family and business are too important to merely guess at or wing it. This support becomes especially valuable when life events inevitably arise and stress mounts. Marriage, having children, starting a business, or approaching retirement are joyful milestones—but they can also be financially nerve-wracking. A steady hand matters even more during life’s difficult moments, such as caring for an aging parent, navigating illness or mental health challenges, or facing business failure.

The point? It’s easy to get caught up in a net worth statement and charts that go up and to the right, but life isn’t lived solely by the numbers. Recent data suggest it’s the emotional side of financial planning—the confidence, clarity, and reassurance—that people value most.

Investors’ Most Important Reasons to Get Advice

Source: Vanguard Group