Why Gas Is Cheap — and Why It Isn’t Cheaper

This week’s insight profiles tender and mild gas prices, why they are not even lower, and what it all means for 2026.

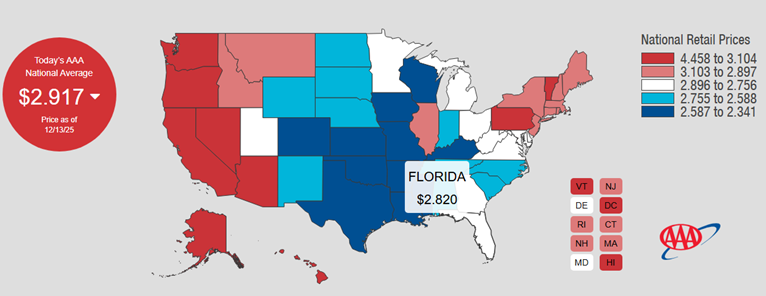

I bring you joyous tidings… at the gas station. According to AAA, the nationwide average price for a gallon of regular unleaded has dropped to $2.917, the lowest in four years. The decline comes as a record number of Americans plan to travel for Christmas. But affordable gas prices could be a whole lot cheaper, based on the wholesale market.

You see, when we tap to pay (and you should always tap, never swipe at the pump—for security reasons), the fuel entering the tank costs much more to get there than it used to. Today’s retail gasoline prices are still more than 50 cents higher than they were in February 2021, which was the last time gasoline futures were at today’s $1.75 level. The disconnect can be traced back to one dominant force: the 2021–2023 inflation spike.

While commodity prices have cooled, the cost of transporting gasoline from refineries to your local station has permanently risen. Labor costs are up. Maintenance is more expensive. Environmental compliance requirements carry higher price tags. Insurance costs have risen sharply. Each link in the chain (refiners, transporters, distributors, and retailers) passes along those higher operating costs. Ultimately, consumers and commuters absorb the difference.

Taxes matter too, particularly at the state level. And national averages can be misleading. As of this past weekend, the AAA national average sat at $2.92 per gallon, but the median price is closer to $2.799 (according to GasBuddy). Why the gap? Blame it on the West Coast and their high taxes and ancillary costs , which skew headline figures.

For a chunk of the country, gasoline is already meaningfully cheaper than the U.S. average. According to GasBuddy’s Patrick De Haan, 21 states are now below $2.75. Florida is on the favorable side of the mean, at $2.82.

The broader takeaway is constructive. Modest and stable oil and gas prices act as an economic stabilizer, which is important as lower-wage earners struggle to keep up. Looking ahead, if we see GDP growth pick up and job creation improve next year, the economic expansion could really take flight.

That might very well be the outcome, considering that companies can better forecast and manage expenses with oil below $60 per barrel. They may be more wont to hire, expand, and invest, also due in part to more favorable taxes (which are retroactive to 2025). For consumers, steadier fuel prices support discretionary spending, which already appears healthy as shoppers post record holiday sales.

Merry USA Gas Prices

Source: AAA