Where’s Santa? Stocks End 2024 on a Whimper. Looking Forward to a Strong 2025

- December was a tough month for most areas of the market amid returning inflation jitters

- The S&P 500 dipped to close out the year, but strength in the Mag 7 kept the decline in check

- Going forward, we see bullish factors outweighing bearish risks, and we detail our 2025 outlook

The S&P 500 fell 2% in December, ending the year on a down note, but it was a second straight year of 20%-plus gains for US large caps. Returns away from mega-cap growth (namely the Mag 7 stocks) were less impressive. The Dow Jones Industrial Average returned 15%, the S&P 500 Equal-Weight ETF (RSP) gained 13%, the Extended Market ETF (VXF), which includes all US stocks not in the S&P 500, was +17%, and the foreign stock market, as measured by the Vanguard FTSE All-World Ex-US ETF (VEU) delivered less than 6%, barely beating Treasury bills. What’s more, the bond market returned only 1.3% (dividends included).

S&P 500 Outperforms With a +23% in 2024 Despite a Late-Year Stumble

Chart courtesy of Stockcharts.com

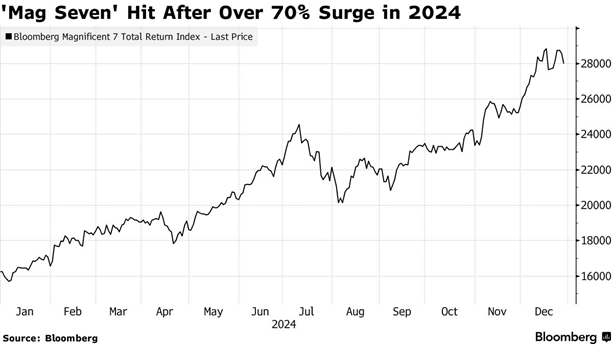

Now contrast those ho-hum numbers with the Mag 7’s superb 70% performance. Indeed, last year was a narrow rally, despite short-lived bouts of broadening out into areas like value, small-cap, and international shares. December was particularly concentrated – the month began with 14 consecutive losing trading sessions for the S&P 500 Value ETF (SPYV).

At the same time, shares of Apple (AAPL), Alphabet (GOOGL), and Tesla (TSLA) soared. Also in the year’s final month, a new entrant into the glamor roster entered the scene: Broadcom (AVGO) is the latest trillion-dollar market cap company. It had its best day ever after it reported quarterly earnings a few weeks ago.

Magnificent Seven Surges 70% in 2024

Source: Bloomberg

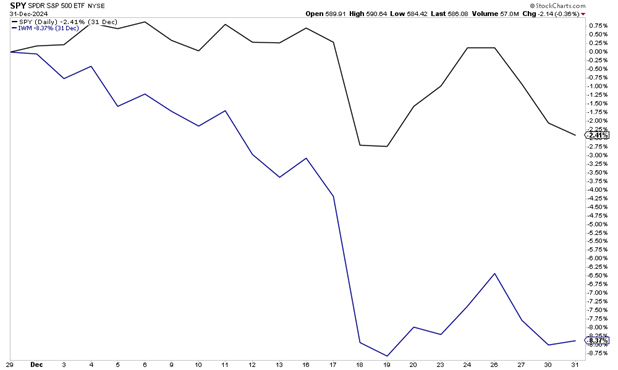

In all, the Magnificent Seven ETF (MAGS) gained 7% in December to cap off a banner year. The Nasdaq 100 ETF (QQQ) was up fractionally, good enough to match the S&P 500’s 25% total return last year. Small caps were downright dreadful during what’s often a cheery time – the Russell 2000 ETF (IWM) fell 8.4% last month, marking its worst month since September of 2022.

Russell 2000 ETF (IWM) Down 8.4% in December

Chart courtesy of Stockcharts.com

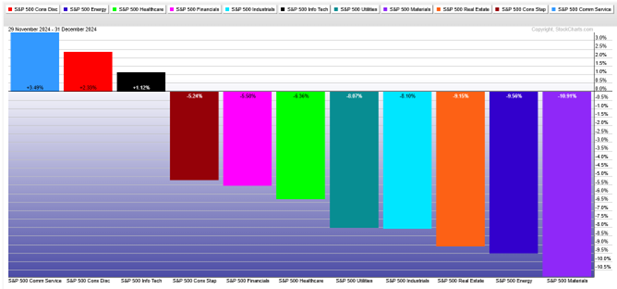

At the sector level, Communications Services was best with a 3.5% rally last month. Consumer Discretionary, helped by stellar returns in Amazon (AMZN) and Tesla (TSLA), was next best with a 2.3% advance. Information Technology was the only other positive slice of the market to close out 2024. Value-oriented and more cyclical sectors were sharply in the red, with the resource-sensitive Materials sector down double digits. Materials was also the only niche to turn in a down 2024.

Just Three Sectors Green in December, Value & Cyclicals Fall

Chart courtesy of Stockcharts.com

So, what gives? Why were so few stocks up during what’s supposed to be a strong month? Well, profit-taking is the number one reason. While it would make the most sense for investors to defer taking gains to the new year (for tax purposes), it’s clear that investors wanted to de-risk in the final four trading days of the year.

Through December 31, the so-called Santa Claus Rally period (the last five trading days of the old year and the first two sessions of the new year) has not lived up to its rosy moniker. Another factor to consider is that some of the worst performers in the last handful of weeks were 2024’s dogs. Thus, tax-loss selling pressure may have come about during the light stretch of macro catalysts.

The bond market played a starring role too. The yield on the benchmark 10-year Treasury note soared from 3.6% around the time of the Fed’s first rate cut in September to briefly above 4.6% between Christmas and New Year’s. Higher borrowing costs weighed on more debt-heavy small caps and capital-intensive cyclicals like Industrials, Energy, and Materials.

10-Year Treasury Rate Jumped After the September Fed Meeting

Source: TradingView

Treasury yields rose sharply last year. To begin 2024, the 10-year rate was under 3.9% with inflation in retreat and healthy skepticism about the durability of the market’s run-up off the October 2022 bottom. An early-year inflation scare culminated with a pullback in stocks in April, and while some volatility ensued in early August thanks to shakiness in Japan, all the dips were bought in short order.

As the second half unfolded, doubt turned into hope for many investors and Wall Street strategists. Donald Trump’s election victory added fuel to the positive sentiment shift. We now enter 2025 with many market participants upbeat about the year ahead, and (spoiler alert) count us among them.

With the Fed likely to err on cutting rates over the next 12 months, a solid economic foundation, beefy corporate earnings, and President-elect Trump poised to take office, we expect a ‘buy-the-dip’ modus operandi to persist.

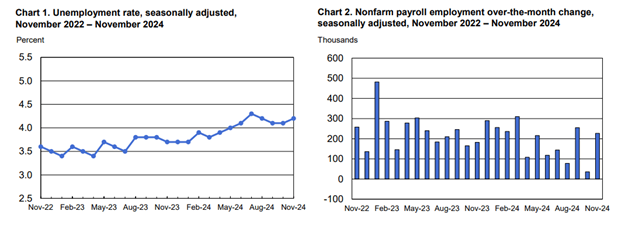

You see, Chair Powell and the Fed have an eye on inflation, but they will probably be more focused on keeping the unemployment rate (which is currently near cycle highs at 4.25%) in check. If we see the economy stumble, rate cuts would be the monetary weapon of choice to thwart significant macro pain.

Unemployment Rate Ticks Higher, But Monthly Jobs Gains Persist

Source: Bureau of Labor Statistics

Next, 2025 is almost certain to be a record year for S&P 500 earnings per share. The average forecasted earnings growth rate is 14% – an acceleration from last year’s 9% expected gain (the Q4 reporting period begins in a couple of weeks). Powered by high-margin tech companies, profits, dividends, and share buybacks are bullish forces as we flip the calendar.

Now let’s talk politics. Don’t sweat it, we focus on your money, not mudslinging. The reality is that Trump pays close attention to the stock market; it’s sort of like his gauge of how well he’s doing as CEO of the nation. If he sees confidence sagging and corporate profitability turning weaker, he’ll seek to implement market-friendly policies (or tone down potentially harmful trade-war talk).

The “Trump Put” Could Support US Stocks in 2025

Source: Fundstrat

Outside of monetary policy and the goings on in DC, investors remain flush with cash. We could see investor capital move out of bond funds (which took in record sums of cash last year) and from cash into stocks.

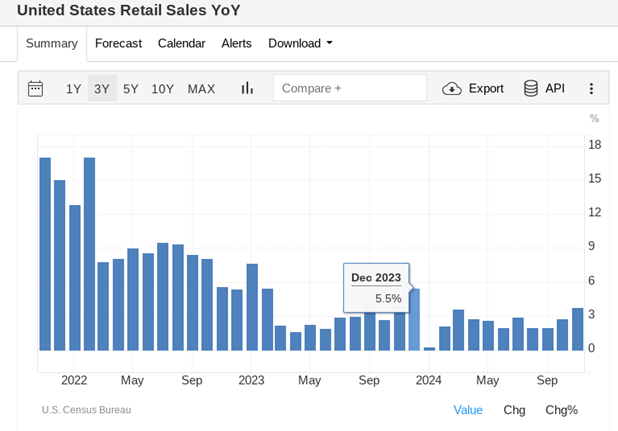

Furthermore, with workers currently netting about 4% in terms of wage growth, easily above the inflation rate, a chunk of that money will find its way into risk assets. Cash not dedicated to stocks will be spent on necessities and discretionary items, fueling economic growth. To wit, in November the Census Bureau reported that Retail Sales was the highest on a year-over-year basis since December of 2023.

November US Retail Sales Rises Above 3% YoY, the Highest Since December 2023

Source: Trading Economics

So, we feel good about markets next year. There are, of course, potential landmines that could explode on us. Among the possible risks include Elon Musk and Vivek Ramaswamy being too effective in slashing government spending – we’ll have to watch how DOGE goes. Additionally, Trump’s tariffs, if implemented as penciled in today, could hurt GDP and pressure multinationals’ earnings.

The US dollar is something macro geeks should monitor. The greenback ended 2024 at its best mark in more than two years, and if we see the buck keep rising, then it’s possible that corporate profit estimates could get hit. Currency swings are always a question mark.

Technically, history shows that the first year of a president’s term is a tale of two halves. January through June has been strong, per the data, but Q3 and Q4 have featured periods of volatility and corrections. Maybe the good times keep rolling for a while, but the 2025’s back nine could feature some tough dog-legs.

The Bottom Line

It was a strong year for the Mag 7 and US large-cap growth stocks. Everything else was so-so. The S&P 500 was up 23%, but the average US stock was up more like 11%. Foreign equities performed even worse, up just a handful of percentage points. The bond market struggled with rising interest rates toward year-end while the US dollar’s strength weighed on some risk assets. Gold and bitcoin hit record highs in 2024 too. As for next year, there will be ups and downs, but we are upbeat about investor returns…at least that’s what our crystal ball suggests.