Trump’s Power Play Rocks the Fed, But Stocks Shrugged in August: Here’s Why

- The S&P 500 logged another monthly gain despite mixed performances among the Mag 7 stocks

- Small caps led, as hope turned into expectation for a Fed rate cut

- In the face of unsettling political shake-ups, stocks and bonds remain up on the year ahead of the sometimes-sketchy month of September

Stocks rose for a fourth straight month in August. The S&P 500 climbed 1.9% in what’s sometimes a weak period. The gain came amid much drama at the macroeconomic and policy levels.

Recall just a handful of weeks ago that volatility stirred up in the wake of the July jobs report and news that the pace of growth in the labor market stalled to just 35,000 per month from May through July. Hours after that data crossed the wires on Friday, August 1, President Trump announced that he had fired the head of the US Bureau of Labor Statistics (BLS).

The S&P 500 Added to its YTD Gain in August

Source: Stockcharts.com

There was fallout at the Federal Reserve as well. Last month, voting member Adriana Kugler unexpectedly announced her resignation, creating a vacancy for the president to fill. Trump chose one of his economic wingmen, Stephen Miran, chair of the Council of Economic Advisers. That series of events followed an unprecedented meeting between Fed chief Jerome Powell and President Trump at the Fed’s headquarters building, which was undergoing renovation in Washington, D.C., amid Trump’s efforts to find cause for Powell’s removal.

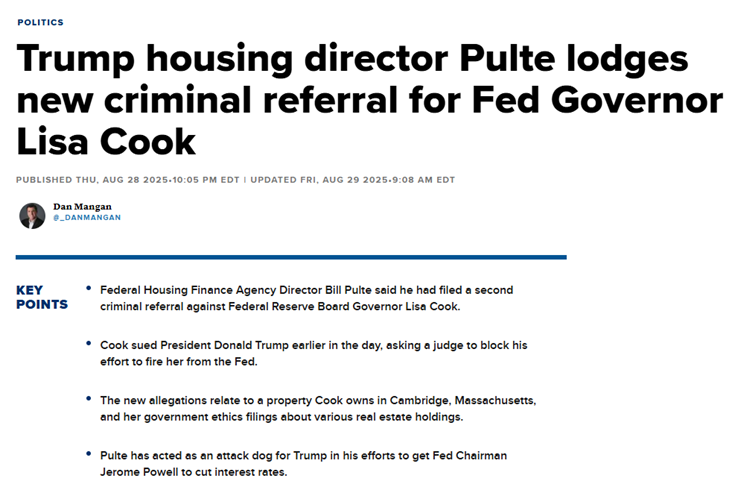

By now, if you’ve watched any cable news or flipped on financial TV for more than a few minutes, you’re likely familiar with the latest saga. Fed governor Lisa Cook has come under siege by Bill Pulte, director of the Federal Housing Finance Agency (FHFA), and the POTUS for allegedly committing mortgage fraud by classifying two properties as her primary residence and making false representations about a third-party home she owns.

Fed Governor Lisa Cook Comes Under Fire

Source: CNBC

Remember when this monthly missive used to be about stocks and bonds? We’ll get to the numbers, charts, and all that good stuff. Indeed, price action seems to have taken a back seat to political posturing and accusations slung from the White House to Federal Reserve officials. The president may be aiming to fulfill his 2016 campaign promise to “drain the swamp.” Along with Cook in the hot seat, Trump ousted CDC director Susan Monarez last week; that move prompted the resignations of many other health experts.

Congress returns from recess this week and will soon vote to confirm Miran to fill the Fed vacancy, while the Trump v. Cook battle may eventually be heard by the Supreme Court.

How did stocks fare amid all the legal uproars and attention-grabbing political headlines? Absolutely fine. Even boring. Not only was August a positive month for stocks, but the Cboe Volatility Index (VIX), also known as Wall Street’s “fear gauge,” sank to its tamest level of the year.

The same dull tape played out in the bond market—the fixed income volatility barometer is now near its lowest mark since early 2022. Despite the outcry surrounding the threat to hallowed Fed independence and the Trump administration’s overreach, markets (so far) have assumed it all is merely media theatrics, not economic substance.

Volatility Index Dropped Further in August

Source: Stockcharts.com

To be clear, “the creature from Jekyll Island” (the Fed) plays a critical and stabilizing role in the US economy. Every president over the past 75-plus years has, in one way or another, at least hinted at preferring lower interest rates. Some leaders have been more forceful than others, and Trump has been by far the most outspoken about his anger and disagreement with current Fed policy.

It’s a real long-term risk if the 12 voting members on the Federal Open Market Committee (FOMC) bow to Trump’s wishes. Central bank independence is revered by the bond market writ large, and if that is perceived as withering, then we could face real macro trouble. Right now, there’s no sign of it in the bond market. In traders’ parlance, “it will only matter when it does.”

To wit, the yield on the benchmark 10-year Treasury note fell 0.13 percentage points in August. Logic would assert that if Fed independence is severed, then bonds should sell off and interest rates should spike. Well, the opposite happened over the past several weeks.

In fact, the 10-year yield notched its cycle high in January, above 4.8%, before Trump began his second term. What’s more, the 30-year interest rate, said to be more sensitive to swings in confidence about long-term US monetary and fiscal policy, is close to unchanged for the year. The upshot? The media storyline and the market’s moves don’t jibe.

US 10-Year Treasury Note Yield Dipped to 4.23% in August, Down from its Early-Year Peak

Source: TradingView

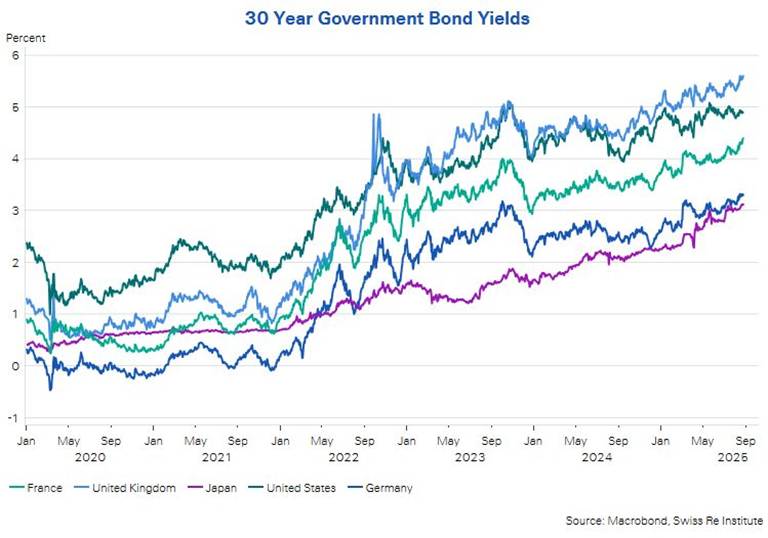

But here’s the secret few seem to want to point out. What’s going on in the fixed-income market really isn’t about the United States and our political discourse. It’s global.

The Japanese 30-year government bond rate has soared by 0.9 percentage points in 2025. In Germany, theirs is higher by 74 basis points. France…+70bps. Portugal, Canada, the UK, Italy, India, Australia, and even China: Each nation’s long-term bond interest rate has risen more than the US 30-year bond yield.

Rising Long-Term Interest Rates: It’s a Global Phenomenon

Source: Macrobond, Swiss Re Institute

So, as the media spins yarns of distrust and a banana republic, those stories don’t seem to apply to the US Treasury market (yet). Rather, the changing global economy—one being stimulated by increased fiscal investment in Germany, business-friendly initiatives in Japan, and actual political upheaval in France—appears to be having a greater impact on markets.

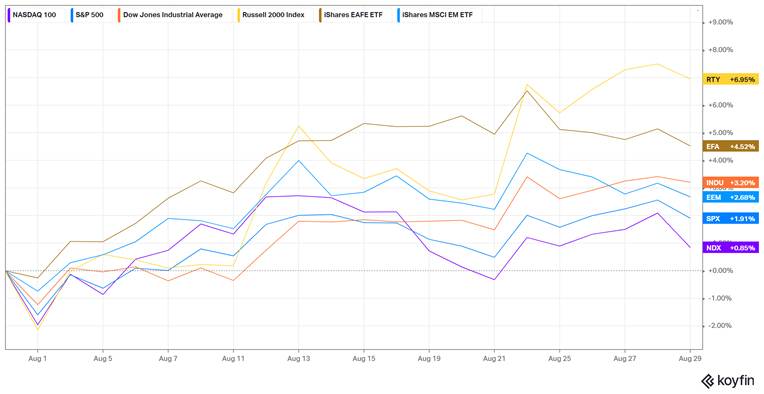

What else is going on? Small caps have been strong. The Russell 2000 Index of small companies soared 7% in August, its best month since last November. It outperformed the S&P 500’s 2% climb and the Nasdaq’s 1.6% advance. Optimism grows that the Fed will cut interest rates when it meets next on September 17.

Odds of a quarter-point ease have swelled to 86%. It’s not a done deal, as we must get through the August jobs report this Friday morning and the mid-month August CPI inflation update. If a strong employment turnaround is reported, and hot inflation data come in, then there’s a chance that the Fed could remain on hold.

August Returns: Russell 2000 Index (RTY) Stole the Show

Source: Koyfin Charts

But Fed Chair Powell’s Jackson Hole address last month took a “dovish” turn, in that he hinted that interest rate cuts were likely to resume sooner rather than later. His speech from Wyoming aligned with statements from Fed governor Chris Waller, seen as a potential successor to Powell.

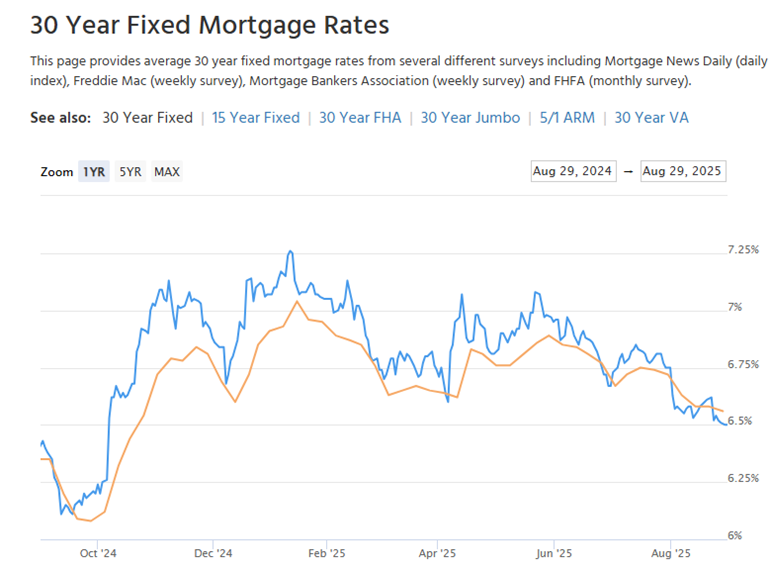

Both men now point to a weakening labor market as potentially outweighing inflation risks caused by Trump’s tariffs. For context, Fed rate cuts are seen as most stimulative for debt-burdened US small-cap stocks. First-time homebuyers also appreciate today’s lower mortgage rates, near 6.5% for the first time since early October 2024.

Mortgage Rates Sink to 11-month Lows Ahead of Likely Fed Rate Cuts

Source: Mortgage News Daily

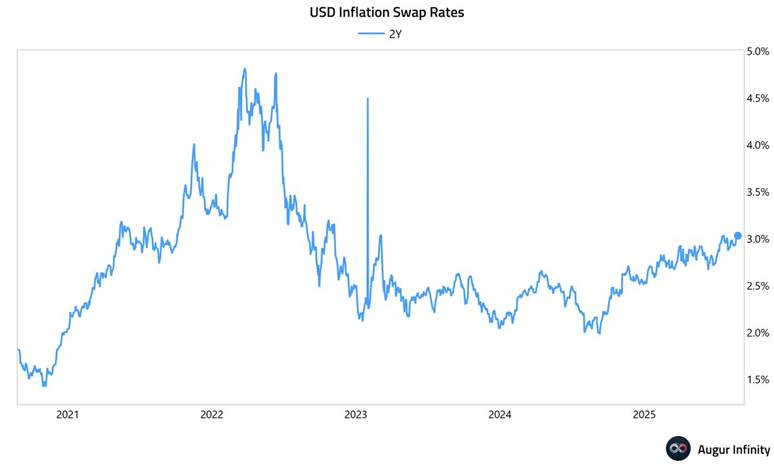

Inflation Risks Rising: 2-Year Inflation Seen Near 3% Per Year

Source: Augur Infinity

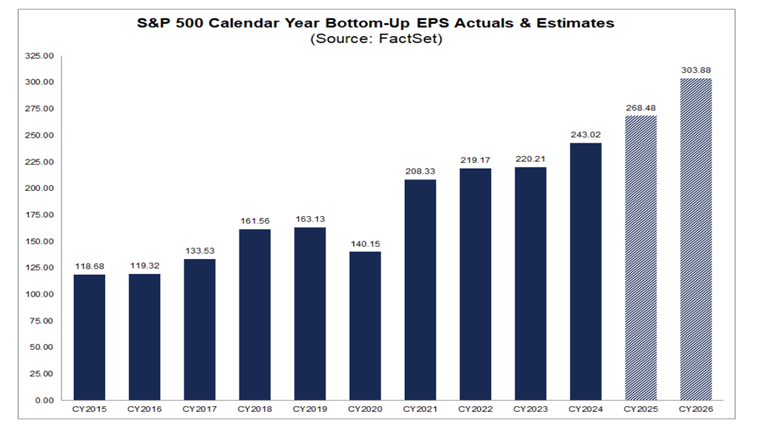

While the macro is important, there’s arguably a bigger theme at play that the Fed has little bearing on: AI. The second-quarter earnings season was a whopper. Strategists were predicting just 4.8% earnings growth as of June 30, before companies began reporting results. As of August’s close, that figure had exploded to 11.9%.

As a result, profit estimates have risen for the entirety of 2025; we’re also seeing earnings per share forecasts tick higher for next year. Thus, we shouldn’t be shocked to see stocks march higher (even with political turmoil unfolding).

S&P 500 Earnings Growth Steamrolls Ahead, Political Drama Be Darned

Source: FactSet

It was also encouraging to see sectors other than those related to tech rally. Health Care and Materials, a pair of seemingly chronic underperforming areas, stood out in a good way. Both climbed 5% during Q3’s middle month. Consumer Discretionary also performed nicely, which is often viewed as an economic bellwether. Lagging in August was actually Information Technology.

Shares of NVIDIA (NVDA) and Microsoft (MSFT) gave back modest ground in August. Amazon (AMZN) and Meta Platforms (META), while not technically in the I.T. space, were also fractionally lower last month. Rounding out the Magnificent Seven, Apple (AAPL), Alphabet (GOOGL), and Tesla (TSLA) each rose between 8% and 12%.

S&P 500 August Performance Heat Map

Source: Finviz

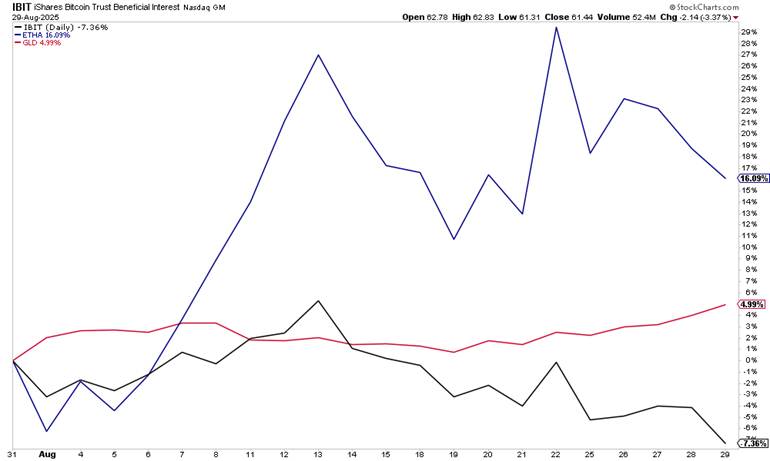

Elsewhere, crypto had a wild ride. Bitcoin notched a fractional new all-time high above $120,000 mid-month, but then shed some of its YTD gain ahead of the Labor Day weekend. In all, the world’s most valuable cryptocurrency fell 7% in August. Ether, however, recaptured Wall Street’s attention. Seen as a more practical token, it was up 30% on the month at one point, even briefly tagging a new high near $5000. Ether, like bitcoin, cooled into month-end, ultimately posting a 16% climb.

Gold was steadier. The precious metal finished August at a record level, just shy of $3450 per ounce. Perhaps US governance unease was a bullish catalyst for gold, but we must remember that its price has been rising for almost 10 years, following a trough at $1046 in late 2015.

Of course, gold’s major upside move began when stocks bottomed in September-October 2022. Silver also made it to fresh highs going back to 2011 by summer’s unofficial end. Briefly on the value of the US dollar…it has steadied itself after a first-half beating. The greenback appears to be in consolidation mode ahead of the spooky September-October period.

Ether +16% in August, Gold +5%, Bitcoin -7%

Source: Stockcharts.com

Why is the transition to autumn “spooky”? Well, stock market returns have been weak toward the end of Q3. As we noted earlier, however, August is not exactly a rip-roaring month when analyzing historical performance trends, and the S&P 500 did just fine this recent go-round.

To avoid succumbing to weak seasonality, optimism must be predicated on continued enthusiasm for AI and decent economic data. A dovish Fed would help, too. Analysts will have reams of data to parse in the days and weeks ahead, so it could be a bumpy ride before the more favorable late-October through Christmas period begins.

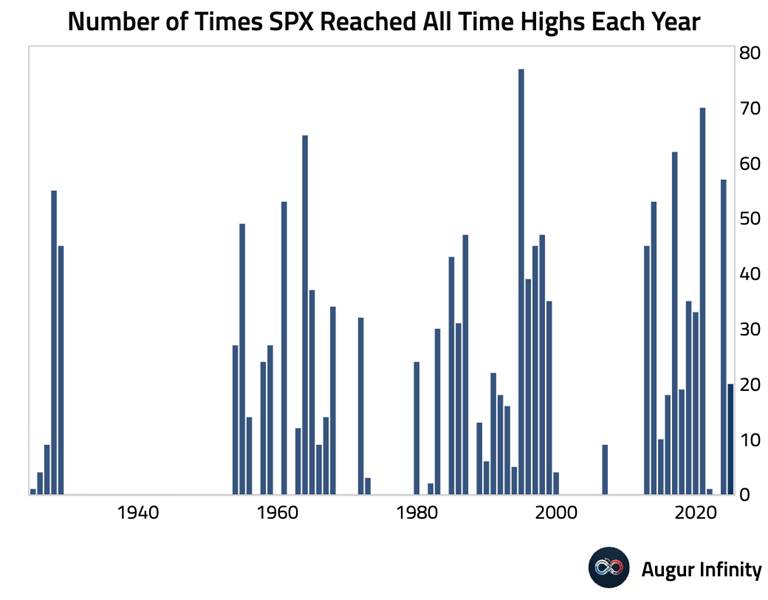

How Many S&P 500 Record Highs in 2025 So Far? 20.

Source: Augur Infinity

The Bottom Line

Stocks were resilient in August. The S&P 500 hit an all-time high, above 6500 for the first time, on the penultimate session of the month. Shares of risky small-cap companies led, ether soared, and gold shined. The bond market remained comfortably numb to the political and fiscal histrionics, along with the shake-ups at the Fed. We now venture into the dark side, not of the moon, but of the calendar. September has been volatile, but markets enter the month on a somewhat high note.