Tax Brackets, Bigger Refunds, and What It Means for 2026

This week’s insight looks ahead to the upcoming tax-filing season.

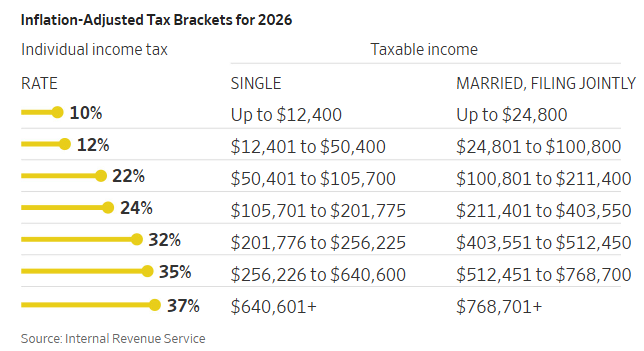

The IRS released its 2026 income tax brackets last week. There’s a 4% increase in the lowest two rungs, while upper brackets are nudged higher by just 2.3%. As is normally the case, the adjustments rarely impact long-term planning strategy, but they’re a reminder that inflation is an ever-present issue. What’s more, the federal government may be trying to help out lower-income households with a larger increase to the 10% and 12% marginal tax brackets.

Bigger picture, an economic boost may be on the way over the February through April period in 2026. You see, tax refunds are expected to be significantly bigger next year, now that many of the One Big, Beautiful Bill Act’s (OBBBA) provisions are already in effect. The average refund this past season was $3,138; some economists predict a 10% to 15% rise in the typical refund in the next go-around.

Imagine the impact of, say, $500 of extra cash hitting each household’s coffers in the first handful of months in 2026. Americans are wont to spend, so it might mean an economic boost. That would benefit struggling small businesses and certainly the retail industry. By then, it’s also probable that most of the tariff impact will have been felt.

So, at the macro level, if the jobs market hangs in there, next year could begin on the front foot. Right now, AI powers U.S. GDP growth, which runs counter to the usual paradigm of a consumer-led economy. The labor situation is precarious, though. The unemployment rate has been rising at a pace of about 0.1 percentage points every two months, and a lack of official data since the beginning of October (care of the government shutdown) leaves strategists and policymakers in the dark.

For you and me, the best we can do is, well, what we always do: strategize for the likely and plan for the possible. The new tax law is in place, and families must review their goals. There may be adjustment opportunities, while fine-tuning an asset allocation could be a worthwhile task by year-end. Finally, keep in mind that the bull market is now three years old—ensuring your portfolio jibes with your situation is always a priority.

2026 Tax Brackets

Source: The Wall Street Journal