Strong Growth Today, Crosscurrents Ahead: What Q3 GDP Tells Us About 2026

This week’s insight is a review of the very strong Q3 GDP report and a look ahead to what 2026 may have in store.

Small business owners are probably skeptical of the 4.3% third-quarter GDP print reported last week. That’s a torrid pace of economic expansion—so-called “trend” growth is more like 2–2.5%, according to the experts. As always, the details matter. Driving a chunk of the increase was higher consumer spending on healthcare. What’s more, the “net exports” figure flattered GDP from July through September.

Still, household and business spending were healthy, bucking many economists’ expectations for cautious consumption in this new high-tariff era. Early indicators suggest that Q4 GDP will be solid, but the October–November government shutdown is likely to have weighed on overall activity.

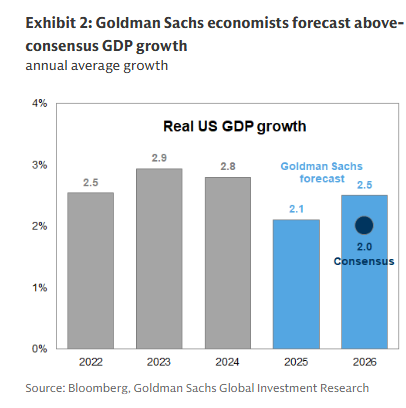

That’s all in the past, and entrepreneurs are more concerned about what lies ahead. There is generally good news here. The consensus calls for a 2.0% growth rate, net of inflation. Goldman Sachs is a little more bullish with its 2.5% prediction. Goldman was among the more upbeat Wall Street firms 12 months ago for 2025, and their team was pretty accurate.

For the year ahead, there’s no shortage of wildcards. There are clear pushes and pulls from the get-go in 2026.

On the plus side, big tax refunds, lower overall taxes under the OBBBA, an improving labor market, and the “wealth effect” from significant stock market gains since late 2022 should all support individual and corporate spending. Focusing only on those tailwinds would be a mistake, though.

The headwinds include the expiration of enhanced ACA tax credits—which, if not extended, would crimp discretionary spending for those on Obamacare—ongoing high electricity inflation (a downside of AI) for everyone, and wage garnishments for student-loan borrowers who are not keeping up with repayments. Government Shutdown Part II could also take the stage toward the end of January (the prediction markets peg the chance at about 1-in-3).

It also remains to be seen how President Trump’s tariff shakeout plays out. The Supreme Court will decide at some point in Q1. If the High Court strikes them down (which is probable), the Trump administration will have to go back to the drawing board on how it defines and classifies the broad set of import duties. On net, we may see the overall tariff rate drop modestly, but most levies will likely remain in place one way or another.

As for inflation, market-based indicators suggest it’s almost a non-issue. Despite all the outrage, “breakeven” rates and the financial swaps market peg year-ahead inflation at just 2.2–2.3%.

US GDP Growth Expected to Hum Along in 2026

Source: Goldman Sachs