Rising Costs, Rising Entrepreneurs: The Surprising Boom in Small-Business Formation

Rising Costs, Rising Entrepreneurs: The Surprising Boom in Small-Business Formation

This week’s insight profiles a surprising trend in small-business formation.

Torsten Slok, chief economist at Apollo Global, a Wall Street research firm, put out a pair of revealing charts earlier this month. One discouraging, one encouraging. Bad news first.

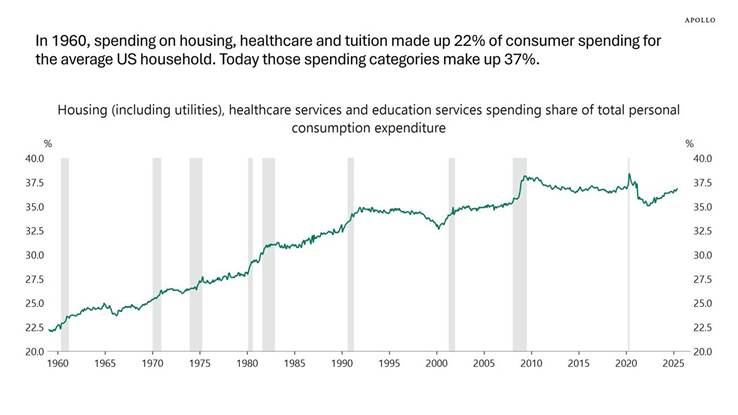

Slok called out that Americans are spending more on housing, healthcare, and tuition combined (Figure 1). Those three categories take up 37% of people’s after-tax income. Just about everyone feels the sting from higher medical and health insurance bills; the average family’s health plan premium now sums to more than $26,000. A decade ago, it was under $18,000. Go back to the year 2000, and it was a mere $6,000.

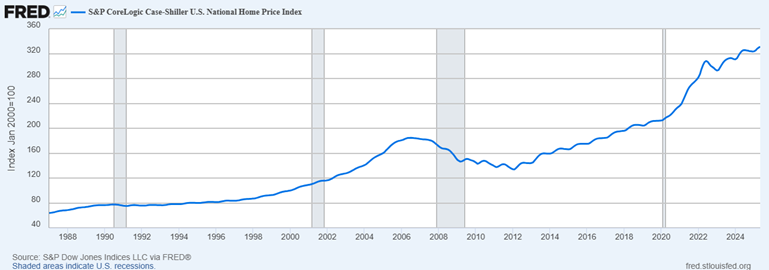

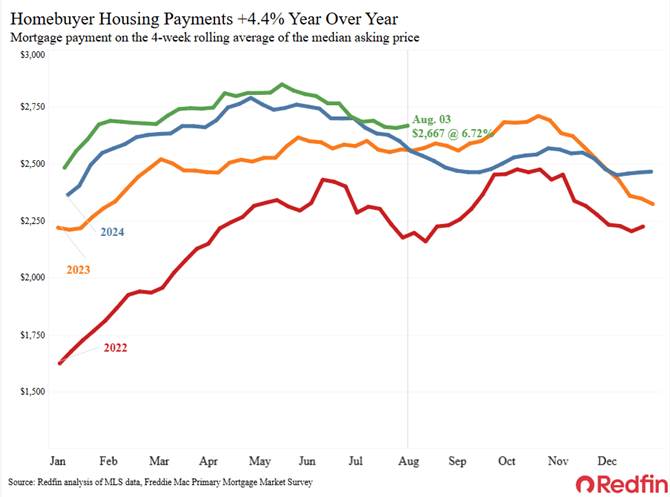

Young and growing families feel the housing pinch the most. While the average 30-year fixed-rate mortgage dipped to near a 10-month low just a few days ago, home values are up 55% since January 2020, according to the benchmark S&P Case-Shiller Home Price Index (Figure 2). Redfin, which puts out some of the best data on the latest real estate trends, reports that the median housing payment is $2,667 for new borrowers, a record amount for this time of year (Figure 3).

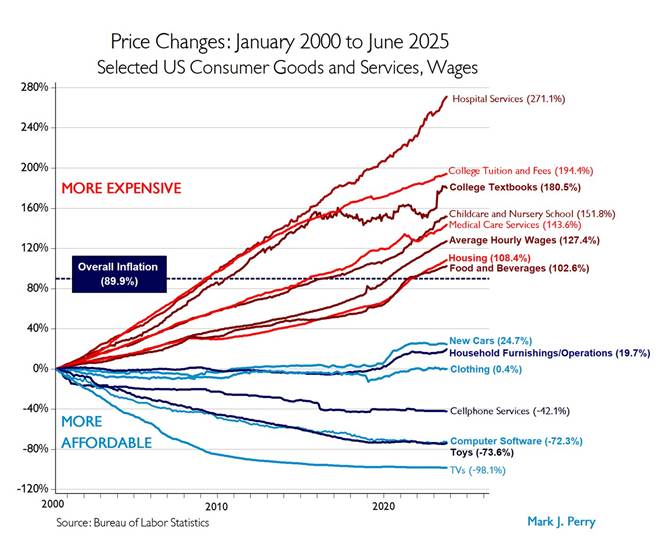

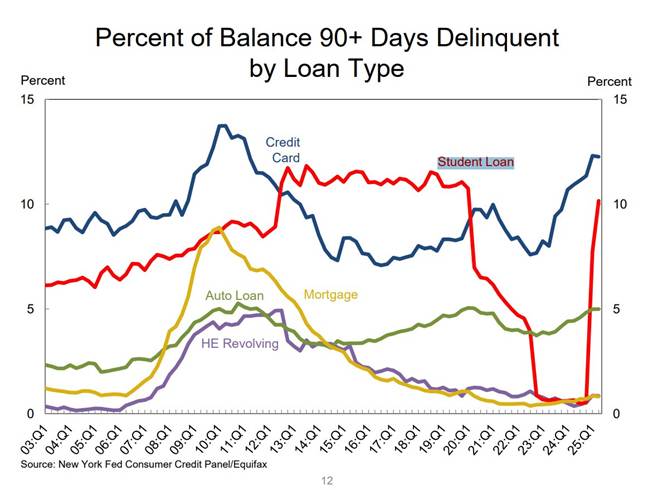

As for tuition, it’s not as pressing a problem as it once was. The cost of education, while still rising, has seen its inflation rate dip as AI has taken hold (Figure 4). Of course, with the COVID student-loan moratorium over, there has been a notable uptick in that borrowing category’s delinquency rate, as reported by the NY Fed last week (Figure 5).

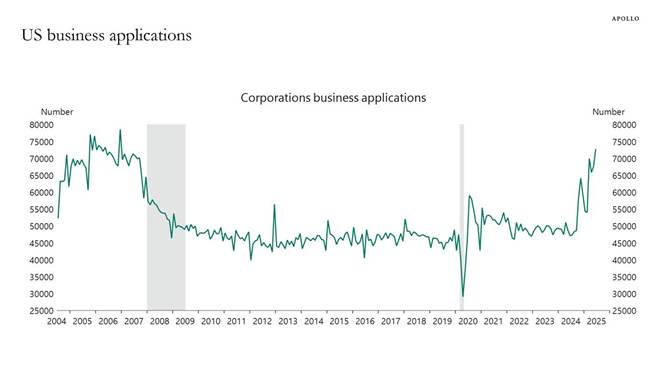

But what about the good news? More Americans appear to be taking control of their financial future by launching small businesses. Just since last November, the number of startups has swelled from a 50,000 yearly pace to now north of 70,000, per Apollo (Figure 6). There was a bump up in entrepreneurial activity during and immediately after the pandemic, but then the count of new small businesses cooled off, likely due to worries about inflation and taxes.

Today, inflation is still too high for comfort as far as the Federal Reserve is concerned, but clarity around taxes and enhanced benefits for US businesses could result in strong GDP growth in the quarters ahead.

Related Charts:

Figure 1

Source: Torsten Slok, Apollo

Figure 2

Source: St. Louis Federal Reserve

Figure 3

Source: Redfin

Figure 4

Source: Mark J. Perry

Figure 5

Source: NY Fed

Figure 6

Source: Torsten Slok, Apollo Global