No Santa Rally, No Problem: How Markets Powered Through 2025

- Stocks delivered strong returns in 2025, even without a year-end rally

- Earnings growth, resilient consumers, and calmer inflation kept markets moving higher

- As 2026 begins, solid momentum remains—but valuations leave less room for mistakes

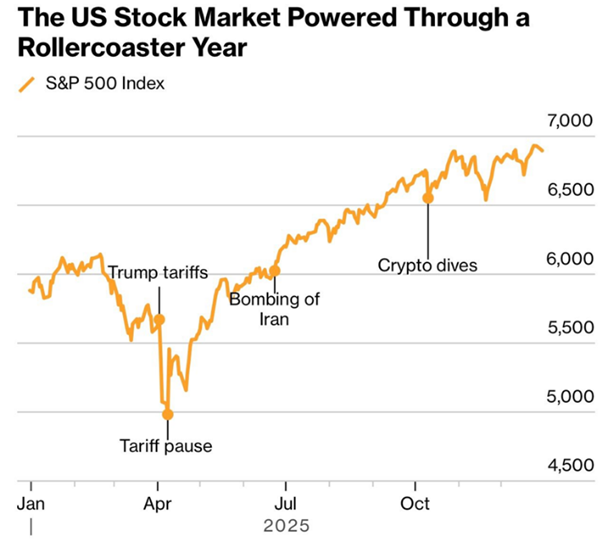

Santa didn’t visit Wall Street to finish off December, but it didn’t m

atter. The S&P 500 rose 16.4% in 2025, its third consecutive year of double-digit gains. The Nasdaq Composite notched a 20.4% advance, while gains across the stock-market spectrum were impressive. U.S. small- and mid-cap stocks came on strong over the second half, and international markets outperformed sharply.

S&P 500 in 2025: January Optimism, April Fear, Big Gains by December

Source: Bloomberg

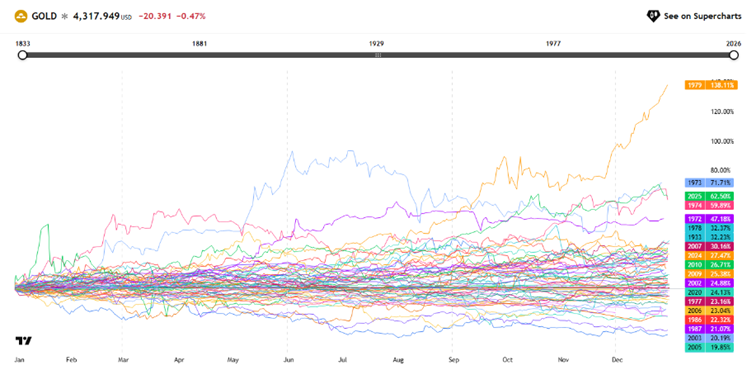

Metals Take Center Stage

Precious metals stole the show, particularly during the low-volatility finish to 2025. The yellow metal posted a 65% annual advance, its best year since 1979. The same was true for silver—it soared 144%, even with a late-December stumble. Often, when speculative commodities are on a heater, it spells trouble for the U.S. dollar.

That really wasn’t the case as 2025 progressed. Yes, the greenback weakened from January through June, but that bearish trend reversed in the second half—the dollar actually rose versus a basket of other currencies. Oil, meanwhile, finished last year at a tame $57. Believe it or not, a barrel of crude is cheaper today than it was 20 years ago.

Gold’s Best Year Since 1979

Source: TradingView

Bonds: Quiet to a Fault

To recap so far, it was a strong year for diversified equity investors and a historic one for metals. Categorically unexciting lately have been bonds. The yield on the benchmark 10-year Treasury note closed last week at 4.20%, stuck in a range between 3.95% and 4.20% that dates back to September.

In fact, measured bond-market volatility is near its softest level since Q3 2021. That has surprised experts, given unprecedented uncertainty surrounding the Federal Reserve’s makeup, jumpy long-term rates globally, and a shifting macro backdrop at home.

Bonds (AGG) +7.2% in 2025, S&P 500 Total Return Index +17.9%

Source: Stockcharts.com

That’s the lay of the land as 2026 gets underway. Let’s dig into the key issues markets face this year and what they mean for your portfolio.

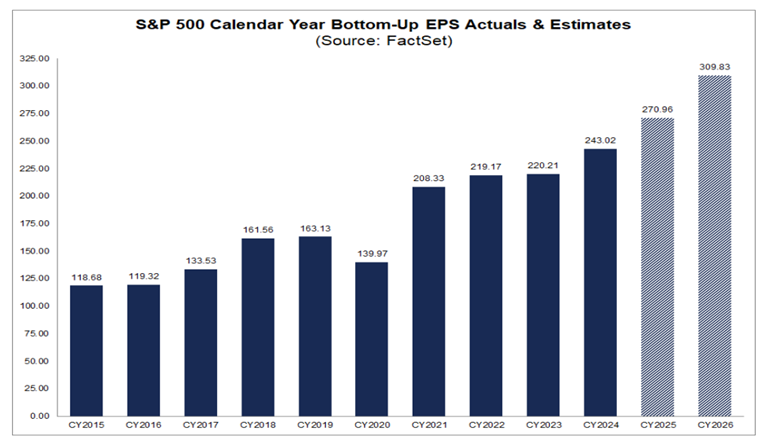

Corporate America Delivers

Let’s begin with a hat tip to corporate America. It’s likely that S&P 500 companies will collectively report earnings per share close to $275 for 2025. We’ll know for sure once the Q4 earnings season is in the books two months from now. As it stands, annual profit growth may come in between 12% and 14%, which is quite the feat given all that businesses big and small endured last year.

Strong S&P 500 Earnings Growth Since 2023

Source: FactSet

From Optimism to Shock—and Back Again

Recall that 2025 began with optimism around deregulation, tax cuts, and a generally pro-business Trump administration. The S&P 500 peaked in January and early February, crypto was soaring, and interest rates were rising for the right reasons. That upbeat narrative was upended in the lead-up to the April 2 “Liberation Day” announcement from the White House Rose Garden.

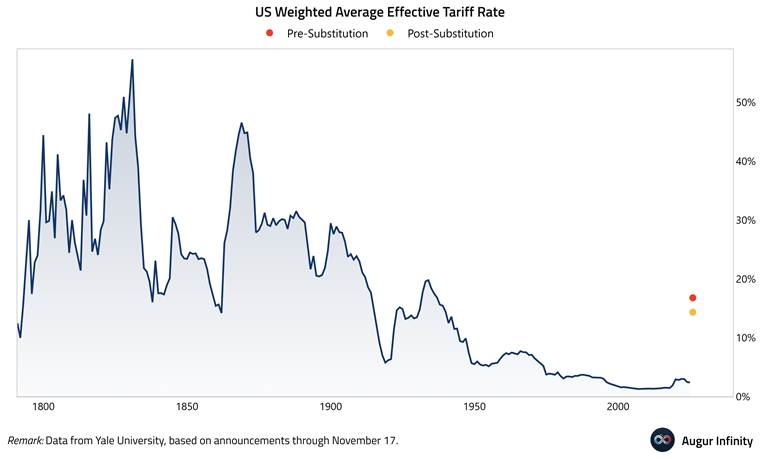

US Average Tariff Rate Jumps to the Mid-Teens, Highest Since the 1930s

Source: Augur Infinity

President Trump rolled out tariff rates that sent markets tumbling. Bonds also turned “yippy,” as he put it. But the 19% crash proved to be a rare buying opportunity since the bull run began in October 2022. CEOs and CFOs pivoted, thought creatively, and navigated uncertain macro waters.

Battle-tested, the S&P 500 rallied from May through November. Along the way, Fed drama added another layer of uncertainty. Almost from the onset of Trump 2.0, the president berated Chair Jerome Powell and the other 11 Federal Open Market Committee (FOMC) voting members to lower policy rates.

In May, Trump further stirred the pot by threatening to fire Powell (though he cannot legally do so). Over the summer, the president turned his attention—and social media posts—toward Fed Governor Lisa Cook. Accused of committing mortgage fraud, Dr. Cook remains on the Committee, but her case is not yet settled.

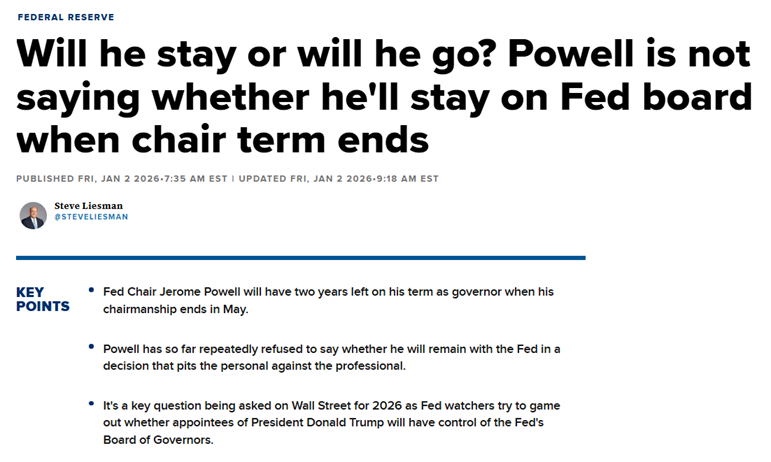

Powell’s Last Stand

Source: CNBC

A Fed in Flux

Adriana Kugler was another Fed character. She resigned in August due to improper trading involving her and her husband. Trump filled that open seat with one of his right-hand men, Stephen Miran, then chair of the Council of Economic Advisers. Miran pushed for immediate and steep rate cuts—and he more or less got his wish. The Fed cut rates in each of its final three meetings of the year. Miran may remain a voting member or return to his prior post after the January FOMC meeting.

Powell will almost certainly depart from his chair role in May. According to prediction markets, a man named “Kevin” will likely succeed Jay—either Kevin Hassett (Director of the National Economic Council) or Kevin Warsh (banker and former Fed governor). Either way, a more dovish Federal Reserve is probably in the works by June.

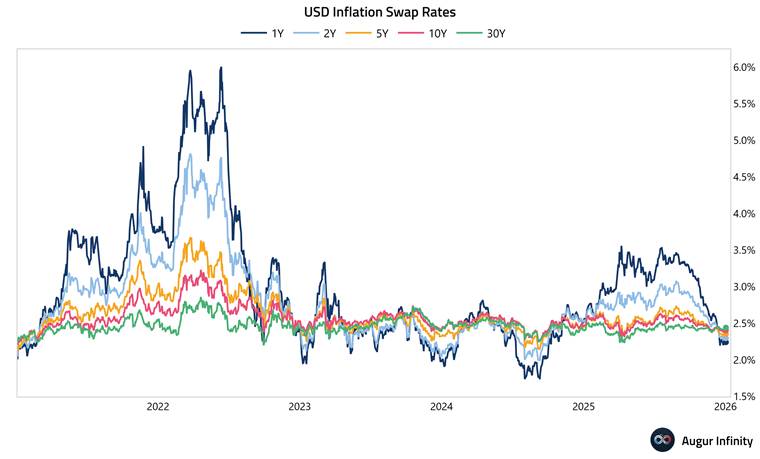

A Kevin is Likely to Be Nominated as the Next Fed Chair

Source: Kalshi

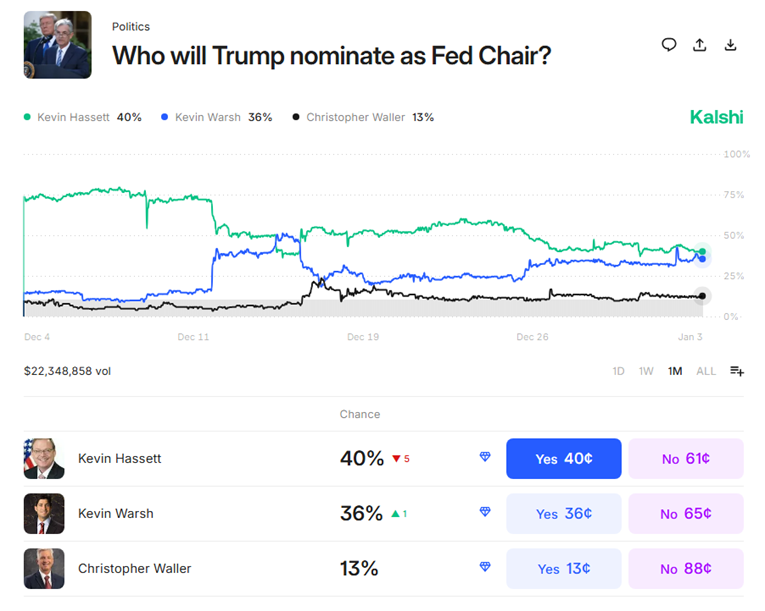

Labor Market Cracks, Not Collapse

The Fed storyline has been box-office material for financial-news junkies, but real-world data mattered, too. The labor market has turned increasingly worrisome for the FOMC and economists alike. After the record-long government shutdown, the Bureau of Labor Statistics finally published an October–November employment update.

It revealed that the jobless rate rose to 4.56%, the highest since Q3 2021… the “slow hire, slow fire” labor market presses on. October’s headline payrolls change was –105,000, the worst reading since December 2020, negatively impacted by laid-off DOGE workers finally hitting the unemployment line. November’s payrolls gain was better than expected, though. The upshot: The labor market is stagnant, but not on the verge of falling off a cliff.

We’ll get fresh updates in the coming days, as official data flows normalize following the October–November government shutdown.

Unemployment Rate Rising, Stalled Job Growth

Source: BLS

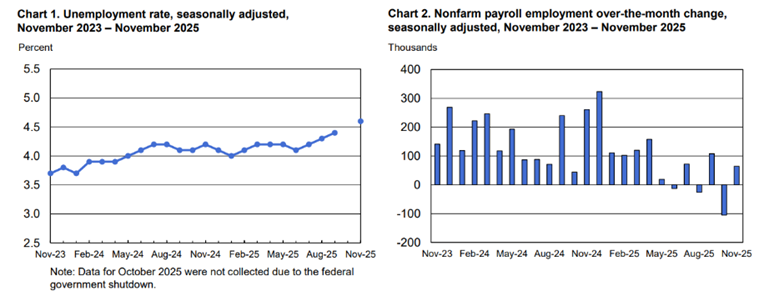

Inflation: Perception vs. Reality

As for inflation, consumers are angrier about it than markets. Look no further than the University of Michigan Consumer Sentiment report, which shows households expect year-ahead inflation of 4.2%. Market-based measures tell a different story. One-year inflation swaps sit at 2.2%, while Treasury breakeven inflation rates remain in the low-to-mid 2% range. In short, inflation is yesterday’s war.

Here’s one way to think about it: Workers’ wages have grown faster than inflation for 31 straight months. Yes, “affordability” remains a hot-button issue, but according to the data, conditions have been improving since mid-2023. In real time, inflation appears to be falling sharply—the “Truflation” gauge sits below 2%, its lowest reading since August.

Market Pricing Points to Sub-2.5% Inflation in the Years Ahead

Source: Augur Infinity

Private-Based Truflation Dropping Like a Rock: 1.81%

Source: Truflation

The Consumer Keeps Spending

Consumers may wring their hands about today’s prices compared to six years ago, but that hasn’t stopped them from spending heavily on staples and discretionary items. While precise numbers aren’t available yet, the holiday shopping season appears to have been a banger.

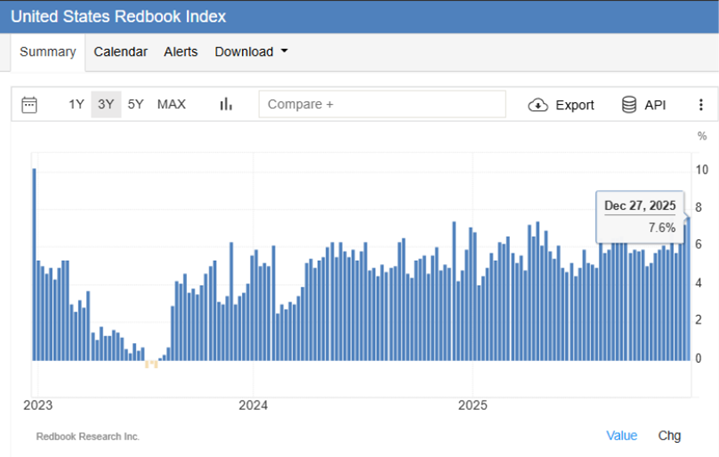

In November, the National Retail Federation predicted roughly a 4% rise in seasonal spending, pushing the total to $1 trillion for the first time. The official Retail Sales report arrives later this month, but the weekly Johnson Redbook update last showed a firm 7.6% year-over-year increase, tying for the strongest reading in three years.

Johnson Redbook Retail Sales Close to a 3-Year High at +7.6% YoY

Source: Trading Economics

Stellar U.S. GDP Rate in Q3-Q4 2025

Source: Trading Economics

Crosscurrents for Households

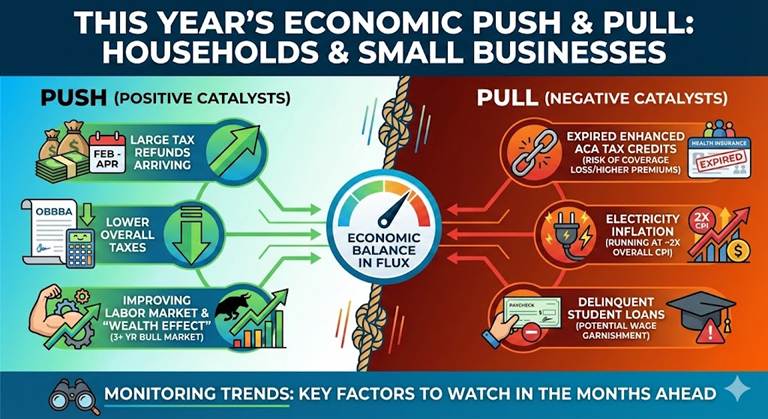

This year features a push-and-pull for households and small businesses. Positive catalysts include large tax refunds hitting from this February through April, lower overall taxes from the One Big Beautiful Bill Act (OBBBA), a potentially improving labor market, and the “wealth effect” from a bull market now more than three years old.

Negative catalysts also loom. Enhanced ACA tax credits have not been extended; if that remains the case, millions could lose coverage, while others face sharply higher premiums. Electricity inflation continues to run at roughly twice the pace of overall CPI, squeezing lower- and middle-income households. Meanwhile, some workers with delinquent student loans may face wage garnishment. These are trends worth monitoring in the months ahead.

Dinner-Table Financial Issues

Animal Spirits Still Roaring

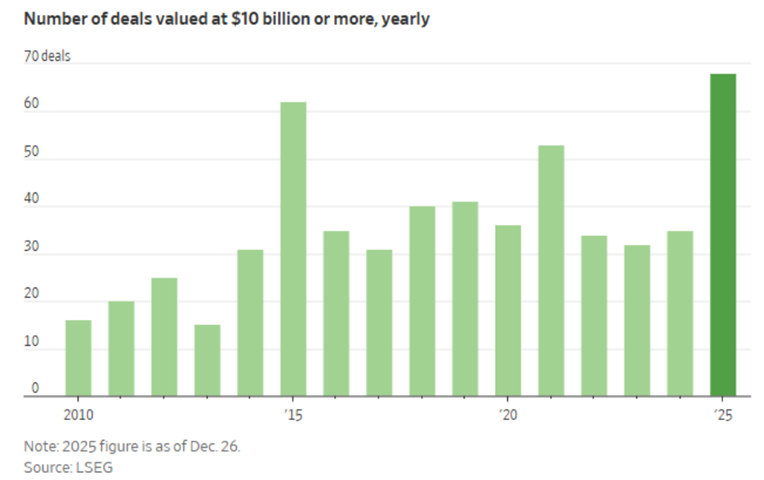

The shaky jobs picture, improved inflation backdrop, and unsettled Main Street environment may justify a couple more Fed rate cuts this year. Or maybe not. Either way, CEOs and bankers don’t appear overly concerned. 2025 was a banner year for corporate M&A and IPOs, with a record 68 deals valued at $10 billion or more confirmed. Most experts expect even more capital markets activity in 2026, particularly if the administration focuses on cutting red tape and easing off the tariff gas pedal.

IPOs were also back in vogue, led by high-profile AI and crypto-related offerings. CoreWeave, Circle, and Chime were among the standout go-public stories. It’s also possible that record-sized IPOs lie ahead. OpenAI, SpaceX, and Anthropic could all hit the tape with valuations in the hundreds of billions. On this front, animal spirits are alive and well.

2025’s M&A Boom

Source: The Wall Street Journal

Risks Beneath the Optimism

Big picture, we remain bullish on markets. The AI megatrend hasn’t been a smooth ride, but it continues to support corporate earnings. This could also be the year that AI adopters—including small and medium-sized businesses—begin to see more tangible benefits from the general-purpose technology. Cooling inflation and potential labor-market stabilization should help domestically, while fiscal spending abroad may keep pushing international markets to new highs.

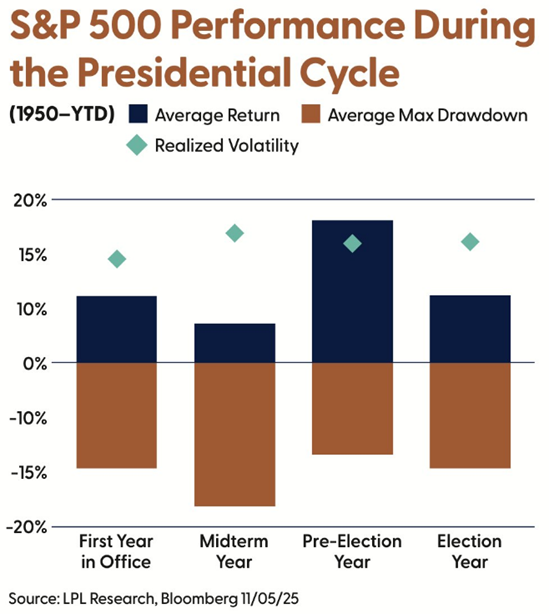

Still, 2026 is a midterm election year, which historically has been sketchy for stocks. Volatility tends to run higher, and equity drawdowns—when they occur—are often more severe. The past is not always prologue, but history has a habit of rhyming. The S&P 500 enters 2026 at a rich valuation, too, leaving little margin for error. The good news is that once Election Day passes, stocks tend to soar over the ensuing quarters.

LPL Financial: Midterm Years Can be Rocky

Source: LPL Financial

The Bottom Line

2025 was a great year for investors. Stocks returned close to 20%, bonds worked through early-year volatility, and precious metals stole the spotlight in the fourth quarter. Crypto wobbled, as it occasionally does, but diversified portfolios benefited from staying the course and ignoring the media’s scary headlines. 2026 may be another year where keeping your cool proves to be the best strategy.