Mortgage Rates Sink to 11-Month Low: Is a 5% Handle Coming Soon?

This week’s insight offers good news for prospective home buyers.

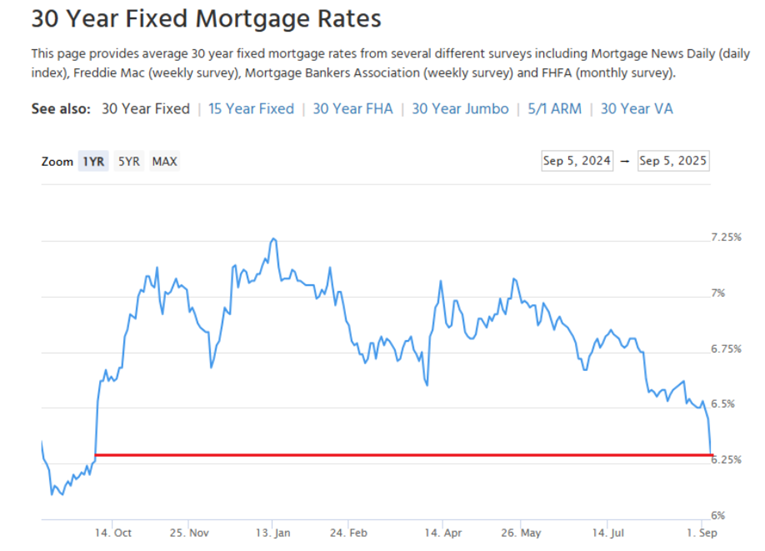

The average 30-year fixed-rate mortgage plunged 0.16% to 6.29% in the wake of last Friday’s weak August jobs report. That continued a trend of falling interest rates leading up to the mid-month Federal Reserve meeting. Prospective homebuyers may now lock in a mortgage at the cheapest rate in 11 months. For perspective, it was just this past May when 7% was the norm. But could it go even lower? And are there other options? Let’s flesh that out.

It wouldn’t take much to push the 30-year borrowing rate below 6%. Unfortunately, declining yields might hinge on a steady diet of weak economic data. Continued weakness in the jobs market could bring the benchmark 10-year Treasury note interest rate below 4%. If we apply the usual 2% adder to that (common for mortgage rates compared to the 10-year Treasury yield), then 6% becomes the bogey.

Also key is upcoming inflation data. This week, August wholesale and retail prices cross the wires. We’ll learn more about the extent to which President Trump’s tariffs have flowed through the economy. July’s Producer Price Index (PPI) report revealed that businesses absorbed a large chunk of the duties, while the Consumer Price Index (CPI) did not rise much. The upshot: If August inflation data come in below estimates, Treasury and mortgage rates could retreat further.

Then comes the Fed’s gathering on September 16–17. Markets widely expect a quarter-point rate cut, and we can’t rule out a jumbo ease of 50 basis points. To be clear, the Fed does not directly influence prevailing mortgage rates. In fact, housing affordability dropped sharply when Chair Powell and the other 11 voting members of the Committee began cutting rates precisely a year ago.

This time could be different, though. The economy has cooled, and overall interest rate volatility has declined. If the trend keeps up, a five-handle 30-year fixed-rate mortgage could arrive in Q4. Additionally, shorter-term yields are even lower. The 15-year Treasury now yields a paltry 3.59%, helping to pressure the 15-year mortgage rate to 5.60%, very close to the lowest mark since January 2023.

The Average 30-Year Mortgage Rate Fell to an 11-Month Low Last Friday

Source: Mortgage News Daily