Jobs Revision Shakes the Data, But Not the Market

This week’s insight offers a fresh look at the jobs market. It’s not so rosy anymore.

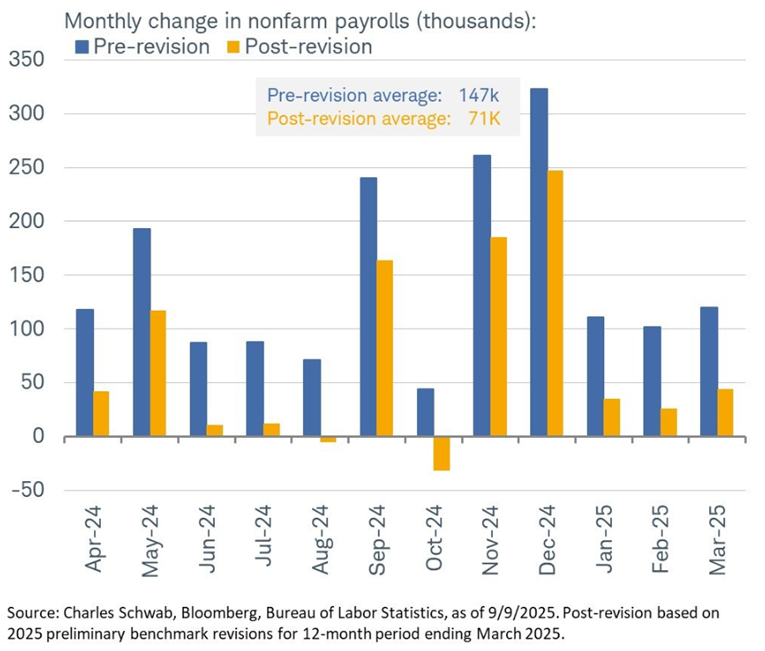

Last week, the Bureau of Labor Statistics (BLS) released its annual benchmark employment revision. Maybe you heard. The true-up resulted in a steep 911,000-job negative change to cumulative gains over the April 2024 to March 2025 period. Wall Street economists had expected a downward revision of 400,000 to 500,000 jobs. How did stocks respond? Just fine.

The S&P 500 was essentially unchanged in the moments after the data dropped at 10 a.m. ET on Tuesday, September 9. Why? Because the Quarterly Census of Employment and Wages (QCEW) adjustment is among the most backward-looking data points out there. By the time it hits the wires, the information is already months old. In other words, even a big negative number is not necessarily a market mover. Last year’s revision was weak as well, so the pattern is hardly unprecedented.

Still, the news isn’t all bad. With fewer workers on payrolls, productivity (measured as output per hour worked) was stronger than previously thought. That silver lining is important in an economy that has had fits and starts with productivity. And then there’s the Fed. With three of the past 13 monthly jobs reports now showing outright declines in employment, the Federal Open Market Committee (FOMC) is primed to slash its target policy rate at least a few times over the next six months.

Lower short-term borrowing costs are like rocket fuel for small businesses. There’s more tinder, too. Wage growth has eased, offering an expense tailwind for many labor-intensive industries. Those factors, combined with the full-expensing provisions from the One Big, Beautiful Bill Act (OBBBA), could make for a gangbuster 2026.

That’s the hope. Nobody knows what the future holds, and a US recession can’t be ruled out. Still, the forces may be coming together for a better macro setup for small businesses, not just big multinational corporations.

Payroll growth has been negative in three of the past 13 months: August 2024, October 2024, and June 2025

Source: Liz Ann Sonders